Answered step by step

Verified Expert Solution

Question

1 Approved Answer

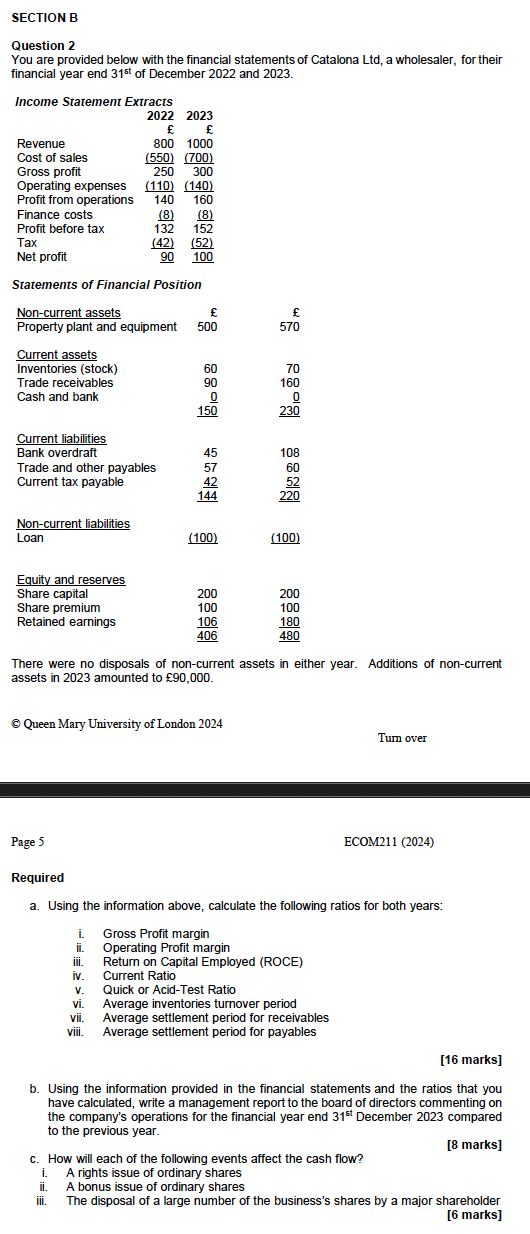

SECTION B Question 2 You are provided below with the financial statements of Catalona Ltd, a wholesaler, for their financial year end 31st of

SECTION B Question 2 You are provided below with the financial statements of Catalona Ltd, a wholesaler, for their financial year end 31st of December 2022 and 2023. Income Statement Extracts 2022 2023 800 1000 Revenue Cost of sales Gross profit (550) (700) 250 300 Operating expenses (110) (140) Profit from operations 140 160 Finance costs (8) (8) Profit before tax 132 152 Tax (42) (52) Net profit 90 100 Statements of Financial Position Non-current assets Property plant and equipment 500 Current assets Inventories (stock) Trade receivables Cash and bank 60 90 150 Current liabilities Bank overdraft 45 Trade and other payables 57 Current tax payable 42 144 60 e Non-current liabilities Loan (100) (100) Equity and reserves Share capital 200 200 Share premium 100 100 Retained earnings 106 180 406 480 There were no disposals of non-current assets in either year. Additions of non-current assets in 2023 amounted to 90,000. Queen Mary University of London 2024 Tum over Page 5 Required ECOM211 (2024) a. Using the information above, calculate the following ratios for both years: i. Gross Profit margin II. Operating Profit margin Return on Capital Employed (ROCE) iv. Current Ratio V. Quick or Acid-Test Ratio vi. Average inventories turnover period vii. Average settlement period for receivables Average settlement period for payables viii. [16 marks] b. Using the information provided in the financial statements and the ratios that you have calculated, write a management report to the board of directors commenting on the company's operations for the financial year end 31st December 2023 compared to the previous year. c. How will each of the following events affect the cash flow? i. A rights issue of ordinary shares ii. A bonus issue of ordinary shares III. [8 marks] The disposal of a large number of the business's shares by a major shareholder [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculating Ratios for both years 1 Gross Profit Margin 2019 Gross Profit Revenue 100 250 800 100 3125 2020 300 1000 100 30 2 Operating Profit Margi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started