Answered step by step

Verified Expert Solution

Question

1 Approved Answer

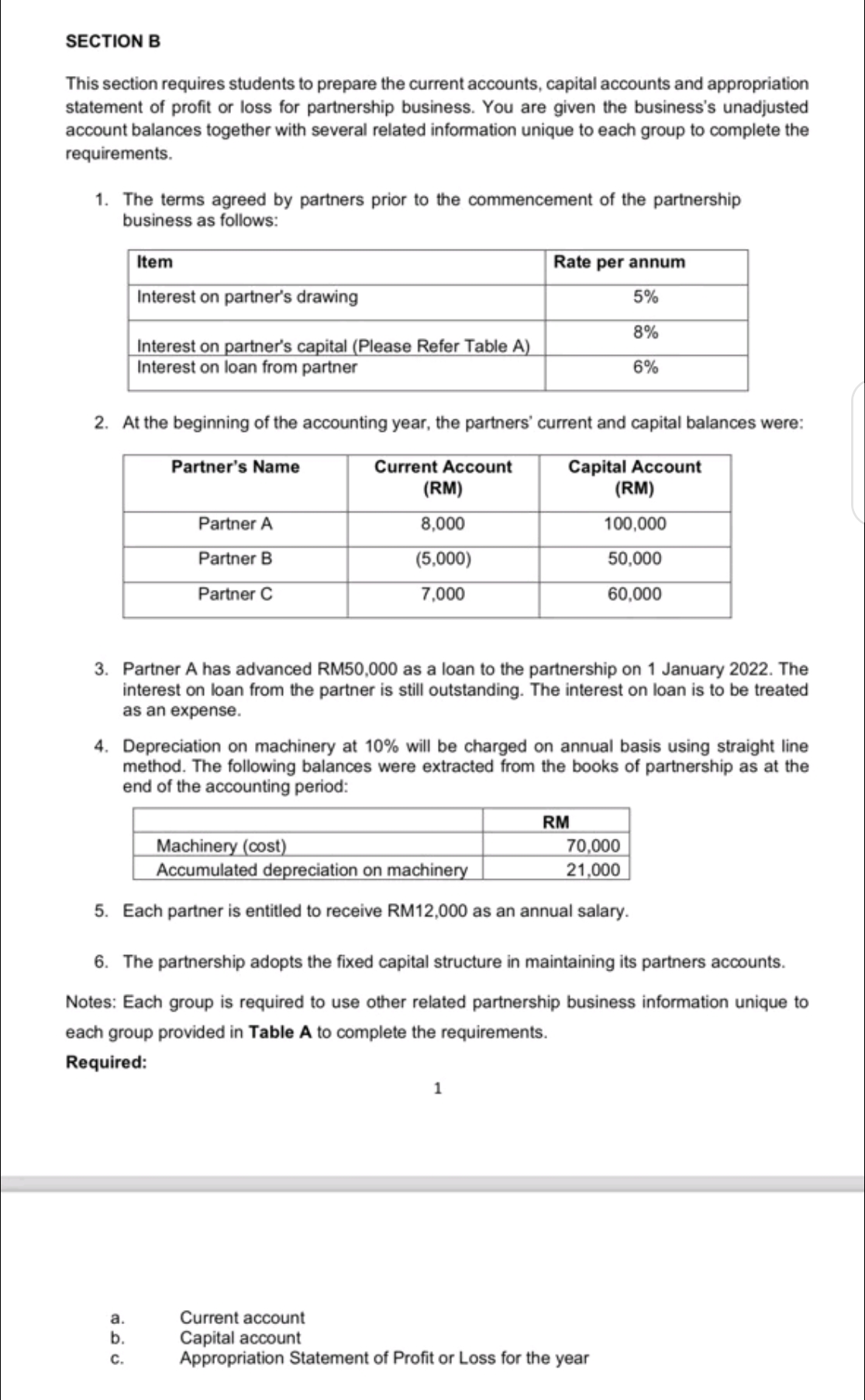

SECTION B This section requires students to prepare the current accounts, capital accounts and appropriation statement of profit or loss for partnership business. You are

SECTION B

This section requires students to prepare the current accounts, capital accounts and appropriation

statement of profit or loss for partnership business. You are given the business's unadjusted

account balances together with several related information unique to each group to complete the

requirements.

The terms agreed by partners prior to the commencement of the partnership

business as follows:

At the beginning of the accounting year, the partners' current and capital balances were:

Partner A has advanced RM as a loan to the partnership on January The

interest on loan from the partner is still outstanding. The interest on loan is to be treated

as an expense.

Depreciation on machinery at will be charged on annual basis using straight line

method. The following balances were extracted from the books of partnership as at the

end of the accounting period:

Each partner is entitled to receive RM as an annual salary.

The partnership adopts the fixed capital structure in maintaining its partners accounts.

Notes: Each group is required to use other related partnership business information unique to

each group provided in Table to complete the requirements.

Required:

a Current account

b Capital account

c Appropriation Statement of Profit or Loss for the year help

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started