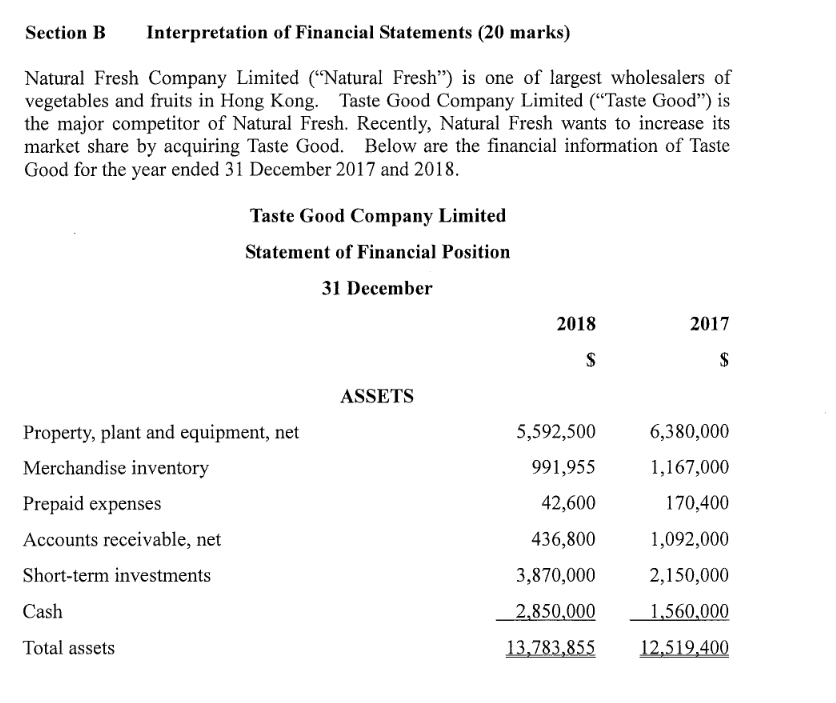

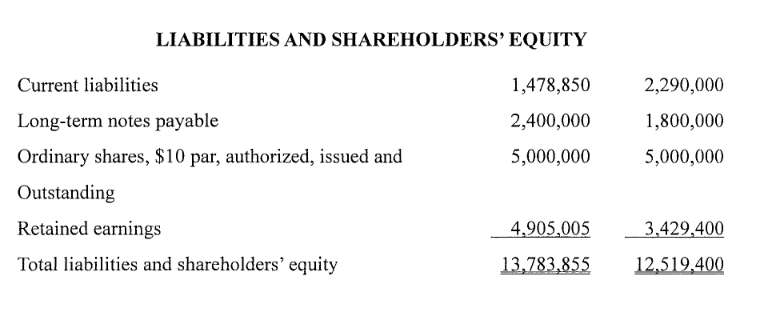

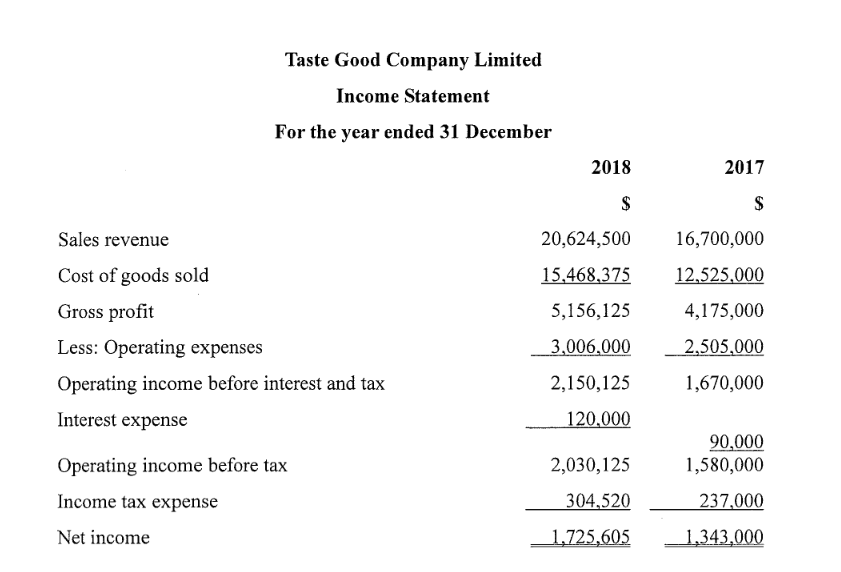

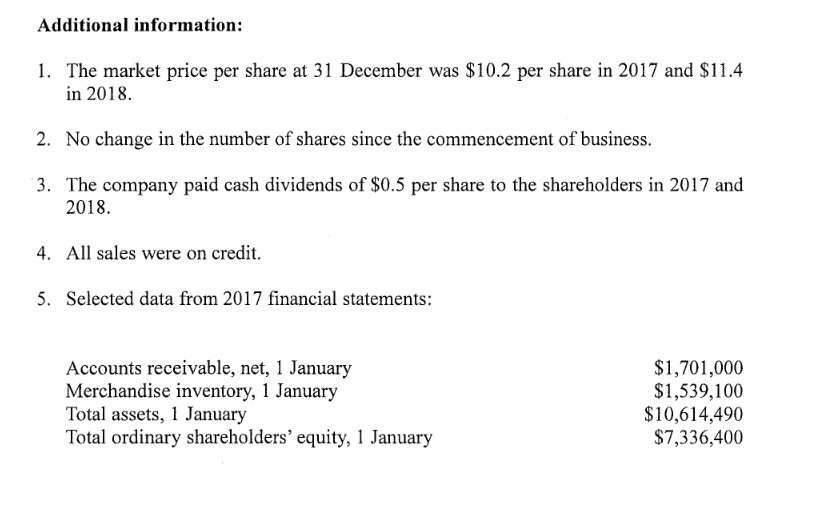

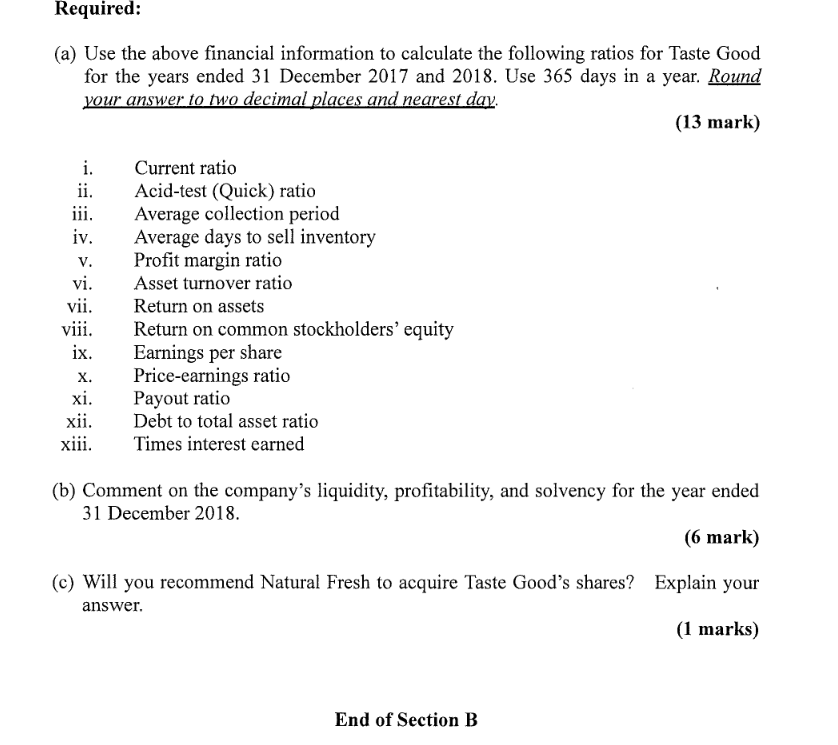

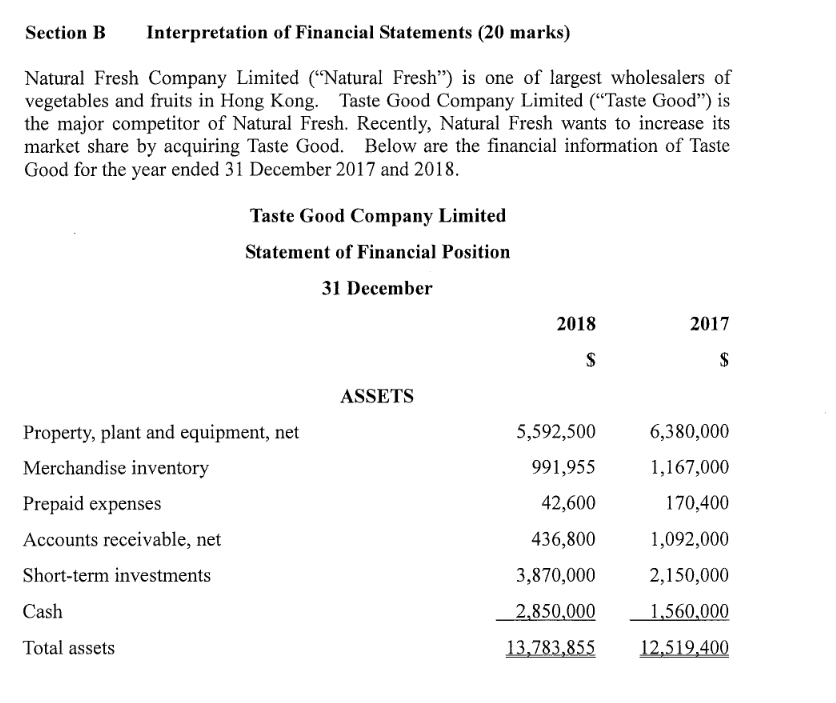

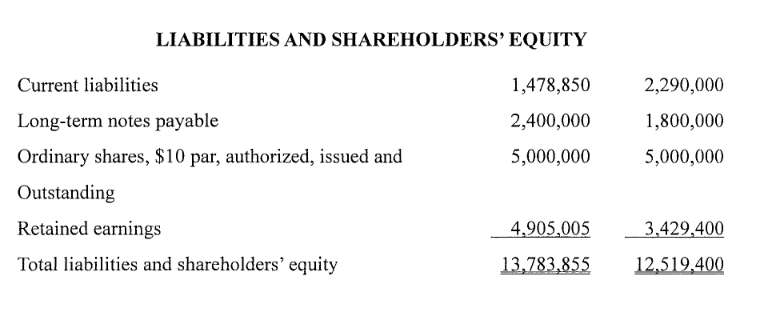

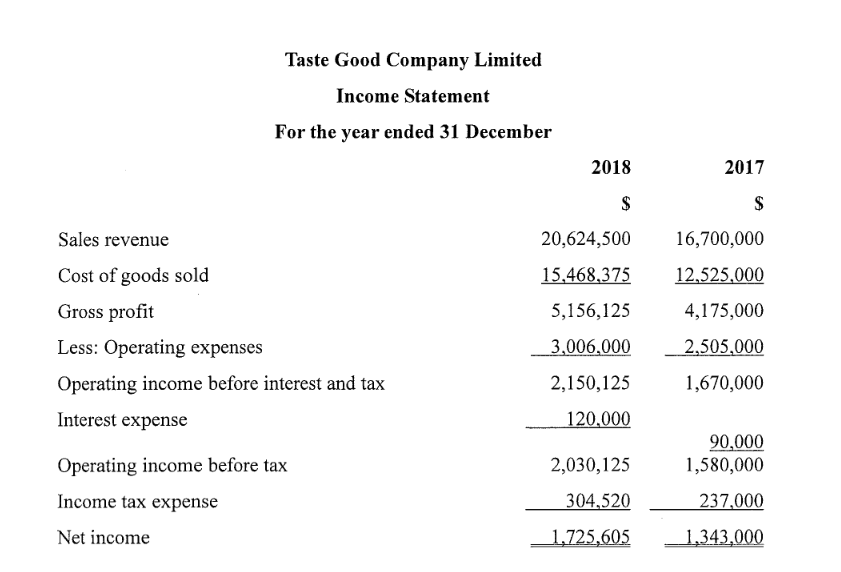

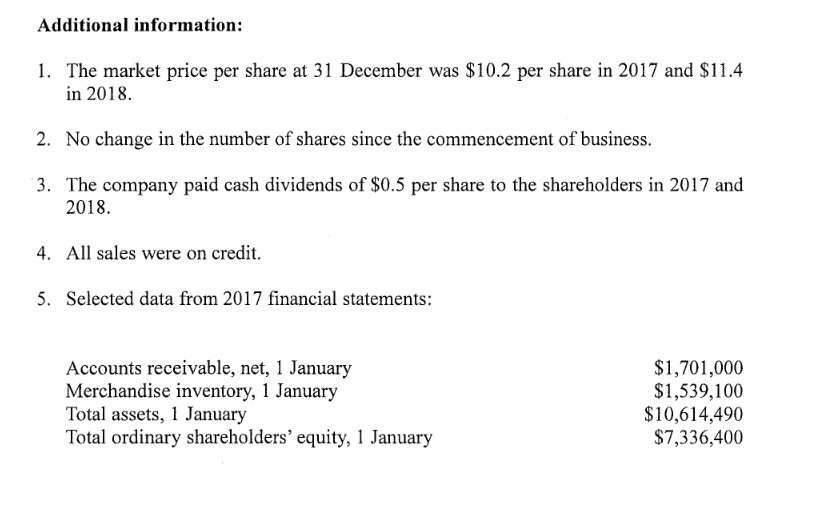

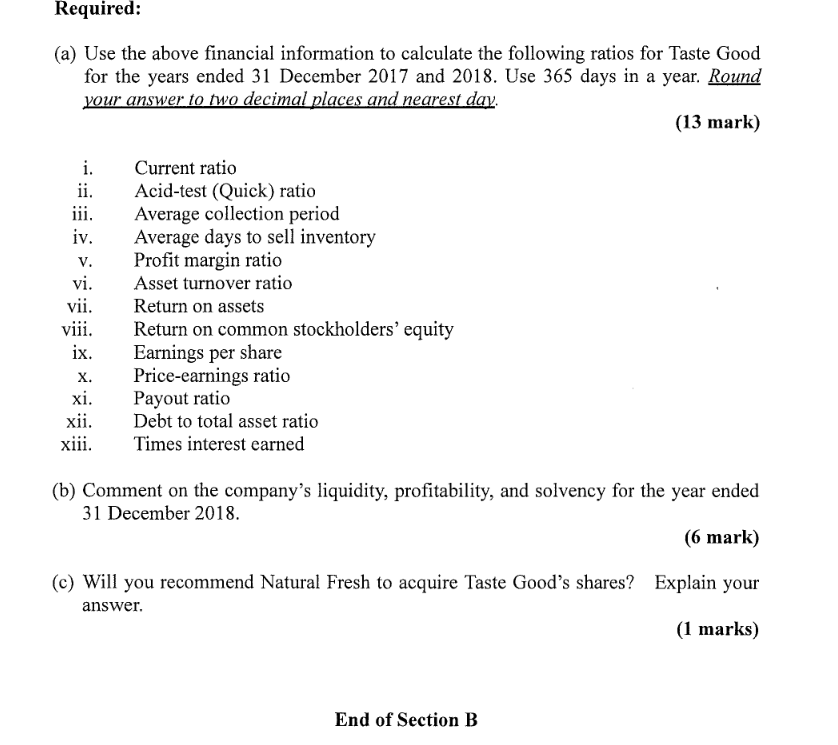

Section B Interpretation of Financial Statements ( 20 marks) Natural Fresh Company Limited ("Natural Fresh") is one of largest wholesalers of vegetables and fruits in Hong Kong. Taste Good Company Limited ("Taste Good") is the major competitor of Natural Fresh. Recently, Natural Fresh wants to increase its market share by acquiring