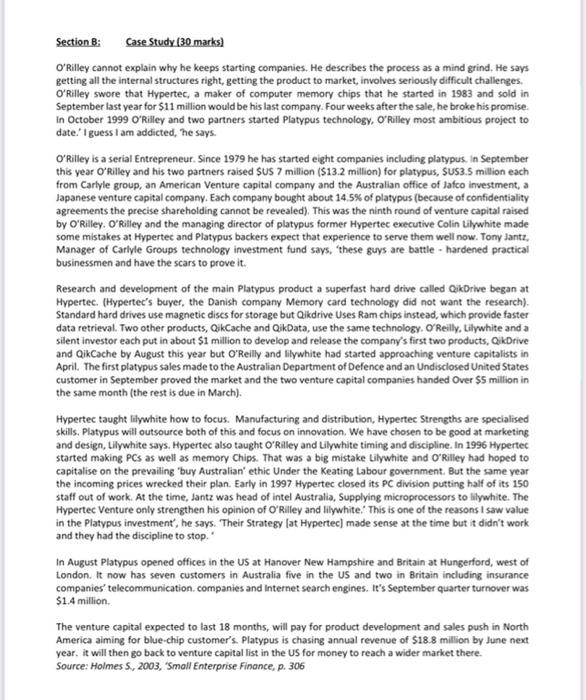

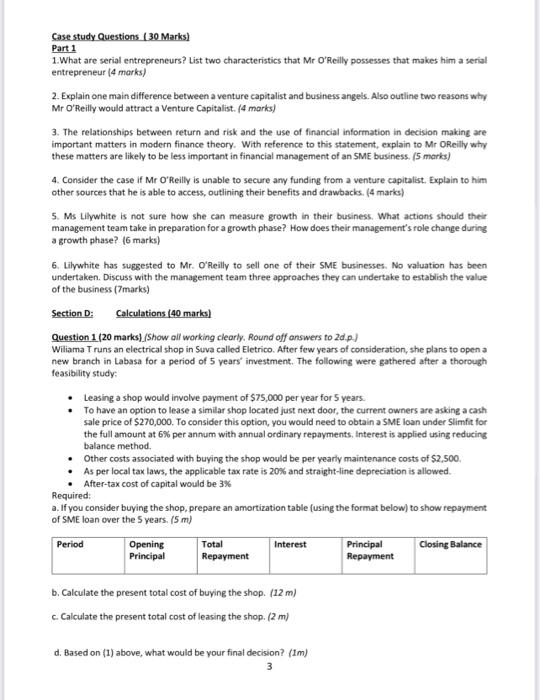

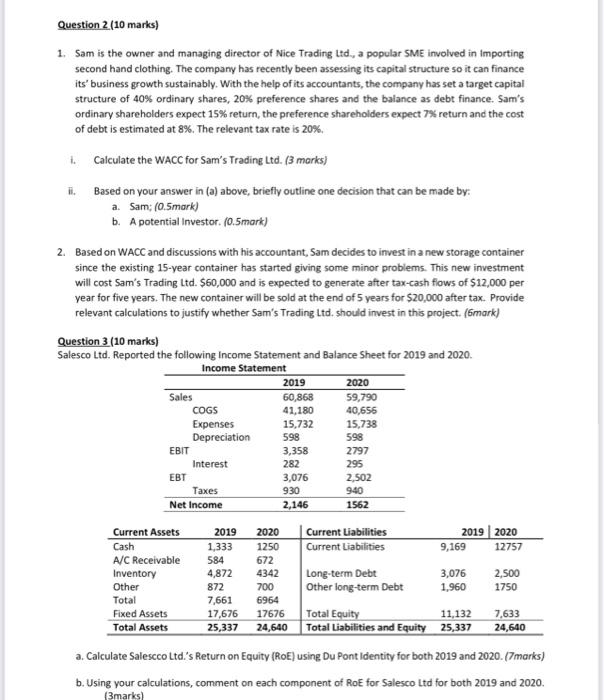

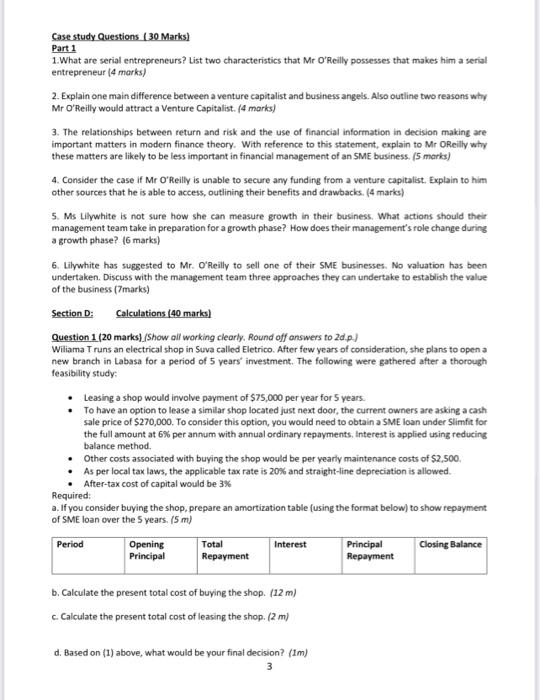

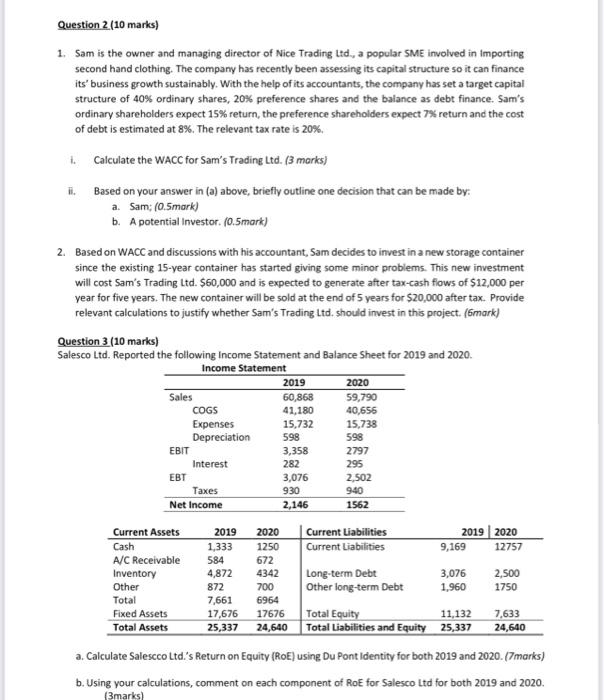

Section B: Case Study (30 marks) O'Rilley cannot explain why he keeps starting companies. He describes the process as a mind grind. He says getting all the internal structures right, getting the product to market, involves seriously difficult challenges O'Rilley swore that Hypertec, a maker of computer memory chips that he started in 1983 and sold in September last year for $11 million would be his last company. Four weeks after the sale, he broke his promise In October 1999 O'Riley and two partners started Platypus technology, O'Riley most ambitious project to date. I guess I am addicted, The says. O'Rilley is a serial Entrepreneur. Since 1979 he has started eight companies including platypus. In September this year ORilley and his two partners raised SUS 7 million ($13.2 million) for platypus, SUS3.5 million each from Carlyle group, an American Venture capital company and the Australian office of Jafco investment, a Japanese venture capital company. Each company bought about 14.5% of platypus (because of confidentiality agreements the precise shareholding cannot be revealed). This was the ninth round of venture capital raised by O'Rilley. O'Rilley and the managing director of platypus former Hypertec executive Colin Lilywhite made some mistakes at Hypertec and Platypus backers expect that experience to serve them well now. Tony Jantz, Manager of Carlyle Groups technology investment fund says, "these guys are battle - hardened practical businessmen and have the scars to prove it. Research and development of the main Platypus product a superfast hard drive called QikDrive began at Hypertec. (Hypertec's buyer, the Danish company Memory card technology did not want the research). Standard hard drives use magnetic discs for storage but Qikdrive Uses Ram chips instead, which provide faster data retrieval. Two other products, QkCache and QikData, use the same technology. O'Reilly, Lilywhite and a silent investor each put in about $1 million to develop and release the company's first two products, QikDrive and QikCache by August this year but O'Reilly and lilywhite had started approaching venture capitalists in April. The first platypus sales made to the Australian Department of Defence and an Undisclosed United States customer in September proved the market and the two venture capital companies handed over $5 million in the same month (the rest is due in March). Hypertec taught lilywhite how to focus. Manufacturing and distribution, Hypertec Strengths are specialised skills. Platypus will outsource both of this and focus on innovation. We have chosen to be good at marketing and design, Lilywhite says. Hypertec also taught O'Rilley and Lilywhite timing and discipline. In 1996 Hypertec started making PCs as well as memory Chips. That was a big mistake Lilywhite and O'Riley had hoped to capitalise on the prevailing 'buy Australian' ethic Under the Keating Labour government. But the same year the incoming prices wrecked their plan. Early in 1997 Hypertec closed its PC division putting half of its 150 staff out of work. At the time, Jantz was head of intel Australia, Supplying microprocessors to lilywhite. The Hypertec Venture only strengthen his opinion of O'Rilley and lilywhite. This is one of the reasons I saw value in the Platypus investment, he says. Their Strategy (at Hypertec) made sense at the time but it didn't work and they had the discipline to stop In August