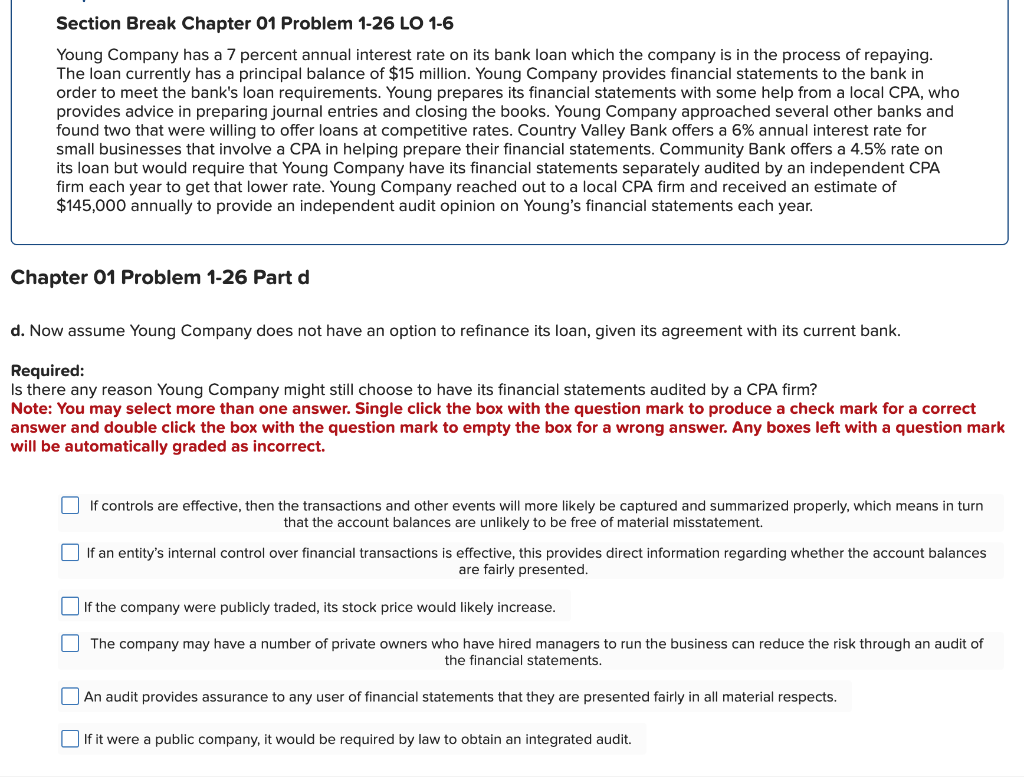

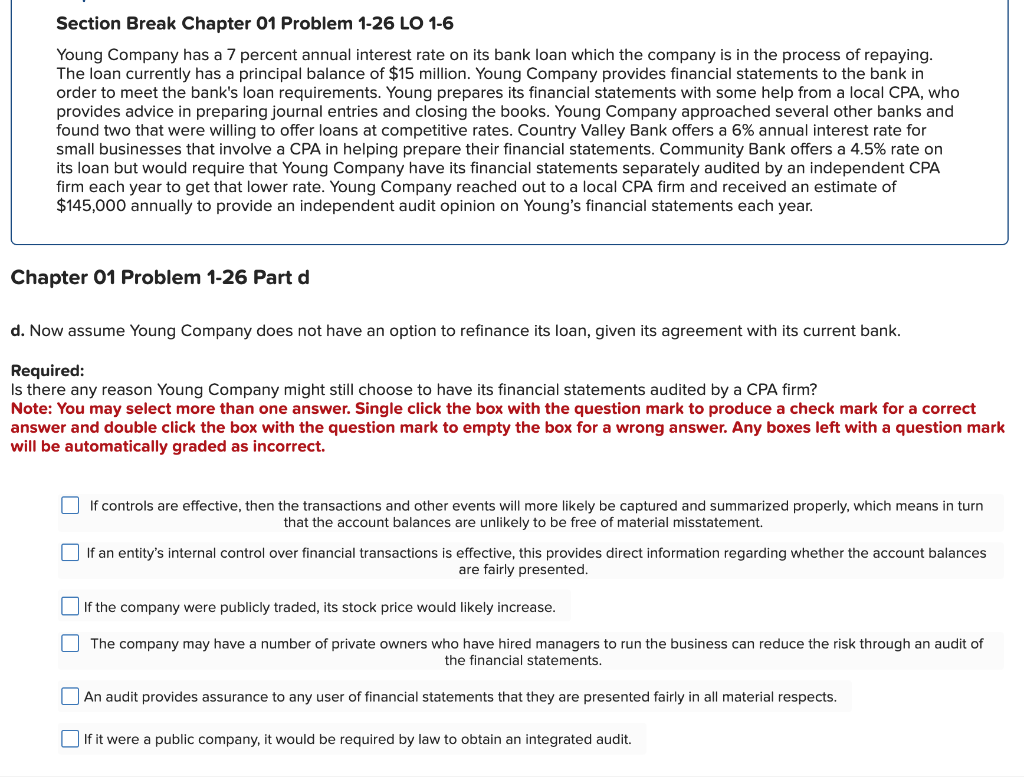

Section Break Chapter 01 Problem 1-26 LO 1-6 Young Company has a 7 percent annual interest rate on its bank loan which the company is in the process of repaying. The loan currently has a principal balance of $15 million. Young Company provides financial statements to the bank in order to meet the bank's loan requirements. Young prepares its financial statements with some help from a local CPA, who provides advice in preparing journal entries and closing the books. Young Company approached several other banks and found two that were willing to offer loans at competitive rates. Country Valley Bank offers a 6% annual interest rate for small businesses that involve a CPA in helping prepare their financial statements. Community Bank offers a 4.5% rate on its loan but would require that Young Company have its financial statements separately audited by an independent CPA firm each year to get that lower rate. Young Company reached out to a local CPA firm and received an estimate of $145,000 annually to provide an independent audit opinion on Young's financial statements each year. Chapter 01 Problem 1-26 Part d d. Now assume Young Company does not have an option to refinance its loan, given its agreement with its current bank. Required: Is there any reason Young Company might still choose to have its financial statements audited by a CPA firm? Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect. U If controls are effective, then the transactions and other events will more likely be captured and summarized properly, which means in turn that the account balances are unlikely to be free of material misstatement. If an entity's internal control over financial transactions is effective, this provides direct information regarding whether the account balances are fairly presented. If the company were publicly traded, its stock price would likely increase. The company may have a number of private owners who have hired managers to run the business can reduce the risk through an audit of the financial statements. An audit provides assurance to any user of financial statements that they are presented fairly in all material respects. If it were a public company, it would be required by law to obtain an integrated audit