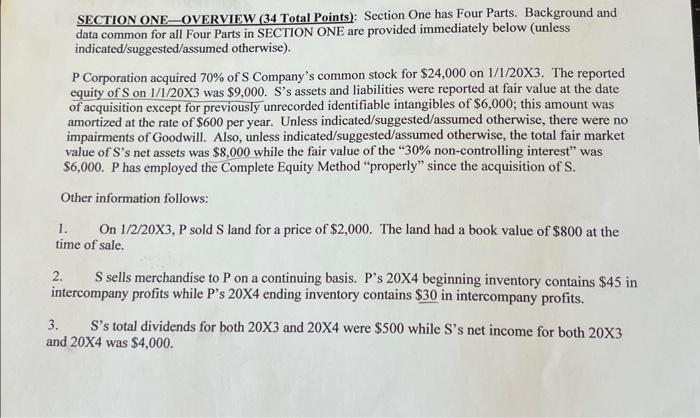

SECTION ONE-OVERVIEW (34 Total Points): Section One has Four Parts. Background and data common for all Four Parts in SECTION ONE are provided immediately below (unless indicated/suggested/assumed otherwise). P Corporation acquired 70% of S Company's common stock for $24,000 on 1/1/203. The reported equity of S on 1/1/203 was $9,000. S's assets and liabilities were reported at fair value at the date of acquisition except for previously unrecorded identifiable intangibles of $6,000; this amount was amortized at the rate of $600 per year. Unless indicated/suggested/assumed otherwise, there were no impairments of Goodwill. Also, unless indicated/suggested/assumed otherwise, the total fair market value of S's net assets was $8,000 while the fair value of the " 30% non-controlling interest" was $6,000. P has employed the Complete Equity Method "properly" since the acquisition of S. Other information follows: 1. On 1/2/203,P sold S land for a price of $2,000. The land had a book value of $800 at the time of sale, 2. S sells merchandise to P on a continuing basis. P 's 20X4 beginning inventory contains $45 in intercompany profits while P's 20X4 ending inventory contains $30 in intercompany profits. 3. S's total dividends for both 20X3 and 20X4 were $500 while S's net income for both 20X3 and 20X4 was $4,000. SECTION ONE-PART ONE: Calculate the total Goodwill amount at 1/1/203 (using the information provided on page one, as appropriate). Allocation of Goodwill is not required in PART ONE. SECTION ONE-OVERVIEW (34 Total Points): Section One has Four Parts. Background and data common for all Four Parts in SECTION ONE are provided immediately below (unless indicated/suggested/assumed otherwise). P Corporation acquired 70% of S Company's common stock for $24,000 on 1/1/203. The reported equity of S on 1/1/203 was $9,000. S's assets and liabilities were reported at fair value at the date of acquisition except for previously unrecorded identifiable intangibles of $6,000; this amount was amortized at the rate of $600 per year. Unless indicated/suggested/assumed otherwise, there were no impairments of Goodwill. Also, unless indicated/suggested/assumed otherwise, the total fair market value of S's net assets was $8,000 while the fair value of the " 30% non-controlling interest" was $6,000. P has employed the Complete Equity Method "properly" since the acquisition of S. Other information follows: 1. On 1/2/203,P sold S land for a price of $2,000. The land had a book value of $800 at the time of sale, 2. S sells merchandise to P on a continuing basis. P 's 20X4 beginning inventory contains $45 in intercompany profits while P's 20X4 ending inventory contains $30 in intercompany profits. 3. S's total dividends for both 20X3 and 20X4 were $500 while S's net income for both 20X3 and 20X4 was $4,000. SECTION ONE-PART ONE: Calculate the total Goodwill amount at 1/1/203 (using the information provided on page one, as appropriate). Allocation of Goodwill is not required in PART ONE