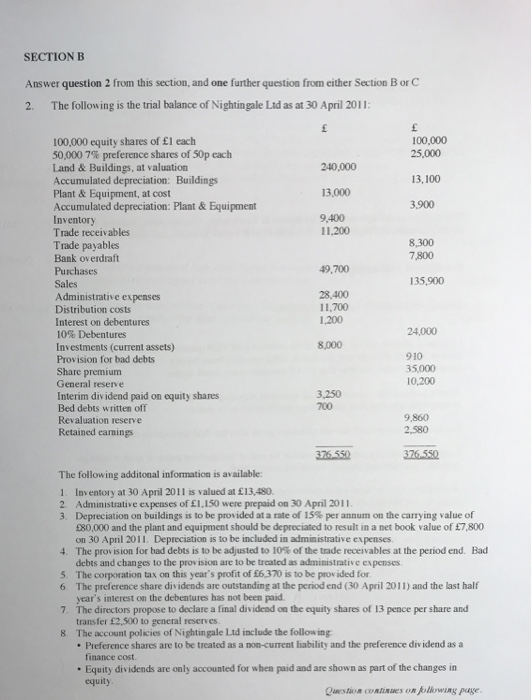

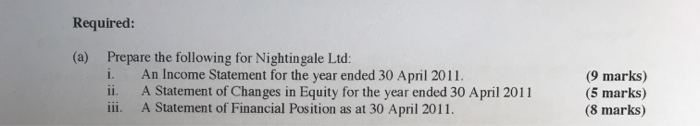

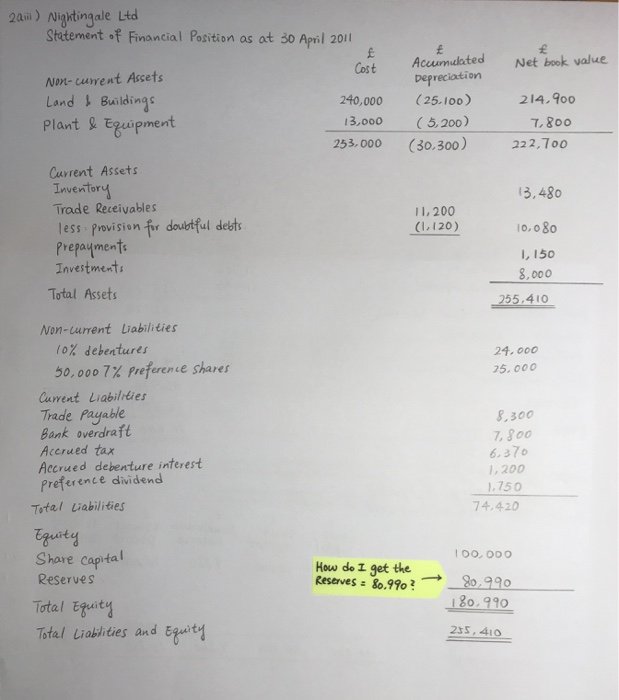

SECTION B Answer question 2 from this section, and one further question from either Section Bor C 2. The following is the trial balance of Nightingale Lid as at 30 April 2011: 100,000 equity shares of 1 each 100,000 50,000 7% preference shares of 50p each 25,000 Land & Buildings, at valuation 240,000 Accumulated depreciation: Buildings 13,100 Plant & Equipment, at cost 13,000 Accumulated depreciation: Plant & Equipment 3.900 Inventory 9,400 Trade receivables 11,200 Trade payables 8,300 Bank overdraft 7,800 Purchases 49,700 Sales 135.900 Administrative expenses 28.400 Distribution costs 11.700 Interest on debentures 1.200 10%. Debentures 24,000 Investments (current assets) 8,000 Provision for bad debts 9 10 Share premium 35.000 General reserve 10,200 Interim dividend paid on equity shares 3.250 Bed debts written off 700 Revaluation reserve 9.860 Retained earings 2.580 376.550 376.550 The following additonal information is available: 1. Inventory at 30 April 2011 is valued at 13,480. 2. Administrative expenses of 1.150 were prepaid on 30 April 2011 3. Depreciation on buildings is to be provided at a rate of 15% per annum on the carrying value of 80,000 and the plant and equipment should be depreciated to result in a netbook value of 7,800 on 30 April 2011 Depreciation is to be included in administrative expenses 4. The provision for bad debts is to be adjusted to 10% of the trade receivables at the period end. Bad debts and changes to the provision are to be treated as administrative expenses 5. The corporation tax on this year's profit of 6.370 is to be provided for 6. The preference share dividends are outstanding at the period end (30 April 2011) and the last half year's interest on the debentures has not been paid 7. The directors propose to declare a final dividend on the equity shares of 13 pence per share and transfer 2,500 to general reserves 8. The account policies of Nightingale Lid include the following Preference shares are to be treated as a non-current liability and the preference dividend as a finance cost Equity dividends are only accounted for when paid and are shown as part of the changes in equity Questo Cures on following page. Required: (a) Prepare the following for Nightingale Ltd: 1. An Income Statement for the year ended 30 April 2011 ii. A Statement of Changes in Equity for the year ended 30 April 2011 iii. A Statement of Financial Position as at 30 April 2011. (9 marks) (5 marks) (8 marks) 205) Nightingale Ltd Statement of Financial Position as at 30 April 2011 Cost Net book value Accumulated Depreciation No-current Assets Land & Buildings Plant & Equipment 240,000 13,000 253.000 ( 25.100) (5,200) (30.300) 214.900 7,800 222,700 13,480 Current Assets Inventory Trade Receivables less provision for doubtful debts. prepayments Investments Total Assets 11,200 (1,120) 10.080 1,150 8.000 255,410 24.000 25.000 Non-Current Liabilities 10% debentures 50.000 7% Preference shares Current Liabilities Trade Payable Bank overdraft Accrued tax Accrued debenture interest Preference dividend Total Liabilities Equity Share capital Reserves Total Equity Total Liabilities and Equity 8,300 7,800 6.370 1,200 1.750 74,420 100,000 How do I get the Reserves = 80.990? $0.990 180.990 255, 410