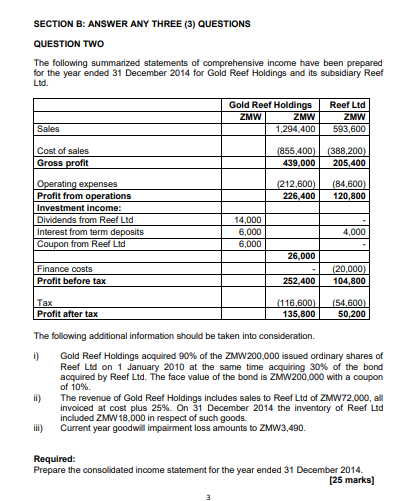

Question: SECTION B: ANSWER ANY THREE (3) QUESTIONS QUESTION TWO The following summarized statements of comprehensive income have been prepared for the year ended 31

SECTION B: ANSWER ANY THREE (3) QUESTIONS QUESTION TWO The following summarized statements of comprehensive income have been prepared for the year ended 31 December 2014 for Gold Reef Holdings and its subsidiary Reef Ltd. Sales Cost of sales Gross profit Operating expenses Profit from operations Investment income: Dividends from Reef Ltd Interest from term deposits Coupon from Reef Ltd Finance costs Profit before tax Tax Profit after tax ii) Gold Reef Holdings ZMW ZMW 1,294,400 iii) 14,000 6,000 6,000 (855,400) (388,200) 439,000 205,400 (212,600) (84,600) 226,400 120,800 26,000 Reef Ltd ZMW 593,600 252,400 (116,600) 135,800 4,000 (20,000) 104,800 The following additional information should be taken into consideration. i) Gold Reef Holdings acquired 90% of the ZMW 200,000 issued ordinary shares of Reef Ltd on 1 January 2010 at the same time acquiring 30% of the bond acquired by Reef Ltd. The face value of the bond is ZMW200,000 with a coupon of 10%. (54,600) 50,200 The revenue of Gold Reef Holdings includes sales to Reef Ltd of ZMW72,000, all invoiced at cost plus 25%. On 31 December 2014 the inventory of Reef Ltd included ZMW 18,000 in respect of such goods. Current year goodwill impairment loss amounts to ZMW3,490. Required: Prepare the consolidated income statement for the year ended 31 December 2014. [25 marks]

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Calculate the Noncontrolling Interest NCI share of Reef Ltds profit Reef L... View full answer

Get step-by-step solutions from verified subject matter experts