Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Section One-Case (22 pts) 1. Bank of America, N.A. v. Bar Facts: Based on documents signed by Barr on behalf of the Stone Scone, Fleet

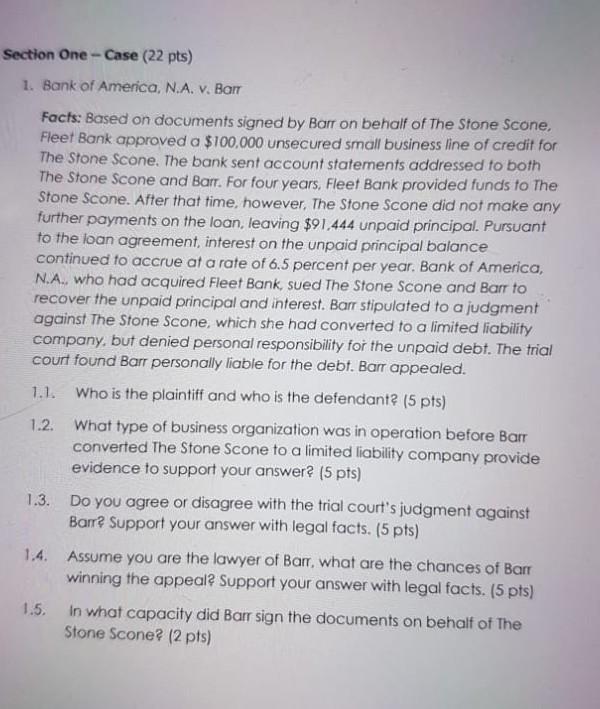

Section One-Case (22 pts) 1. Bank of America, N.A. v. Bar Facts: Based on documents signed by Barr on behalf of the Stone Scone, Fleet Bank approved a $100,000 unsecured small business line of credit for The Stone Scone. The bank sent account statements addressed to both The Stone Scone and Barr. For four years, Fleet Bank provided funds to The Stone Scone. After that time, however, The Stone Scone did not make any further payments on the loan, leaving $91,444 unpaid principal. Pursuant to the loan agreement, interest on the unpaid principal balance continued to accrue at a rate of 6.5 percent per year. Bank of America, N.A., who had acquired Fleet Bank, sued The Stone Scone and Barr to recover the unpaid principal and interest. Barr stipulated to a judgment against The Stone Scone, which she had converted to a limited liability company, but denied personal responsibility for the unpaid debt. The trial court found Barr personally liable for the debt. Barr appealed. 1.1. Who is the plaintiff and who is the defendant? (5 pts) 1.2. What type of business organization was in operation before Barr converted The Stone Scone to a limited liability company provide evidence to support your answer? (5 pts) 1.3. Do you agree or disagree with the trial court's judgment against Barre Support your answer with legal facts. (5 pts) 1.4. Assume you are the lawyer of Barr, what are the chances of Barr winning the appeal? Support your answer with legal facts. (5 pts) 1.5. In what capacity did Barr sign the documents on behalf of The Stone Scone? (2 pts) Section One-Case (22 pts) 1. Bank of America, N.A. v. Bar Facts: Based on documents signed by Barr on behalf of the Stone Scone, Fleet Bank approved a $100,000 unsecured small business line of credit for The Stone Scone. The bank sent account statements addressed to both The Stone Scone and Barr. For four years, Fleet Bank provided funds to The Stone Scone. After that time, however, The Stone Scone did not make any further payments on the loan, leaving $91,444 unpaid principal. Pursuant to the loan agreement, interest on the unpaid principal balance continued to accrue at a rate of 6.5 percent per year. Bank of America, N.A., who had acquired Fleet Bank, sued The Stone Scone and Barr to recover the unpaid principal and interest. Barr stipulated to a judgment against The Stone Scone, which she had converted to a limited liability company, but denied personal responsibility for the unpaid debt. The trial court found Barr personally liable for the debt. Barr appealed. 1.1. Who is the plaintiff and who is the defendant? (5 pts) 1.2. What type of business organization was in operation before Barr converted The Stone Scone to a limited liability company provide evidence to support your answer? (5 pts) 1.3. Do you agree or disagree with the trial court's judgment against Barre Support your answer with legal facts. (5 pts) 1.4. Assume you are the lawyer of Barr, what are the chances of Barr winning the appeal? Support your answer with legal facts. (5 pts) 1.5. In what capacity did Barr sign the documents on behalf of The Stone Scone? (2 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started