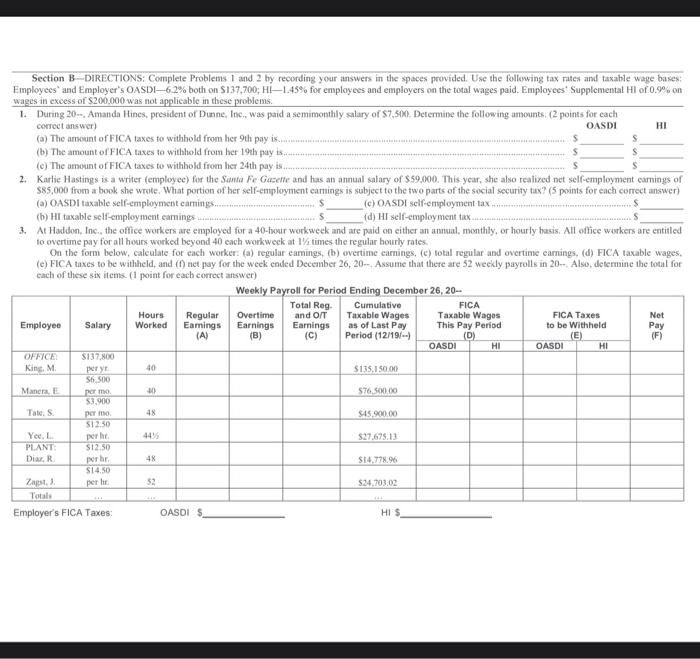

Section B ---DIRECTIONS: Complete Problems 1 and 2 by recording your answers in the spaces provided. Use the following tax rates and taxable wage buses: Employees and Employer's OASDI46.2% both on S137,700; HI 1.45% for employees and employers on the total wages paid. Employees' Supplemental Hl of 0.9% on wages in excess of $200.000 was not applicable in these problems. 1. During 20-, Amanda Ilines, president of Dunne, Inc., was paid a semimonthly salary of $7,500 Determine the following amounts. (2 points for each correct answer) OASDI HI (a) The amount of FICA taxes to withhold from her 9th pay (b) The amount of FICA taxes to withhold from her 19th payts, (c) The amount of FICA taxes to withhold from her 24th pay is 2. Karlie Hastings is a writer (employee) for the Santa Fe Gacette and has an annual salary of $59.000. This year, she also realized net self-employment earnings of $85,000 from a book she wrote. What portion of her self-employment camnings is subject to the two parts of the social security tax? (5 points for each correct answer) (a) OASDi taxable self-employment earnings.. (c) OASDI self-employment tax... (b) HI taxable self-employment camnings... (d) HI self-employment tax.... 3. At Haddon, Inc., the office workers are employed for a 40-twur workweek and are paid on either an annual, monthly, or hourly basis. All office workers are entitled to overtime pay for all hours worked beyond 40 each workweek at 17 times the regular hourly rates On the form below, calculate for each worker: (a) regular camnings, (b) overtime carnings. (c) total regular and overtime camnings. (d) FICA taxable wages (e) FICA taxes to be withheld, and () net pay for the week ended December 26, 20. Assume that there are 52 weekly payrolls in 20- Also, determine the total for cach of these six items (1 point for each correct answer) Weekly Payroll for Period Ending December 26, 20- Total Reg. Cumulative FICA Hours Regular Overtime and O/T Taxable Wages Taxable Wages FICA Taxes Net Employee Salary Worked Eamings Earnings Earnings as of Last Pay This Pay Period to be withheld (A) (B) (C) Period (12/19/ (D) (E) (F) OASDI HI OASDI HI OFFICE $137.800 King.M pery 40 $135,150.00 S6.500 Manera, 10 576.500.00 $3.900 Tales $45.900.00 $12.50 Ye. perhe 44 $27.675.13 PLANT S12.50 Diar, $14,778.96 $14.50 Zapest, per hr 52 $24.703.02 Totale Employer's FICA Taxes: OASIS HIS Pay norme permo per hr 48 Section B ---DIRECTIONS: Complete Problems 1 and 2 by recording your answers in the spaces provided. Use the following tax rates and taxable wage buses: Employees and Employer's OASDI46.2% both on S137,700; HI 1.45% for employees and employers on the total wages paid. Employees' Supplemental Hl of 0.9% on wages in excess of $200.000 was not applicable in these problems. 1. During 20-, Amanda Ilines, president of Dunne, Inc., was paid a semimonthly salary of $7,500 Determine the following amounts. (2 points for each correct answer) OASDI HI (a) The amount of FICA taxes to withhold from her 9th pay (b) The amount of FICA taxes to withhold from her 19th payts, (c) The amount of FICA taxes to withhold from her 24th pay is 2. Karlie Hastings is a writer (employee) for the Santa Fe Gacette and has an annual salary of $59.000. This year, she also realized net self-employment earnings of $85,000 from a book she wrote. What portion of her self-employment camnings is subject to the two parts of the social security tax? (5 points for each correct answer) (a) OASDi taxable self-employment earnings.. (c) OASDI self-employment tax... (b) HI taxable self-employment camnings... (d) HI self-employment tax.... 3. At Haddon, Inc., the office workers are employed for a 40-twur workweek and are paid on either an annual, monthly, or hourly basis. All office workers are entitled to overtime pay for all hours worked beyond 40 each workweek at 17 times the regular hourly rates On the form below, calculate for each worker: (a) regular camnings, (b) overtime carnings. (c) total regular and overtime camnings. (d) FICA taxable wages (e) FICA taxes to be withheld, and () net pay for the week ended December 26, 20. Assume that there are 52 weekly payrolls in 20- Also, determine the total for cach of these six items (1 point for each correct answer) Weekly Payroll for Period Ending December 26, 20- Total Reg. Cumulative FICA Hours Regular Overtime and O/T Taxable Wages Taxable Wages FICA Taxes Net Employee Salary Worked Eamings Earnings Earnings as of Last Pay This Pay Period to be withheld (A) (B) (C) Period (12/19/ (D) (E) (F) OASDI HI OASDI HI OFFICE $137.800 King.M pery 40 $135,150.00 S6.500 Manera, 10 576.500.00 $3.900 Tales $45.900.00 $12.50 Ye. perhe 44 $27.675.13 PLANT S12.50 Diar, $14,778.96 $14.50 Zapest, per hr 52 $24.703.02 Totale Employer's FICA Taxes: OASIS HIS Pay norme permo per hr 48