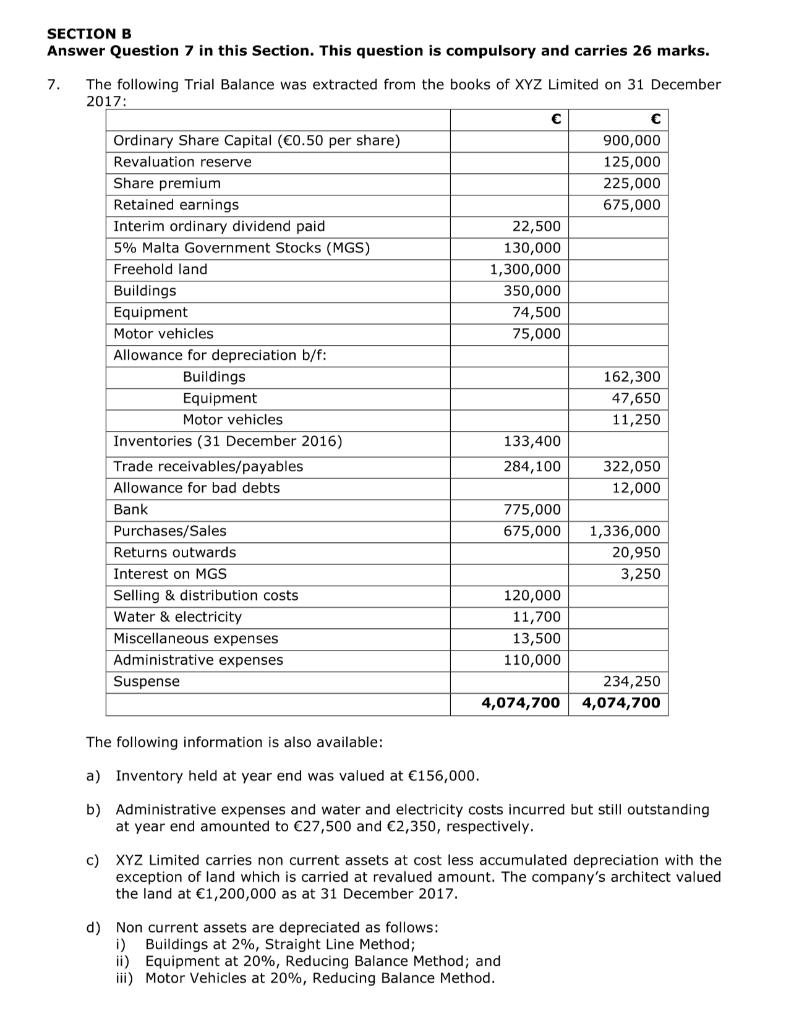

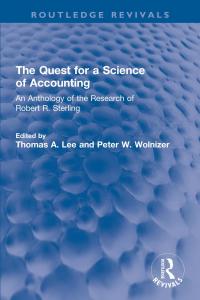

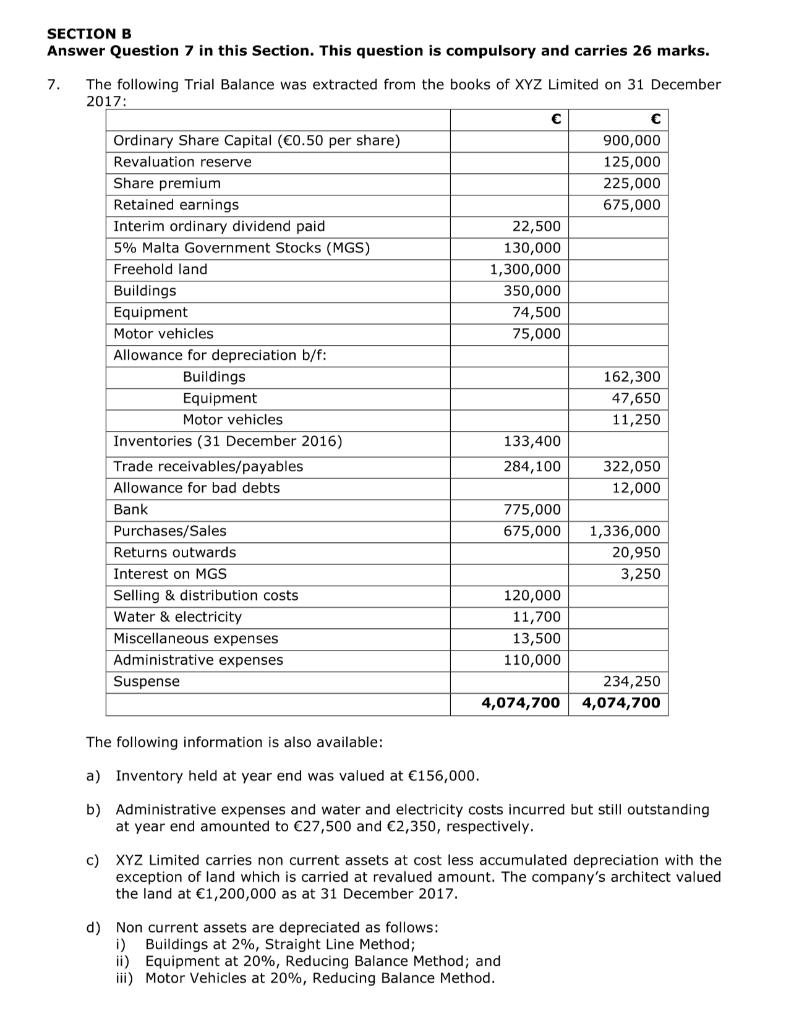

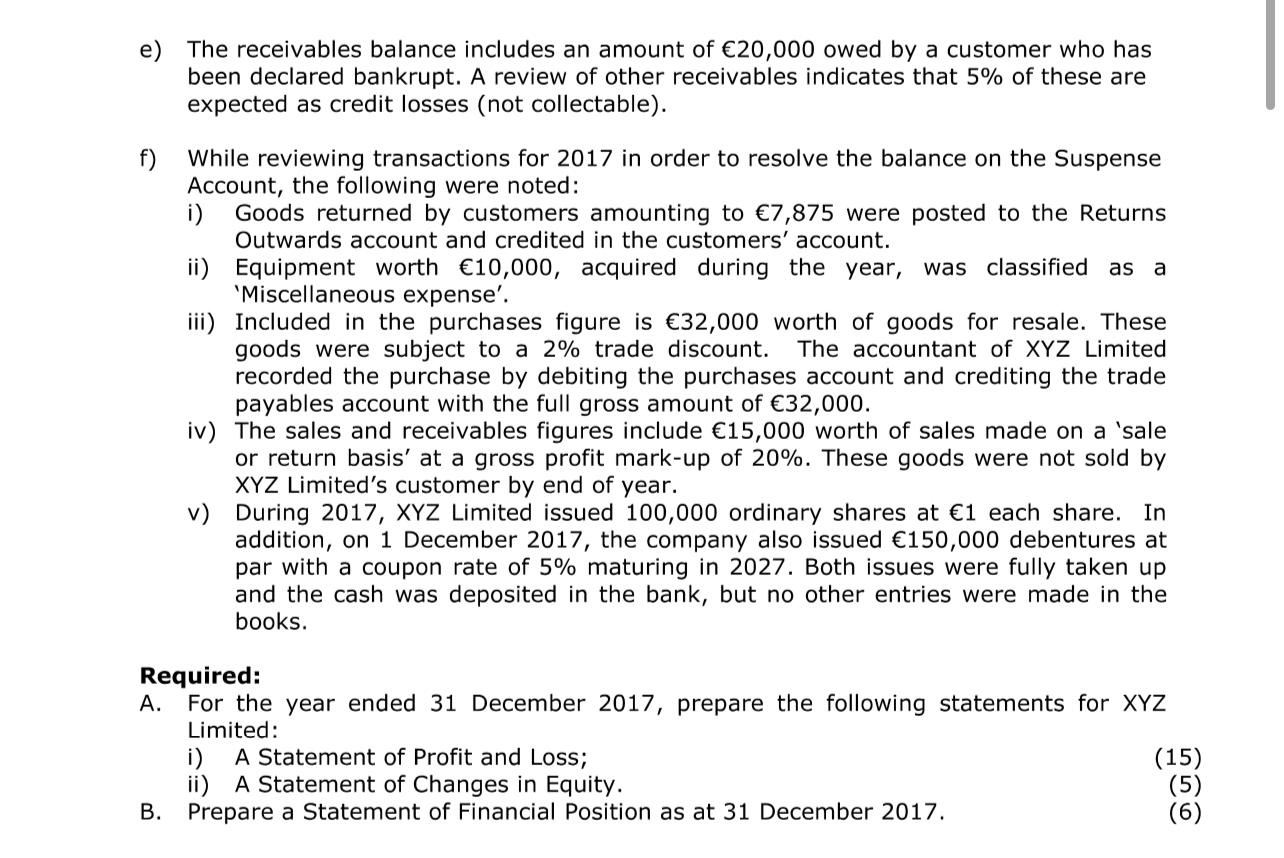

SECTION B Answer Question 7 in this section. This question is compulsory and carries 26 marks. 7. The following Trial Balance was extracted from the books of XYZ Limited on 31 December 2017: Ordinary Share Capital (0.50 per share) 900,000 Revaluation reserve 125,000 Share premium 225,000 Retained earnings 675,000 Interim ordinary dividend paid 22,500 5% Malta Government Stocks (MGS) 130,000 Freehold land 1,300,000 Buildings 350,000 Equipment 74,500 Motor vehicles 75,000 Allowance for depreciation b/f: Buildings 162,300 Equipment 47,650 Motor vehicles 11,250 Inventories (31 December 2016) 133,400 Trade receivables/payables 284,100 322,050 Allowance for bad debts 12,000 Bank 775,000 Purchases/Sales 675,000 1,336,000 Returns outwards 20,950 Interest on MGS 3,250 Selling & distribution costs 120,000 Water & electricity 11,700 Miscellaneous expenses 13,500 Administrative expenses 110,000 Suspense 234,250 4,074,700 4,074,700 The following information is also available: a) Inventory held at year end was valued at 156,000. b) Administrative expenses and water and electricity costs incurred but still outstanding at year end amounted to C27,500 and 2,350, respectively. c) XYZ Limited carries non current assets at cost less accumulated depreciation with the exception of land which is carried at revalued amount. The company's architect valued the land at 1,200,000 as at 31 December 2017. d) Non current assets are depreciated as follows: i) Buildings at 2%, Straight Line Method; ii) Equipment at 20%, Reducing Balance Method; and iii) Motor Vehicles at 20%, Reducing Balance Method. The receivables balance includes an amount of 20,000 owed by a customer who has been declared bankrupt. A review of other receivables indicates that 5% of these are expected as credit losses (not collectable). f) a While reviewing transactions for 2017 in order to resolve the balance on the Suspense Account, the following were noted: i) Goods returned by customers amounting to 7,875 were posted to the Returns Outwards account and credited in