Taste Good. Below are the financial information of Taste Good for the year ended 31 December 2017 and 2018. Taste Good Company Limited LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Long-term notes payable Ordinary shares, \$10 par, authorized, issued and 1,478,8502,400,0005,000,0002,290,0001,800,0005,000,000 Outstanding Retained earnings Total liabilities and shareholders' equity Taste Good Company Limited Income Statement For the year ended 31 December \begin{tabular}{lrr} Sales revenue & 20,624,500 & 16,700,000 \\ Cost of goods sold & 15,468,375 & 12,525,000 \\ Gross profit & 5,156,125 & 4,175,000 \\ Less: Operating expenses & 3,006,000 & 2,505,000 \\ Operating income before interest and tax & 2,150,125 & 1,670,000 \\ Interest expense & 120,000 & \\ Operating income before tax & 2,030,125 & 1,580,000 \\ Income tax expense & 304,520 & 237,000 \\ Net income & 1,725,605 & 1,343,000 \\ \hline \hline \end{tabular} Additional information: 1. The market price per share at 31 December was $10.2 per share in 2017 and $11.4 in 2018. 2. No change in the number of shares since the commencement of business. 3. The company paid cash dividends of $0.5 per share to the shareholders in 2017 and 2018. 4. All sales were on credit. 5. Selected data from 2017 financial statements: Accounts receivable, net, 1 January Merchandise inventory, 1 January Total assets, 1 January Total ordinary shareholders' equity, 1 January $1,701,000 $1,539,100 $10,614,490 $7,336,400 (a) Use the above financial information to calculate the following ratios for Taste Good for the years ended 31 December 2017 and 2018. Use 365 days in a year. Round your answer to two decimal places and nearest day. (13 mark) i. Current ratio ii. Acid-test (Quick) ratio iii. Average collection period iv. Average days to sell inventory v. Profit margin ratio vi. Asset turnover ratio vii. Return on assets viii. Return on common stockholders' equity ix. Earnings per share x. Price-earnings ratio xi. Payout ratio xii. Debt to total asset ratio xiii. Times interest earned (b) Comment on the company's liquidity, profitability, and solvency for the year ended 31 December 2018. (6 mark) (c) Will you recommend Natural Fresh to acquire Taste Good's shares? Explain your answer. (1 marks)