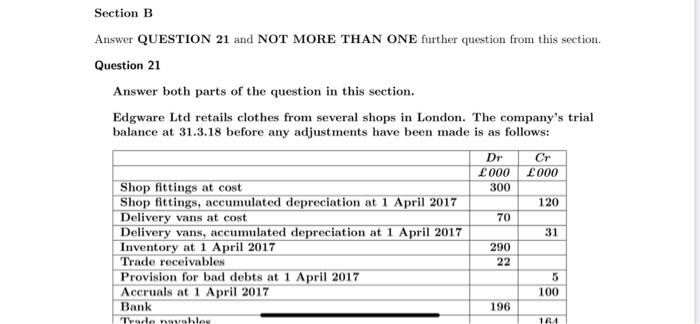

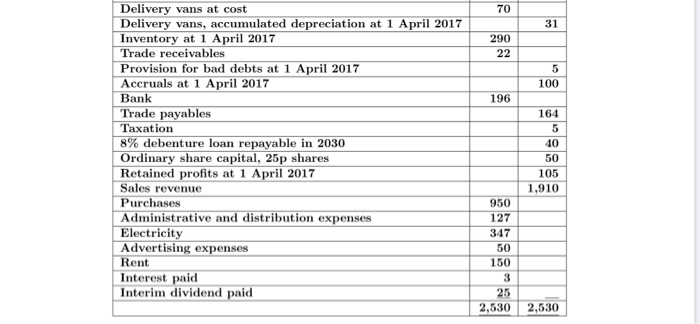

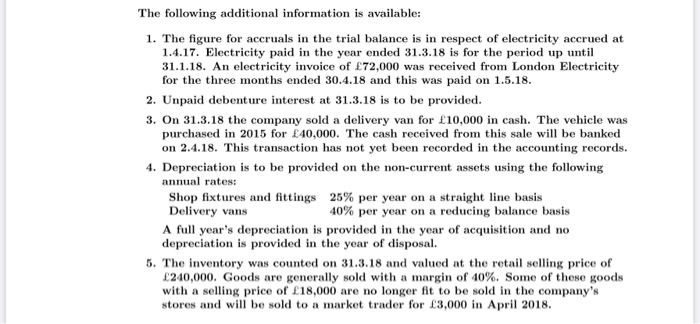

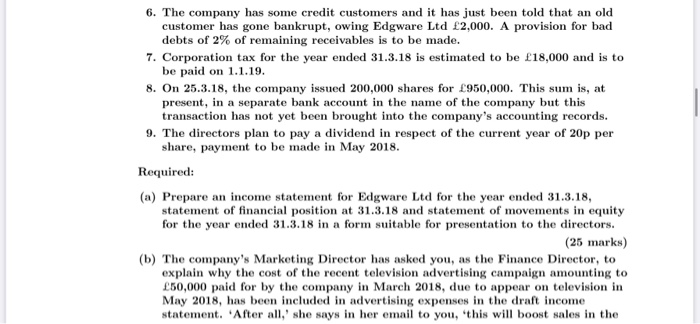

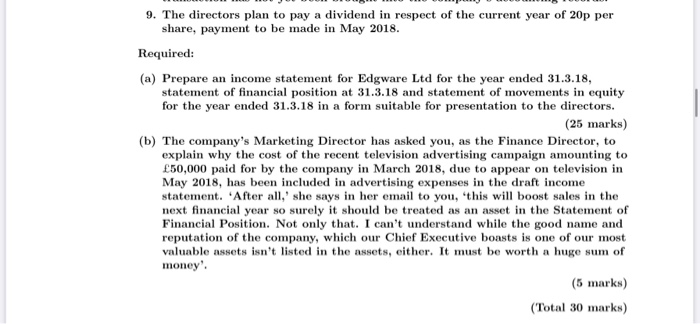

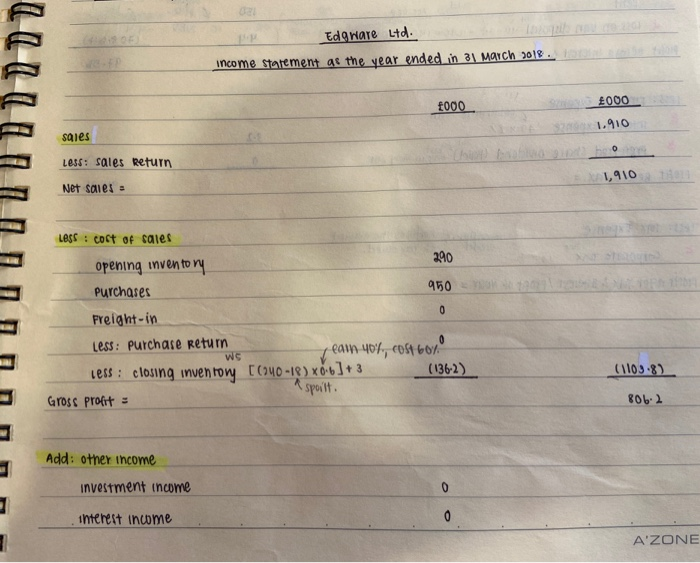

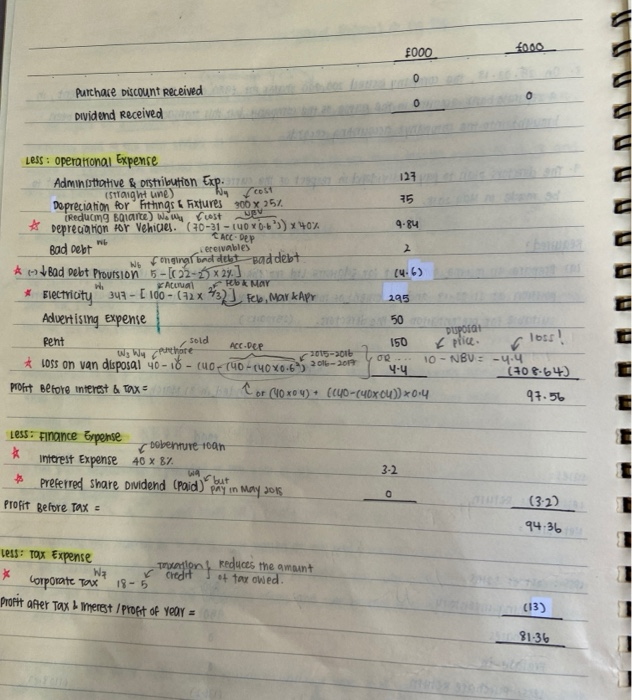

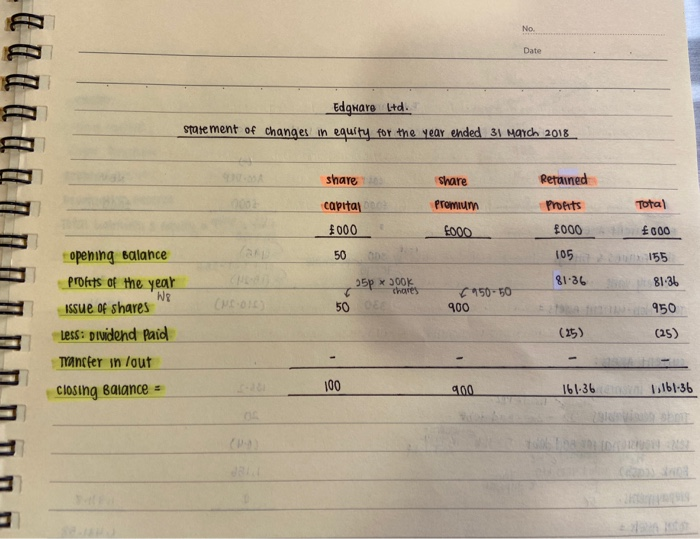

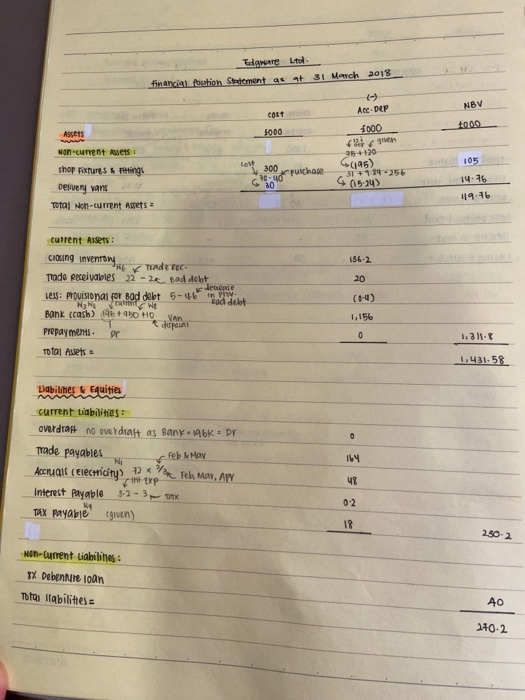

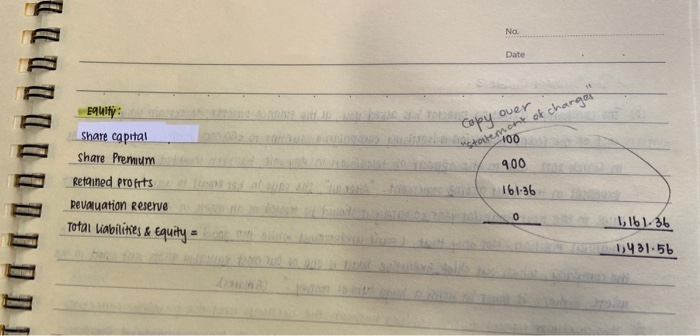

Section B Answer QUESTION 21 and NOT MORE THAN ONE further question from this section. Question 21 Answer both parts of the question in this section. Edgware Ltd retails clothes from several shops in London. The company's trial balance at 31.3.18 before any adjustments have been made is as follows: Dr Cr 000 000 Shop fittings at cost 300 Shop fittings, accumulated depreciation at 1 April 2017 Delivery vans at cost Delivery vans, accumulated depreciation at 1 April 2017 Inventory at 1 April 2017 Trade receivables Provision for bad debts at 1 April 2017 Accruals at 1 April 2017 Bank 196 Trade novobley 120 70 31 290 22 5 100 164 70 31 290 22 5 100 196 Delivery vans at cost Delivery vans, accumulated depreciation at 1 April 2017 Inventory at 1 April 2017 Trade receivables Provision for bad debts at 1 April 2017 Accruals at 1 April 2017 Bank Trade payables Taxation 8% debenture loan repayable in 2030 Ordinary share capital, 25p shares Retained profits at 1 April 2017 Sales revenue Purchases Administrative and distribution expenses Electricity Advertising expenses Rent Interest paid Interim dividend paid 164 5 40 50 105 1,910 950 127 347 50 150 3 25 2,530 2,530 The following additional information is available: 1. The figure for accruals in the trial balance is in respect of electricity accrued at 1.4.17. Electricity paid in the year ended 31.3.18 is for the period up until 31.1.18. An electricity invoice of 72,000 was received from London Electricity for the three months ended 30.4.18 and this was paid on 1.5.18. 2. Unpaid debenture interest at 31.3.18 is to be provided. 