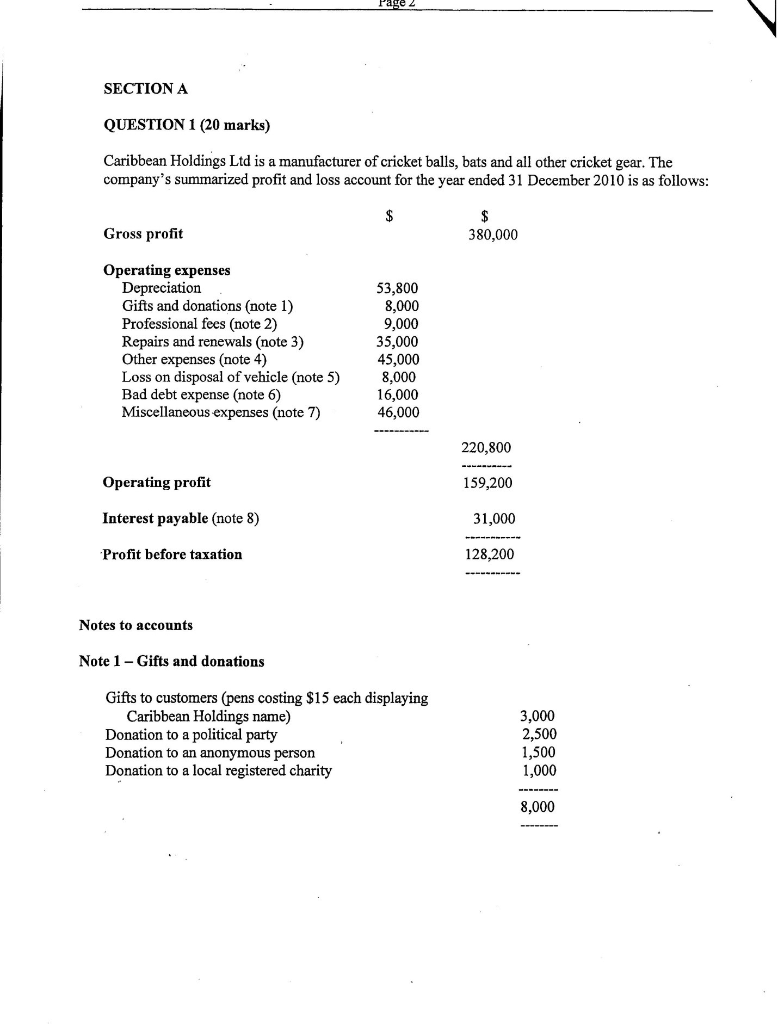

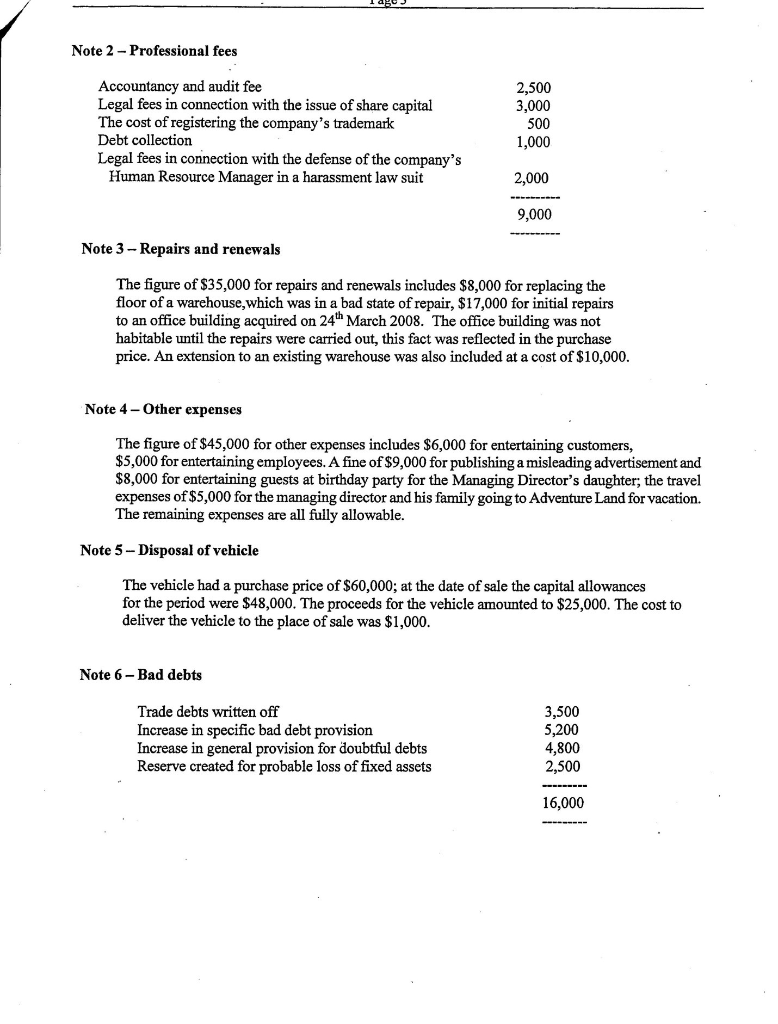

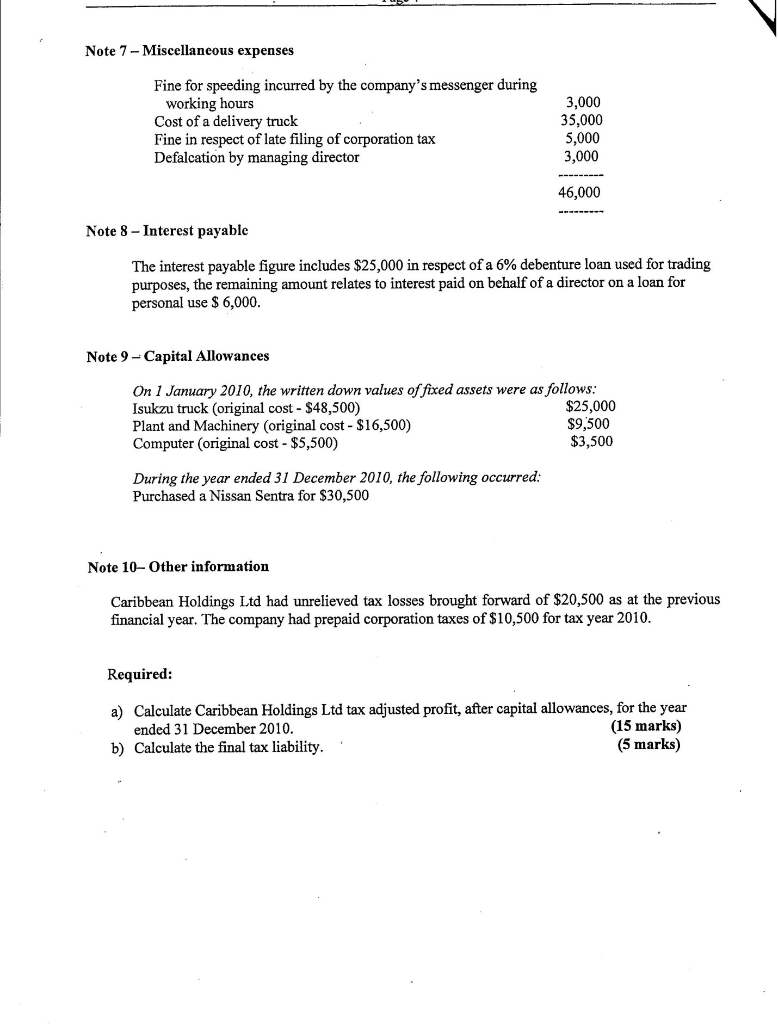

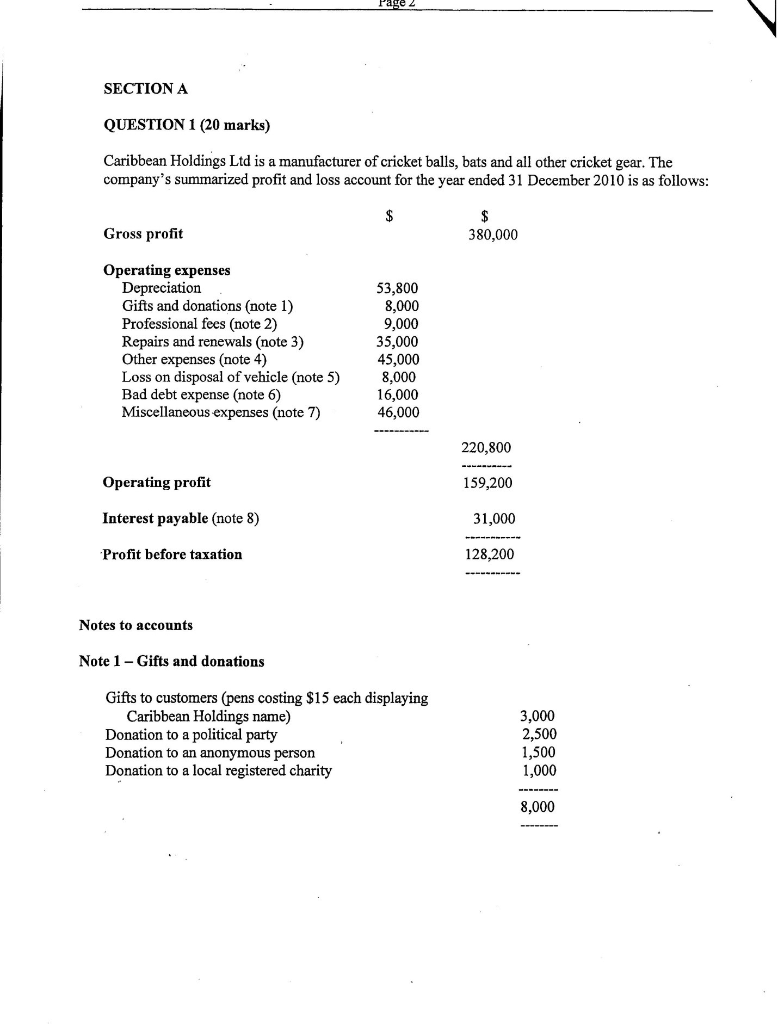

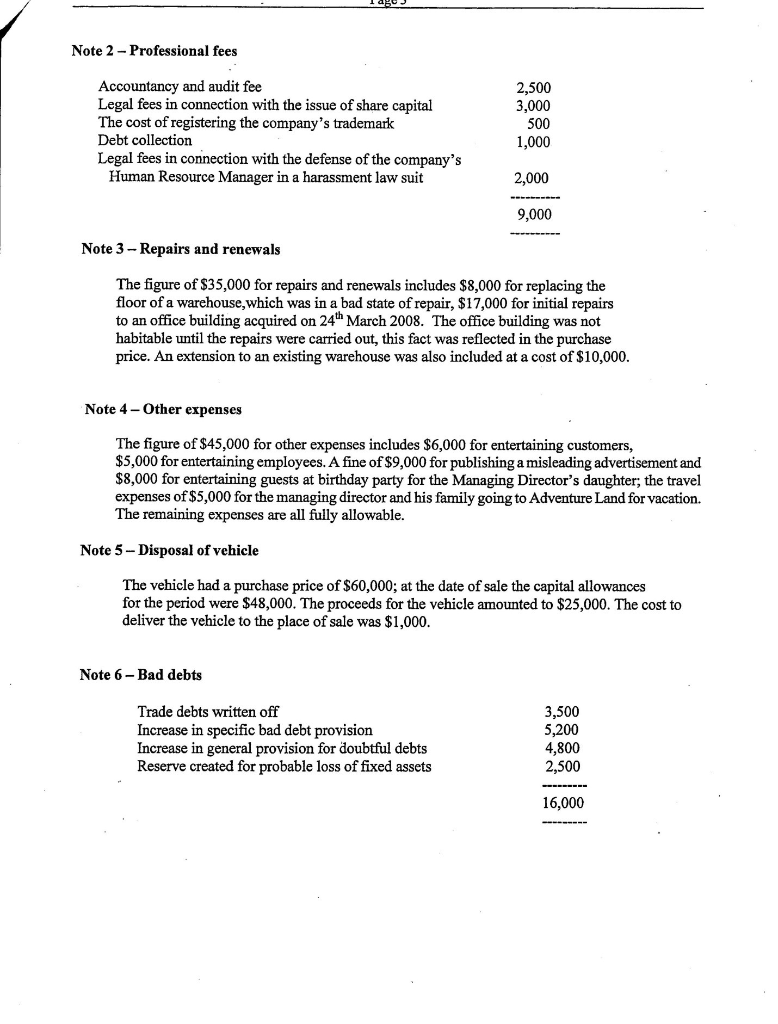

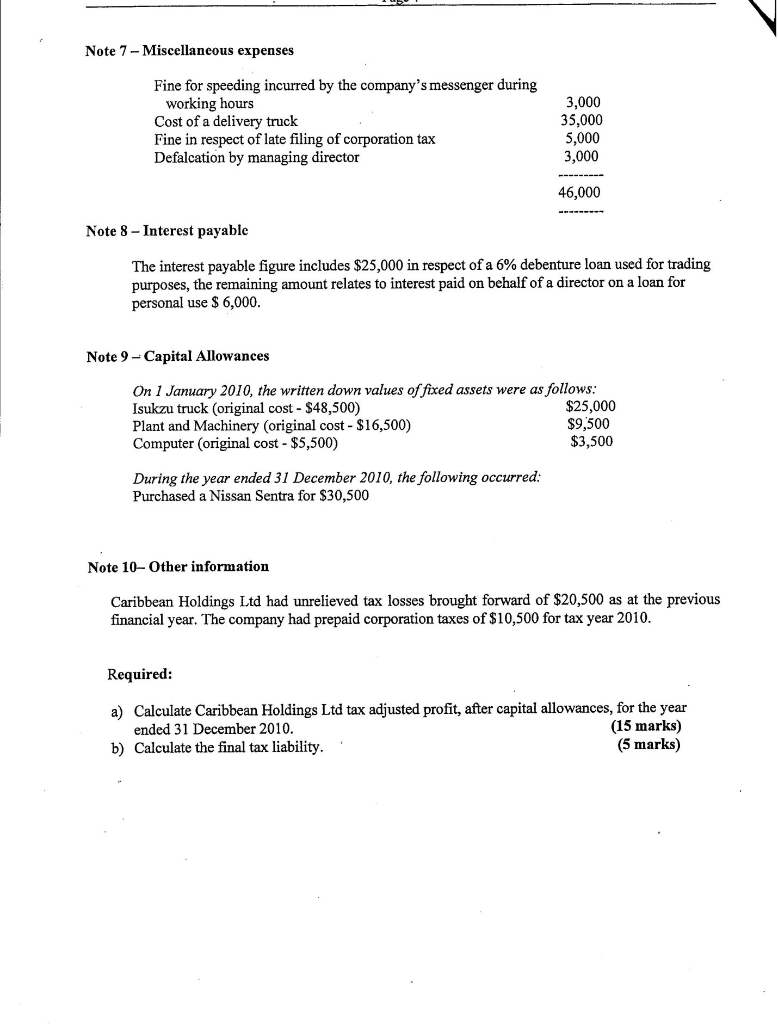

SECTIONA QUESTION 1 (20 marks) Caribbean Holdings Ltd is a manufacturer of cricket balls, bats and all other cricket gear. The company's summarized profit and loss account for the year ended 31 December 2010 is as follows Gross profit 380,000 Operating expenses Depreciation Gifts and donations (note 1) Professional fees (note 2) Repairs and renewals (note 3) Other expenses (note 4) Loss on disposal of vehicle (note 5)8,000 Bad debt expense (note 6) Miscellaneous expenses (note 7) 53,800 8,000 9,000 35,000 45,000 16,000 46,000 Operating profit Interest payable (note 8) Profit before taxation 220,800 159,200 31,000 128,200 Notes to accounts Note 1- Gifts and donations Gifts to customers (pens