Answered step by step

Verified Expert Solution

Question

1 Approved Answer

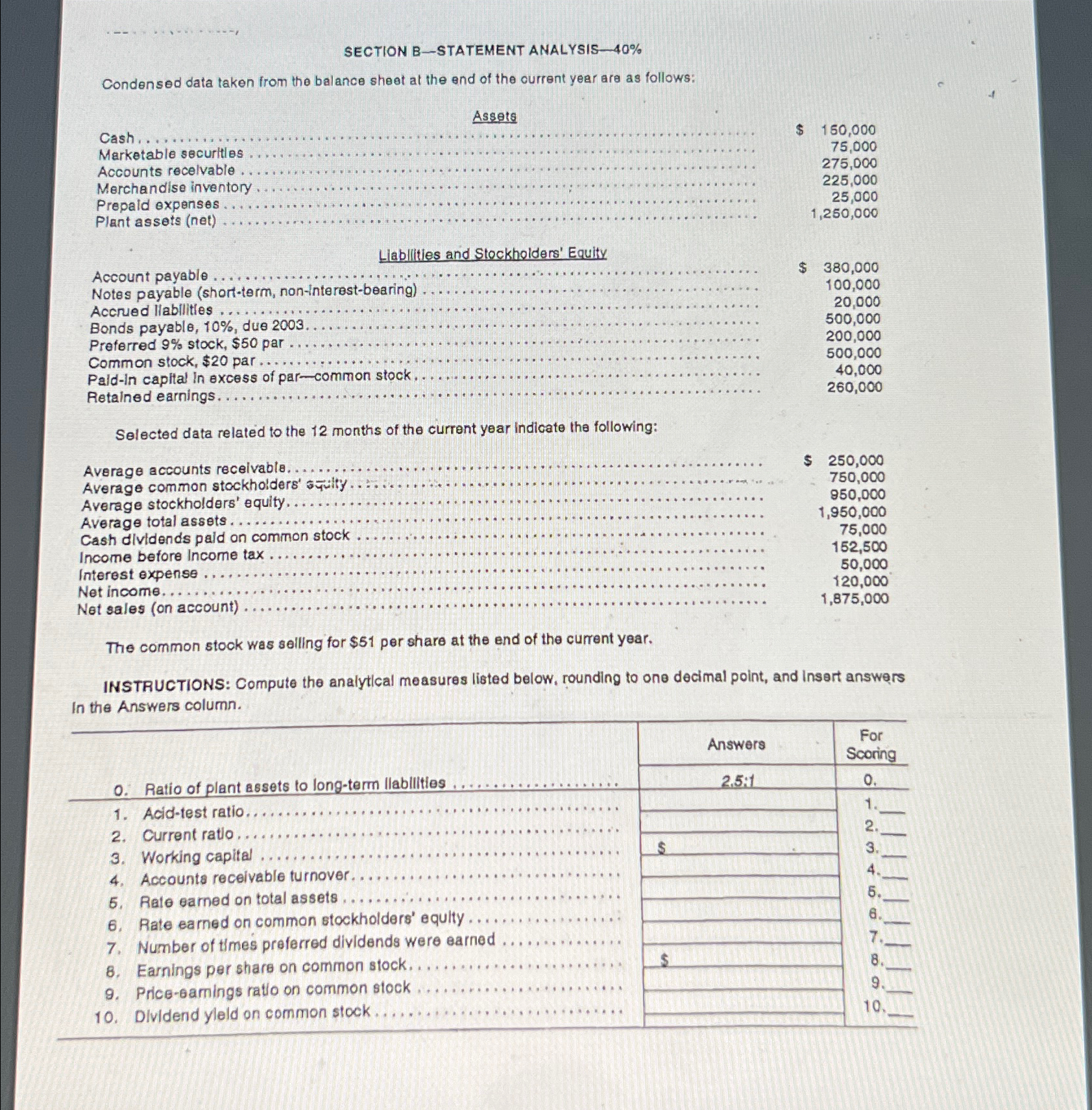

SECTION B-STATEMENT ANALYSIS-40% Condensed data taken from the balance sheet at the end of the current year are as follows: Cash. Marketable securities Accounts

SECTION B-STATEMENT ANALYSIS-40% Condensed data taken from the balance sheet at the end of the current year are as follows: Cash. Marketable securities Accounts receivable Merchandise inventory Prepaid expenses Plant assets (net) Assets $ 150,000 75,000 275,000 225,000 25,000 1,250,000 Liabilities and Stockholders' Equity Account payable. $ 380,000 Notes payable (short-term, non-interest-bearing) 100,000 Accrued liabilities 20,000 500,000 200,000 500,000 40,000 260,000 Bonds payable, 10%, due 2003. Preferred 9% stock, $50 par Common stock, $20 par Paid-in capital in excess of par-common stock. Retained earnings.. Selected data related to the 12 months of the current year Indicate the following: Average accounts receivable.. Average common stockholders' squity. Average stockholders' equity.. Average total assets. Cash dividends pald on common stock Income before Income tax Interest expense Net income... Net sales (on account) $ 250,000 750,000 950,000 1,950,000 75,000 152,500 50,000 120,000 1,875,000 The common stock was selling for $51 per share at the end of the current year. INSTRUCTIONS: Compute the analytical measures listed below, rounding to one decimal point, and Insert answers In the Answers column. 0. Ratio of plant assets to long-term liabilities 1. Acid-test ratio.. 2. Current ratio. 3. Working capital 4. Accounts receivable turnover. 5. Rate earned on total assets 6. Rate earned on common stockholders' equity 7. Number of times preferred dividends were earned 8. Earnings per share on common stock. 9. Price-eamings ratio on common stock 10. Dividend yield on common stock S For Answers Scoring 2.5:1 0. 1. 2. 3. 4. 5. 7. 8. 9. 10.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started