Platypus opened offices in the US at Hanover New Hampshire and Britain at Hungerford, west of London. It now has seven customers in Australia five in the US and two in Britain including insurance companies telecommunication companies and Internet search engines. It's September quarter turnover was $1.4 million. The venture capital expected to last 18 months, will pay for product development and sales push in North America aiming for blue-chip customer's. Platypus is chasing annual revenue of $18.8 million by June next year, it will then go back to venture capital list in the US for money to reach a wider market there. Source: Holmes 5, 2003, 'Small Enterprise Finance, p. 306 Case study Questions (30 Marks) Part 1 1. What are serial entrepreneurs? List two characteristics that Mr O'Reilly possesses that makes him a serial entrepreneur (4 marks) 2. Explain one main difference between a venture capitalist and business angels. Also outline two reasons why Mr O'Reilly would attract a Venture Capitalist. (4 marks) 3. The relationships between return and risk and the use of financial information in decision making are important matters in modern finance theory. With reference to this statement, explain to Mr OReilly why these matters are likely to be less important in financial management of an SME business. (5 marks) 4. Consider the case if Mr O'Reilly is unable to secure any funding from a venture capitalist. Explain to him other sources that he is able to access, outlining their benefits and drawbacks. (4 marks) 5. Ms Lilywhite is not sure how she can measure growth in their business. What actions should their management team take in preparation for a growth phase? How does their management's role change during a growth phase? (6 marks) 6. Lilywhite has suggested to Mr. O'Reilly to sell one of their SME businesses. No valuation has been undertaken. Discuss with the management team three approaches they can undertake to establish the value of the business (marks) Section D: Calculations (40 marks) Question 1 (20 marks]/Show all working clearly. Round off answers to 2d.p.) Wiliama Truns an electrical shop in Suva called Eletrico. After few years of consideration, she plans to open a new branch in Labasa for a period of 5 years' investment. The following were gathered after a thorough feasibility study Leasing a shop would involve payment of $75,000 per year for 5 years. To have an option to lease a similar shop located just next door, the current owners are asking a cash sale price of $270,000. To consider this option, you would need to obtain a SME loan under Slimfit for the full amount at 6% per annum with annual ordinary repayments. Interest is applied using reducing balance method. Other costs associated with buying the shop would be per yearly maintenance costs of $2,500. As per local tax laws, the applicable tax rate is 20% and straight-line depreciation is allowed. After-tax cost of capital would be 3% Required: a. If you consider buying the shop, prepare an amortization table (using the format below) to show repayment of SME loan over the 5 years. (5 m) Period Opening Total Interest Principal Closing Balance Principal Repayment Repayment a b. Calculate the present total cost of buying the shop. (12 m) C.Calculate the present total cost of leasing the shop. (2 m) d. Based on (1) above, what would be your final decision? (im) 3 Question 2 (10 marks) 1. Sam is the owner and managing director of Nice Trading Ltd., a popular SME involved in importing second hand clothing. The company has recently been assessing its capital structure so it can finance its' business