Answered step by step

Verified Expert Solution

Question

1 Approved Answer

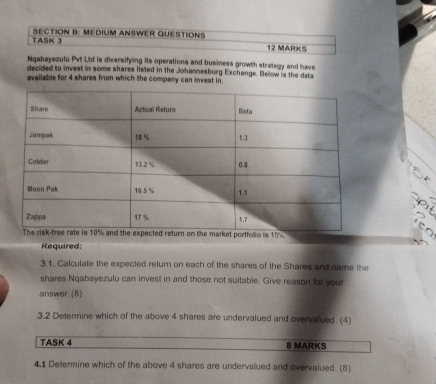

SECTION B: MEDIUM ANSWER QUESTIONS TASK 3 1 2 MARKS Nqabayerulu fert Lod is diversifying its operations and busineas growth strategy and have decided to

SECTION B: MEDIUM ANSWER QUESTIONS

TASK

MARKS

Nqabayerulu fert Lod is diversifying its operations and busineas growth strategy and have decided to invest in some shares listed in the Johmonesurg Exchange. Below is the data available for shares from which the company can irrest in

tableShareActual Return,BetaJampakColderMoon Pak,

The riskfree rate is and the expected return on the market portfolio is

Required:

Calculate the expected retum on each of the shares of the Shares and namo the shares Nqabayezulu can invest in and those not suitable. Give reason for your answer. B

Determine which of the above shares are undervalued and overvalued.

Determine which of the above shares are undervalued and overvalued.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started