3. On 31.3.18 the company sold a delivery van for 10,000 in cash. The vehicle was purchased in 2015 for 40,000. The cash received from this sale will be banked on 2.4.18. This transaction has not yet been recorded in the accounting records. 4. Depreciation is to be provided on the non-current assets using the following annual rates: Shop fixtures and fittings 25% per year on a straight line basis Delivery vans 40% per year on a reducing balance basis A full year's depreciation is provided in the year of acquisition and no depreciation is provided in the year of disposal. 5. The inventory was counted on 31.3.18 and valued at the retail selling price of 240,000. Goods are generally sold with a margin of 40%. Some of these goods with a selling price of 18,000 are no longer fit to be sold in the company's stores and will be sold to a market trader for 3,000 in April 2018. 6. The company has some credit customers and it has just been told that an old customer has gone bankrupt, owing Edgware Ltd 2,000. A provision for bad debts of 2% of remaining receivables is to be made. 7. Corporation tax for the year ended 31.3.18 is estimated to be 18,000 and is to be paid on 1.1.19. 8. On 25.3.18, the company issued 200,000 shares for 950,000. This sum is, at present, in a separate bank account in the name of the company but this transaction has not yet been brought into the company's accounting records. 9. The directors plan to pay a dividend in respect of the current year of 20p per share, payment to be made in May 2018. Required: (a) Prepare an income statement for Edgware Ltd for the year ended 31.3.18, statement of financial position at 31.3.18 and statement of movements in equity for the year ended 31.3.18 in a form suitable for presentation to the directors. (25 marks) (b) The company's Marketing Director has asked you, as the Finance Director, to explain why the cost of the recent television advertising campaign amounting to 50,000 paid for by the company in March 2018, due to appear on television in May 2018, has been included in advertising