the customers' account. ii) Equipment worth 10,000, acquired during the year, was classified as 'Miscellaneous expense'. iii) Included in the purchases figure is 32,000 worth of goods for resale. These goods were subject to a 2% trade discount. The accountant of XYZ Limited recorded the purchase by debiting the purchases account and crediting the trade payables account with the full gross amount of 32,000. iv) The sales and receivables figures include 15,000 worth of sales made on a 'sale or return basis' at a gross profit mark-up of 20%. These goods were not sold by XYZ Limited's customer by end of year. v) During 2017, XYZ Limited issued 100,000 ordinary shares at 1 each share. In addition, on 1 December 2017, the company also issued 150,000 debentures at par with a coupon rate of 5% maturing in 2027. Both issues were fully taken up and the cash was deposited in the bank, but no other entries were made in the books. Required: A. For the year ended 31 December 2017, prepare the following statements for XYZ Limited: i) A Statement of Profit and Loss; (15) ii) A Statement of Changes in Equity. (5) B. Prepare a Statement of Financial Position as at 31 December 2017. (6) SECTION B Answer Question 7 in this section. This question is compulsory and carries 26 marks. 7. The following Trial Balance was extracted from the books of XYZ Limited on 31 December 2017: Ordinary Share Capital (0.50 per share) 900,000 Revaluation reserve 125,000 Share premium 225,000 Retained earnings 675,000 Interim ordinary dividend paid 22,500 5% Malta Government Stocks (MGS) 130,000 Freehold land 1,300,000 Buildings 350,000 Equipment 74,500 Motor vehicles 75,000 Allowance for depreciation b/f: Buildings 162,300 Equipment 47,650 Motor vehicles 11,250 Inventories (31 December 2016) 133,400 Trade receivables/payables 284,100 322,050 Allowance for bad debts 12,000 Bank 775,000 Purchases/Sales 675,000 1,336,000 Returns outwards 20,950 Interest on MGS 3,250 Selling & distribution costs 120,000 Water & electricity 11,700 Miscellaneous expenses 13,500 Administrative expenses 110,000 Suspense 234,250 4,074,700 4,074,700 The following information is also available: a) Inventory held at year end was valued