growth sustainably. With the help of its accountants, the company has set a target capital structure of 40% ordinary shares, 20% preference shares and the balance as debt finance. Sam's ordinary shareholders expect 15% return, the preference shareholders expect 7% return and the cost of debt is estimated at 8%. The relevant tax rate is 20% Calculate the WACC for Sam's Trading Ltd. (3 marks) Based on your answer in (a) above, briefly outline one decision that can be made by: a. Sam:(0.5mark) b. A potential Investor. (0.5mark) 2. Based on WACC and discussions with his accountant, Sam decides to invest in a new storage container since the existing 15-year container has started giving some minor problems. This new investment will cost Sam's Trading Ltd. $60,000 and is expected to generate after tax-cash flows of $12,000 per year for five years. The new container will be sold at the end of 5 years for $20,000 after tax. Provide relevant calculations to justify whether Sam's Trading Ltd, should invest in this project. (Smark) Question 3 (10 marks) Salesco Ltd. Reported the following Income Statement and Balance Sheet for 2019 and 2020. Income Statement 2019 2020 Sales 60,868 59,790 COGS 41,180 40,656 Expenses 15,732 15,738 Depreciation 598 598 EBIT 3,358 2797 Interest 282 295 EBT 3,076 2,502 Taxes 930 940 Net Income 2,146 1562 Current Assets 2019 2020 Current Liabilities 2019 2020 Cash 1,333 1250 Current Liabilities 9,169 12757 A/C Receivable 584 672 Inventory 4,872 4342 Long-term Debt 3,076 2,500 Other 872 700 Other long-term Debt 1.960 1750 Total 7,661 6964 Fixed Assets 17,676 17676 Total Equity 11,132 7,633 Total Assets 25,337 24,640 Total Liabilities and Equity 25,337 24,640 a. Calculate Salescco Ltd.'s Return on Equity (ROE) using Du Pont Identity for both 2019 and 2020. (7marks) b. Using your calculations, comment on each component of RoE for Salesco Ltd for both 2019 and 2020. (3marks) Section B: Case Study (30 marks) O'Rilley cannot explain why he keeps starting companies. He describes the process as a mind grind. He says getting all the internal structures right, getting the product to market, involves seriously difficult challenges O'Rilley swore that Hypertec, a maker of computer memory chips that he started in 1983 and sold in September last year for $11 million would be his last company. Four weeks after the sale, he broke his promise In October 1999 O'Riley and two partners started Platypus technology, O'Riley most ambitious project to date. I guess I am addicted, The says. O'Rilley is a serial Entrepreneur. Since 1979 he has started eight companies including platypus. In September this year ORilley and his two partners raised SUS 7 million ($13.2 million) for platypus, SUS3.5 million each from Carlyle group, an American Venture capital company and the Australian office of Jafco investment, a Japanese venture capital company. Each company bought about 14.5% of platypus (because of confidentiality agreements the precise shareholding cannot be revealed). This was the ninth round of venture capital raised by O'Rilley. O'Rilley and the managing director of platypus former Hypertec executive Colin Lilywhite made some mistakes at Hypertec and Platypus backers expect that experience to serve them well now. Tony Jantz, Manager of Carlyle Groups technology investment fund says, "these guys are battle - hardened practical businessmen and have the scars to prove it. Research and development of the main Platypus product a superfast hard drive called QikDrive began at Hypertec. (Hypertec's buyer, the Danish company Memory card technology did not want the research). Standard