expenses in the draft income statement. After all,' she says in her email to you, this will boost sales in the 9. The directors plan to pay a dividend in respect of the current year of 20p per share, payment to be made in May 2018. Required: (a) Prepare an income statement for Edgware Ltd for the year ended 31.3.18, statement of financial position at 31.3.18 and statement of movements in equity for the year ended 31.3.18 in a form suitable for presentation to the directors. (25 marks) (b) The company's Marketing Director has asked you, as the Finance Director, to explain why the cost of the recent television advertising campaign amounting to 50,000 paid for by the company in March 2018, due to appear on television in May 2018, has been included in advertising expenses in the draft income statement. After all,' she says in her email to you, this will boost sales in the next financial year so surely it should be treated as an asset in the Statement of Financial Position. Not only that. I can't understand while the good name and reputation of the company, which our Chief Executive boasts is one of our most valuable assets isn't listed in the assets, either. It must be worth a huge sum of money'. (5 marks) (Total 30 marks) DEN 22 Edware Ltd. income statement as the year ended in 31 March 2018 f000 000 1,910 sales to Less: sales Return 1,910 Net sales - Less : coct of cales 290 opening inventory Purchases 950 Freight-in Less: Purchase Return WC earn 40%, cost 607 less: closing inventory [640-18) x0-6] + 3 (1362) a spoilt. Gross profit - 0 (1103:8) 806.2 Add: other income investment income 0 interest income 0 A'ZONE 4000 2000 0 0 Purchase Discount Received Dividend received 0 Che Dep 2 Less : operaronai Expense Administrative & Distribution Exp. 123 Stronght une) "We feest 25 Depreciation for Fittings & Fixtures 900 X 257. iReducmg bgiante) Wow Cuesta Depreciation for Vehicles. (70-31 - 140X66') x 40% 4.84 Bad Debt ervables Wb fonginar ondt deltad debt * - Bad Debt Prouision 5-02-5 x 2y.) [4.6) bk MAY * Electricity gua - [ 100 - (12 x 232Feb Mar Apr 295 Advertising Expense 50 Duptat Rent 150 Toss! ACC.Dee W3 Wy cartne * Loss on van disposal 46- 18 - (-140-c40x0.65 2016-2017 10 - NBU = -4.4 (708-64) profit Before interest & Tax = Cor (10 xoy) + (640-640x0U))*0:4 97.56 Sold & price. 