Answered step by step

Verified Expert Solution

Question

1 Approved Answer

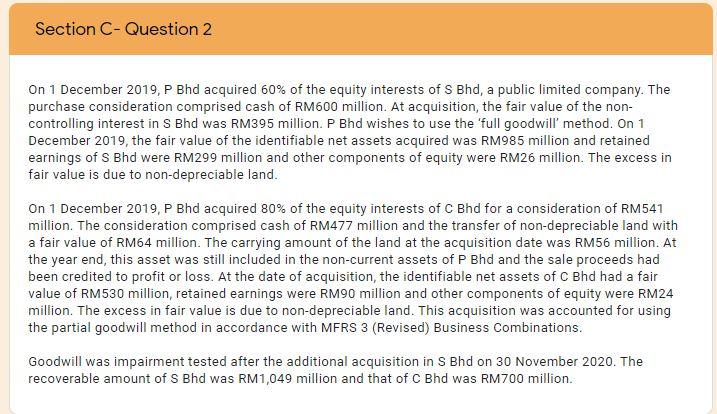

Section C-Question 2 On 1 December 2019, P Bhd acquired 60% of the equity interests of S Bhd, a public limited company. The purchase consideration

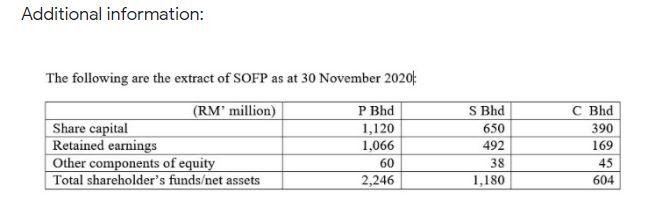

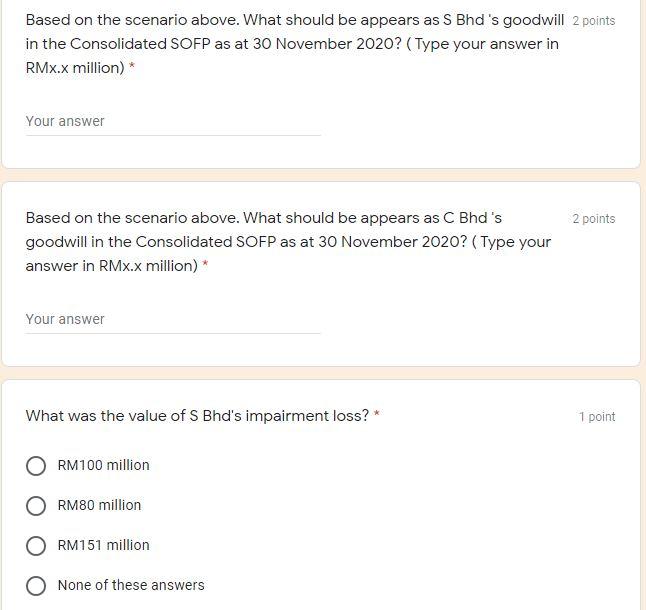

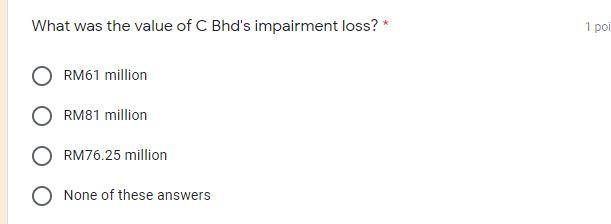

Section C-Question 2 On 1 December 2019, P Bhd acquired 60% of the equity interests of S Bhd, a public limited company. The purchase consideration comprised cash of RM600 million. At acquisition, the fair value of the non- controlling interest in S Bhd was RM395 million. P Bhd wishes to use the 'full goodwill' method. On 1 December 2019, the fair value of the identifiable net assets acquired was RM985 million and retained earnings of S Bhd were RM299 million and other components of equity were RM26 million. The excess in fair value is due to non-depreciable land. On 1 December 2019, P Bhd acquired 80% of the equity interests of C Bhd for a consideration of RM541 million. The consideration comprised cash of RM477 million and the transfer of non-depreciable land with a fair value of RM64 million. The carrying amount of the land at the acquisition date was RM56 million. At the year end, this asset was still included in the non-current assets of P Bhd and the sale proceeds had been credited to profit or loss. At the date of acquisition, the identifiable net assets of C Bhd had a fair value of RM530 million, retained earnings were RM90 million and other components of equity were RM24 million. The excess in fair value is due to non-depreciable land. This acquisition was accounted for using the partial goodwill method in accordance with MERS 3 (Revised) Business Combinations. Goodwill was impairment tested after the additional acquisition in S Bhd on 30 November 2020. The recoverable amount of S Bhd was RM1,049 million and that of C Bhd was RM700 million. Additional information: The following are the extract of SOFP as at 30 November 20201 (RM' million) Share capital Retained earnings Other components of equity Total shareholder's fundset assets P Bhd 1,120 1,066 60 2,246 S Bhd 650 492 38 1,180 C Bhd 390 169 45 604 Based on the scenario above. What should be appears as S Bhd's goodwill 2 points in the Consolidated SOFP as at 30 November 2020? (Type your answer in RMx.x million) * Your answer 2 points Based on the scenario above. What should be appears as C Bhd's goodwill in the Consolidated SOFP as at 30 November 2020? (Type your answer in RMx.x million)* Your answer What was the value of S Bhd's impairment loss? * 1 point RM100 million O RM80 million O RM151 million None of these answers What was the value of C Bhd's impairment loss? 1 pol RM61 million RM81 million RM76.25 million None of these answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started