hard drives use magnetic discs for storage but Qikdrive Uses Ram chips instead, which provide faster data retrieval. Two other products, QkCache and QikData, use the same technology. O'Reilly, Lilywhite and a silent investor each put in about $1 million to develop and release the company's first two products, QikDrive and QikCache by August this year but O'Reilly and lilywhite had started approaching venture capitalists in April. The first platypus sales made to the Australian Department of Defence and an Undisclosed United States customer in September proved the market and the two venture capital companies handed over $5 million in the same month (the rest is due in March). Hypertec taught lilywhite how to focus. Manufacturing and distribution, Hypertec Strengths are specialised skills. Platypus will outsource both of this and focus on innovation. We have chosen to be good at marketing and design, Lilywhite says. Hypertec also taught O'Rilley and Lilywhite timing and discipline. In 1996 Hypertec started making PCs as well as memory Chips. That was a big mistake Lilywhite and O'Riley had hoped to capitalise on the prevailing 'buy Australian' ethic Under the Keating Labour government. But the same year the incoming prices wrecked their plan. Early in 1997 Hypertec closed its PC division putting half of its 150 staff out of work. At the time, Jantz was head of intel Australia, Supplying microprocessors to lilywhite. The Hypertec Venture only strengthen his opinion of O'Rilley and lilywhite. This is one of the reasons I saw value in the Platypus investment, he says. Their Strategy (at Hypertec) made sense at the time but it didn't work and they had the discipline to stop In August Platypus opened offices in the US at Hanover New Hampshire and Britain at Hungerford, west of London. It now has seven customers in Australia five in the US and two in Britain including insurance companies telecommunication companies and Internet search engines. It's September quarter turnover was $1.4 million. The venture capital expected to last 18 months, will pay for product development and sales push in North America aiming for blue-chip customer's. Platypus is chasing annual revenue of $18.8 million by June next year, it will then go back to venture capital list in the US for money to reach a wider market there. Source: Holmes 5, 2003, 'Small Enterprise Finance, p. 306 Case study Questions (30 Marks) Part 1 1. What are serial entrepreneurs? List two characteristics that Mr O'Reilly possesses that makes him a serial entrepreneur (4 marks) 2. Explain one main difference between a venture capitalist and business angels. Also outline two reasons why Mr O'Reilly would attract a Venture Capitalist. (4 marks) 3. The relationships between return and risk and the use of financial information in decision making are important matters in modern finance theory. With reference to this statement, explain to Mr OReilly why these matters are likely to be less important in financial management of an SME business. (5 marks) 4. Consider the case if Mr O'Reilly is unable to secure any funding from a venture capitalist. Explain to him other sources that he is able to access, outlining their benefits and drawbacks. (4 marks) 5. Ms Lilywhite is not sure how she can measure growth in their business. What actions should their management team take in preparation for a growth phase? How does their management's role change during a growth phase? (6 marks) 6. Lilywhite has suggested to Mr. O'Reilly to sell one of their SME businesses. No valuation has been undertaken. Discuss with the management team three