2015-2016 4.4 LESS: Finance Expense dobenture 10an * interest Expense 40 x 87 + Preferred Share Dividend (paid) pay in May 2015 Profit Before Tax 3-2 ir but a (3-2) 94.36 Less: Tox Expense munion reduces the amount * Wz Credit corporate Tax 19 - 5 Profit after Tax L merest / profit of Year = (13) 1 81-36 No Date Edgware Ltd. statement of changes in equity for the year ended 31 March 2018 Share Retained share capital 9000 Promium Profits Total E000 2000 600 50 155 105 81.36 81-36 55p 300K chares 50 DE (MCO) 950-50 900 opening balance profets of the year W8 issue of shares Less: Dividend paid Transfer in lout closing Balance - 950 (25) (25) 100 9.00 161-36 1,161-36 0 daware Ltd financial fusion Statement as at 31 March 2018 COLT NBV Acc. per 0.00 ASSES 5000 000 gen 35+120 495) 31 +84-256 (5.24) 105 cv 300 Non-current Assets shop Fixtures & things Delivery van Total Non-current Assets - uichote 10:40 20 14.76 119.76 current Assets : 136.2 20 dede CIONS Inventory "H6 Tradec Todo Receivables 22 - 2 od debt Leis: Provisional for bad debt 5-46 in VW W3 Wi end debt Bank (cash) 196 +960 +10 Van tip Prepayments Dr 1,156 0 1,311-8 To foi Auets 1.431.58 0 Liabilities Equities current liabilities overdraft no overdraht as Bank - 196K - DI Feb & Moy Ni Accrugi (Electricity fele. Many, APY in typ Interest Payable 3-2 - 3 TAX payable given) Trade payables 164 48 02 18 2.30-2 Non-Current Liabiline 1 Debenhire loan Tota labilites 310-2 No. Date ouer Copy statement of changai 100 Equity: Share capital Share Premium Retained profits Revaluation Reserve 900 ITI021121 161.36 0 Total liabilities & Equity 1161.36 = 1,481.56 I need help to answer an 21 (b), as I have attached the answer for Qn 21(a). I need a comprehensive and detailed explanation to an 21 (b)