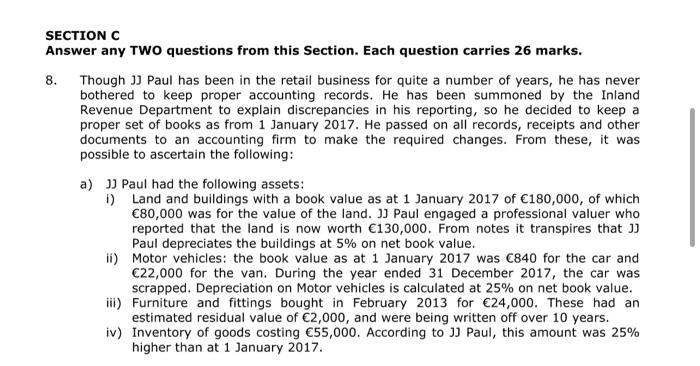

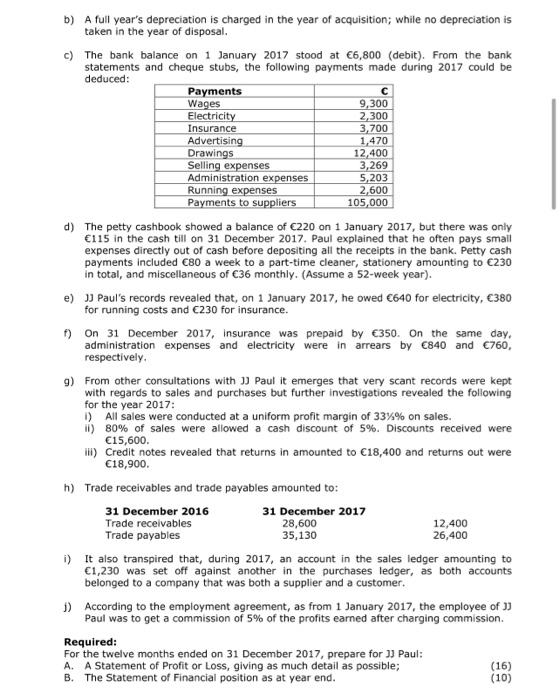

SECTION C Answer any TWO questions from this section. Each question carries 26 marks. 8. Though JJ Paul has been in the retail business for quite a number of years, he has never bothered to keep proper accounting records. He has been summoned by the Inland Revenue Department to explain discrepancies in his reporting, so he decided to keep a proper set of books as from 1 January 2017. He passed on all records, receipts and other documents to an accounting firm to make the required changes. From these, it was possible to ascertain the following: a) JJ Paul had the following assets: 1) Land and buildings with a book value as at 1 January 2017 of 180,000, of which 80,000 was for the value of the land. JJ Paul engaged a professional valuer who reported that the land is now worth 130,000. From notes it transpires that ] Paul depreciates the buildings at 5% on net book value. ii) Motor vehicles: the book value as at 1 January 2017 was 840 for the car and 22,000 for the van. During the year ended 31 December 2017, the car was scrapped. Depreciation on Motor vehicles is calculated at 25% on net book value. iii) Furniture and fittings bought in February 2013 for 24,000. These had an estimated residual value of 2,000, and were being written off over 10 years. iv) Inventory of goods costing 55,000. According to JJ Paul, this amount was 25% higher than at 1 January 2017. b) A full year's depreciation is charged in the year of acquisition; while no depreciation is taken in the year of disposal. c) The bank balance on 1 January 2017 stood at 6,800 (debit). From the bank statements and cheque stubs, the following payments made during 2017 could be deduced: Payments Wages 9,300 Electricity 2,300 Insurance 3,700 Advertising 1,470 Drawings 12,400 Selling expenses 3,269 Administration expenses 5,203 Running expenses 2,600 Payments to suppliers 105,000 d) The petty cashbook showed a balance of C220 on 1 January 2017, but there was only 115 in the cash till on 31 December 2017. Paul explained that he often pays small expenses directly out of cash before depositing all the receipts in the bank. Petty cash payments included 80 a week to a part-time cleaner, stationery amounting to C230 in total, and miscellaneous of C36 monthly. (Assume a 52-week year). e) J Paul's records revealed that, on 1 January 2017, he owed 640 for electricity, 380 for running costs and 230 for insurance. On 31 December 2017, insurance was prepaid by 350. On the same day, administration expenses and electricity were in arrears by 840 and 760, respectively, 9) From other consultations with JJ Paul it emerges that very scant records were kept with regards to sales and purchases but further investigations revealed the following for the year 2017: 1) All sales were conducted at a uniform profit margin of 33%% on sales. 1) 80% of sales were allowed a cash discount of 5%. Discounts received were 15,600 ) Credit notes revealed that returns in amounted to 18,400 and returns out were 18,900. h) Trade receivables and trade payables amounted to: 31 December 2016 31 December 2017 Trade receivables 28,600 12,400 Trade payables 35,130 26,400 i) It also transpired that, during 2017, an account in the sales ledger amounting to 1,230 was set off against another in the purchases ledger, as both accounts belonged to a company that was both a supplier and a customer. 1) According to the employment agreement, as from 1 January 2017, the employee of J] Paul was to get a commission of 5% of the profits earned after charging commission. Required: For the twelve months ended on 31 December 2017, prepare for JJ Paul: A. A Statement of Profit or Loss, giving as much detail as possible; (16) B. The Statement of Financial position as at year end