Answered step by step

Verified Expert Solution

Question

1 Approved Answer

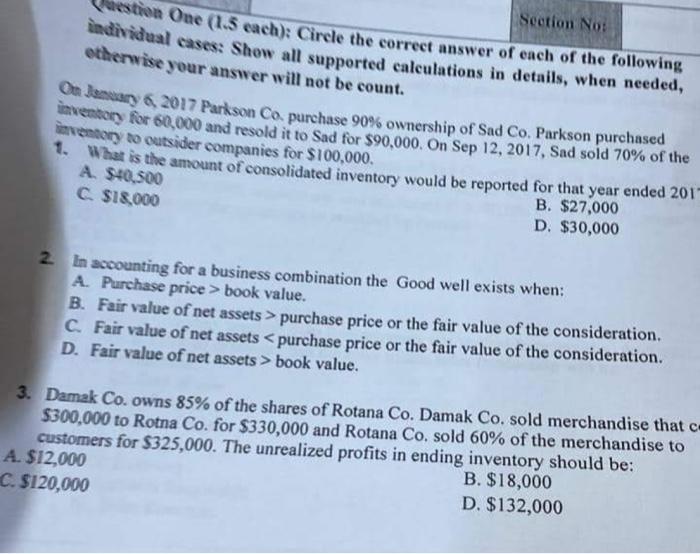

Section No: estion One (1.5 each): Circle the correct answer of each of the following individual cases: Show all supported calculations in details, when

Section No: estion One (1.5 each): Circle the correct answer of each of the following individual cases: Show all supported calculations in details, when needed, otherwise your answer will not be count. On January 6, 2017 Parkson Co. purchase 90% ownership of Sad Co. Parkson purchased inventory for 60,000 and resold it to Sad for $90,000. On Sep 12, 2017, Sad sold 70% of the inventory to outsider companies for $100,000. 1. What is the amount of consolidated inventory would be reported for that year ended 201 A. $40,500 C. $18,000 B. $27,000 D. $30,000 2. In accounting for a business combination the Good well exists when: A. Purchase price > book value. B. Fair value of net assets > purchase price or the fair value of the consideration. C. Fair value of net assets book value. 3. Damak Co. owns 85% of the shares of Rotana Co. Damak Co. sold merchandise that c $300,000 to Rotna Co. for $330,000 and Rotana Co, sold 60% of the merchandise to customers for $325,000. The unrealized profits in ending inventory should be: A. $12,000 C. $120,000 B. $18,000 D. $132,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started