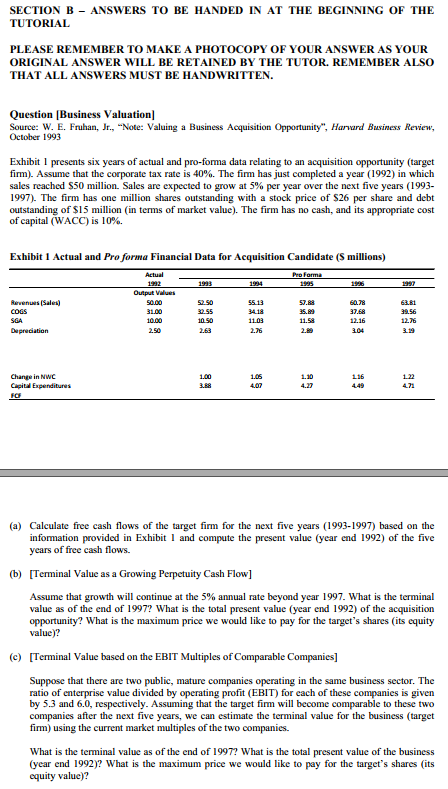

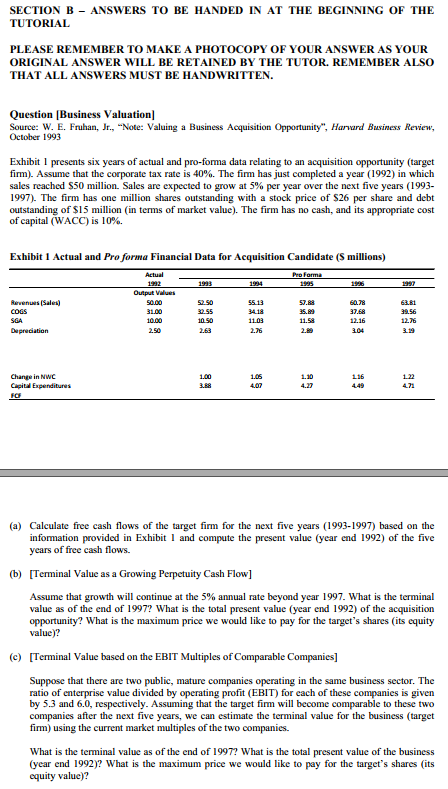

SECTION B-ANSWERS TO BE HANDED IN AT THE BEGINNING OF THE TUTORIAL PLEASE REMEMBER TO MAKE A PHOTOCOPY OF YOUR ANSWER AS YOUR ORIGINAL ANSWER WILL BE RETAINED BY THE TUTOR. REMEMBER ALSO THAT ALL ANSWERS MUST BE HANDWRITTEN. Question Business Valuationl Source: W. E. Fruhan, Jr., "Note: Valuing a Business Acquisition Opportunity", Harvard Business Review, October 1993 Exhibit 1 presents six years of actual and pro-forma data relating to an acquisition opportunity (target firm). Assume that the corporate tax rate is 40%. The firm has just completed a year (1992) in which sales reached S50 million. Sales are expected to grow at 5% per year over the next five years (1993- 1997). The firm has one million shares outstanding with a stock price of S26 per share and debt outstanding of $15 million (in tems of market valuc). The firm has no cash, and its appropriate cost of capital (WACC) is 10%. Exhibit 1 Actual and Pro forma Financial Data for Acquisition Candidate (S millions) Output Vialues 250 Change in NWC Cpi Expenditure (a) Calculate free cash flows of the target firm for the next five years (1993-1997) based on the and compute the present value (year end 1992) of the five information provided in Exhibit years of free cash flows. (b) [Terminal Value as a Growing Perpctuity Cash Flow] Assume that growth will continue at the 5% annual rate beyond year 1997-what is the terminal value as of the end of 1997? What is the total present value (ycar end 1992) of the acquisition opportunity? What is the maximum price we would like to pay for the target's shares (its equity valuc)? (c) [Terminal Value based on the EBIT Multiples of Comparable Companics] Suppose that there are two public, mature companies operating in the same business sector. The ratio of enterprise value divided by operating profit (EBIT) for each of these companies is given by 5.3 and 6.0, respectively. Assuming that the target firm will become comparable to these two companics after the next five years, we can estimate the terminal value for the business (target firm) using the current market multiples of the two companics. What is the terminal value as of the end of 1997? What is the total present value of the business (year end 1992)? What is the maximum price we would like to pay for the target's shares (its equity value)