approaches they can undertake to establish the value of the business (marks) Section D: Calculations (40 marks) Question 1 (20 marks]/Show all working clearly. Round off answers to 2d.p.) Wiliama Truns an electrical shop in Suva called Eletrico. After few years of consideration, she plans to open a new branch in Labasa for a period of 5 years' investment. The following were gathered after a thorough feasibility study Leasing a shop would involve payment of $75,000 per year for 5 years. To have an option to lease a similar shop located just next door, the current owners are asking a cash sale price of $270,000. To consider this option, you would need to obtain a SME loan under Slimfit for the full amount at 6% per annum with annual ordinary repayments. Interest is applied using reducing balance method. Other costs associated with buying the shop would be per yearly maintenance costs of $2,500. As per local tax laws, the applicable tax rate is 20% and straight-line depreciation is allowed. After-tax cost of capital would be 3% Required: a. If you consider buying the shop, prepare an amortization table (using the format below) to show repayment of SME loan over the 5 years. (5 m) Period Opening Total Interest Principal Closing Balance Principal Repayment Repayment a b. Calculate the present total cost of buying the shop. (12 m) C.Calculate the present total cost of leasing the shop. (2 m) d. Based on (1) above, what would be your final decision? (im) 3 Question 2 (10 marks) 1. Sam is the owner and managing director of Nice Trading Ltd., a popular SME involved in importing second hand clothing. The company has recently been assessing its capital structure so it can finance its' business growth sustainably. With the help of its accountants, the company has set a target capital structure of 40% ordinary shares, 20% preference shares and the balance as debt finance. Sam's ordinary shareholders expect 15% return, the preference shareholders expect 7% return and the cost of debt is estimated at 8%. The relevant tax rate is 20% Calculate the WACC for Sam's Trading Ltd. (3 marks) Based on your answer in (a) above, briefly outline one decision that can be made by: a. Sam:(0.5mark) b. A potential Investor. (0.5mark) 2. Based on WACC and discussions with his accountant, Sam decides to invest in a new storage container since the existing 15-year container has started giving some minor problems. This new investment will cost Sam's Trading Ltd. $60,000 and is expected to generate after tax-cash flows of $12,000 per year for five years. The new container will be sold at the end of 5 years for $20,000 after tax. Provide relevant calculations to justify whether Sam's Trading Ltd, should invest in this project. (Smark) Question 3 (10 marks) Salesco Ltd. Reported the following Income Statement and Balance Sheet for 2019 and 2020. Income Statement 2019 2020 Sales 60,868 59,790 COGS 41,180 40,656 Expenses 15,732 15,738 Depreciation 598 598 EBIT 3,358 2797 Interest 282 295 EBT 3,076 2,502 Taxes 930 940 Net Income 2,146 1562 Current Assets 2019 2020 Current Liabilities 2019 2020 Cash 1,333 1250 Current Liabilities 9,169 12757 A/C Receivable 584 672 Inventory 4,872 4342 Long-term Debt 3,076 2,500 Other 872 700 Other long-term Debt 1.960 1750 Total 7,661 6964 Fixed Assets 17,676 17676 Total Equity 11,132 7,633 Total Assets 25,337 24,640 Total Liabilities and Equity 25,337 24,640 a. Calculate Salescco Ltd.'s Return on Equity (ROE) using Du Pont Identity for both 2019 and 2020. (7marks) b. Using your calculations, comment on each component of RoE for Salesco Ltd for both 2019 and 2020. (3marks)