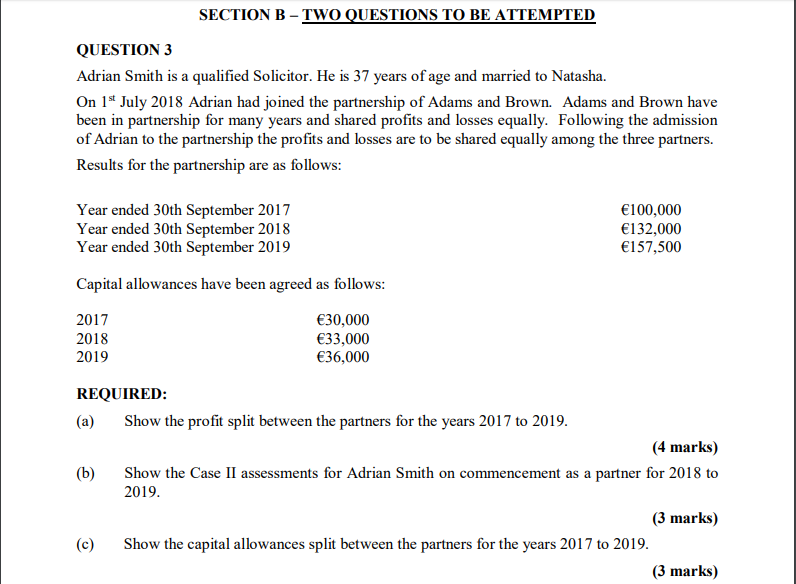

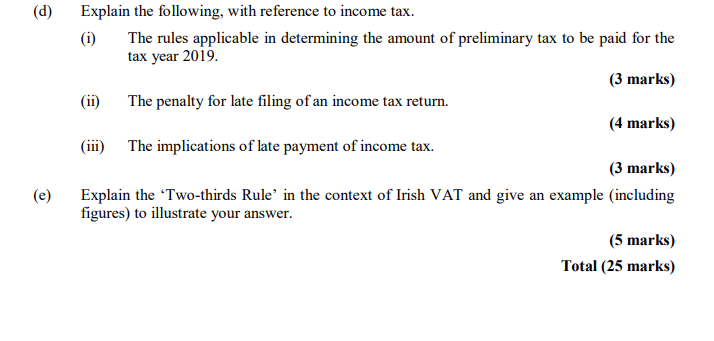

SECTION B - TWO QUESTIONS TO BE ATTEMPTED QUESTION 3 Adrian Smith is a qualified Solicitor. He is 37 years of age and married to Natasha. On 1st July 2018 Adrian had joined the partnership of Adams and Brown. Adams and Brown have been in partnership for many years and shared profits and losses equally. Following the admission of Adrian to the partnership the profits and losses are to be shared equally among the three partners. Results for the partnership are as follows: Year ended 30th September 2017 Year ended 30th September 2018 Year ended 30th September 2019 100,000 132,000 157,500 Capital allowances have been agreed as follows: 2017 30,000 2018 33,000 2019 36,000 REQUIRED: (a) Show the profit split between the partners for the years 2017 to 2019. (4 marks) (b) Show the Case II assessments for Adrian Smith on commencement as a partner for 2018 to 2019. (3 marks) (c) Show the capital allowances split between the partners for the years 2017 to 2019. (3 marks) (d) Explain the following, with reference to income tax. (1) The rules applicable in determining the amount of preliminary tax to be paid for the tax year 2019. (3 marks) (ii) The penalty for late filing of an income tax return. (4 marks) (iii) The implications of late payment of income tax. (3 marks) Explain the Two-thirds Rule' in the context of Irish VAT and give an example (including figures) to illustrate your answer. (5 marks) Total (25 marks) (e) SECTION B - TWO QUESTIONS TO BE ATTEMPTED QUESTION 3 Adrian Smith is a qualified Solicitor. He is 37 years of age and married to Natasha. On 1st July 2018 Adrian had joined the partnership of Adams and Brown. Adams and Brown have been in partnership for many years and shared profits and losses equally. Following the admission of Adrian to the partnership the profits and losses are to be shared equally among the three partners. Results for the partnership are as follows: Year ended 30th September 2017 Year ended 30th September 2018 Year ended 30th September 2019 100,000 132,000 157,500 Capital allowances have been agreed as follows: 2017 30,000 2018 33,000 2019 36,000 REQUIRED: (a) Show the profit split between the partners for the years 2017 to 2019. (4 marks) (b) Show the Case II assessments for Adrian Smith on commencement as a partner for 2018 to 2019. (3 marks) (c) Show the capital allowances split between the partners for the years 2017 to 2019. (3 marks) (d) Explain the following, with reference to income tax. (1) The rules applicable in determining the amount of preliminary tax to be paid for the tax year 2019. (3 marks) (ii) The penalty for late filing of an income tax return. (4 marks) (iii) The implications of late payment of income tax. (3 marks) Explain the Two-thirds Rule' in the context of Irish VAT and give an example (including figures) to illustrate your answer. (5 marks) Total (25 marks) (e)