at 156,000. b) Administrative expenses and water and electricity costs incurred but still outstanding at year end amounted to C27,500 and 2,350, respectively. c) XYZ Limited carries non current assets at cost less accumulated depreciation with the exception of land which is carried at revalued amount. The company's architect valued the land at 1,200,000 as at 31 December 2017. d) Non current assets are depreciated as follows: i) Buildings at 2%, Straight Line Method; ii) Equipment at 20%, Reducing Balance Method; and iii) Motor Vehicles at 20%, Reducing Balance Method. The receivables balance includes an amount of 20,000 owed by a customer who has been declared bankrupt. A review of other receivables indicates that 5% of these are expected as credit losses (not collectable). f) a While reviewing transactions for 2017 in order to resolve the balance on the Suspense Account, the following were noted: i) Goods returned by customers amounting to 7,875 were posted to the Returns Outwards account and credited in the customers' account. ii) Equipment worth 10,000, acquired during the year, was classified as 'Miscellaneous expense'. iii) Included in the purchases figure is 32,000 worth of goods for resale. These goods were subject to a 2% trade discount. The accountant of XYZ Limited recorded the purchase by debiting the purchases account and crediting the trade payables account with the full gross amount of 32,000. iv) The sales and receivables figures include 15,000 worth of sales made on a 'sale or return basis' at a gross profit mark-up of 20%. These goods were not sold by XYZ Limited's customer by end of year. v) During 2017, XYZ Limited issued 100,000 ordinary shares at 1 each share. In addition, on 1 December 2017, the company also issued 150,000 debentures at par with a coupon rate of 5% maturing in 2027. Both issues were fully taken up and the cash was deposited in the bank, but no other entries were made in the books. Required: A. For the year ended 31 December 2017, prepare the following statements for XYZ Limited: i) A Statement of Profit and Loss; (15) ii) A Statement of Changes in Equity. (5) B. Prepare a Statement of Financial Position as at 31 December 2017. (6)