costing $15 each displaying Caribbean Holdings name) Donation to a political party Donation to an anonymous person Donation to a local registered charity 3,000 2,500 1,500 1,000 8,000 Note 2 - Professional fees Accountancy and audit fee Legal fees in connection with the issue of share capital The cost of registering the company's trademark Debt collection Legal fees in connection with the defense of the company's 2,500 3,000 500 1,000 Human Resource Manager in a harassment law suit 2,000 9,000 Note 3- Repairs and renewals The figure of S35,000 for repairs and renewals includes $8,000 for replacing the floor of a warehouse,which was in a bad state of repair, $17,000 for initial repairs to an office building acquired on 24h March 2008. The office building was not habitable until the repairs were carried out, this fact was reflected in the purchase price. An extension to an existing warehouse was also included at a cost of $10,000 Note 4- Other expenses The figure of $45,000 for other expenses includes $6,000 for entertaining customers, $5,000 for entertaining employees. A fine of $9,000 for publishing a misleading advertisement and $8,000 for entertaining guests at birthday party for the Managing Director's daughter, the travel expenses of $5,000 for the managing director and his family going to Adventure Land for vacation. The remaining expenses are all fully allowable. Note 5-Disposal of vehicle The vehicle had a purchase price of $60,000; at the date of sale the capital allowances for the period were $48,000. The proceeds for the vehicle amounted to $25,000. The cost to deliver the vehicle to the place of sale was $1,000 Note 6- Bad debts Trade debts written off Increase in specific bad debt provision Increase in general provision for doubtful debts Reserve created for probable loss of fixed assets 3,500 5,200 4,800 2,500 16,000 Note 7- Miscellaneous expenses Fine for speeding incurred by the company's messenger during working hours Cost of a delivery truck Fine in respect of late filing of corporation tax Defalcation by managing director 3,000 35,000 5,000 3,000 46,000 Note 8 - Interest payable The interest payable figure includes $25,000 in respect of a 6% debenture loan used for trading purposes, the remaining amount relates to interest paid on behalf of a director on a loan for personal use $ 6,000 Note 9 - Capital Allowances On 1 January 2010, the written down values of fixed assets were as follows Isukzu truck (original cost - $48,500) Plant and Machinery (original cost - S16,500) Computer (original cost - $5,500) $25,000 S9,500 $3,500 During the year ended 31 December 2010, the following occurred. Purchased a Nissan Sentra for S30,500 Note 10- Other information Caribbean Holdings Ltd had unrelieved tax losses brought forward of $20,500 as at the previous financial year. The company had prepaid corporation taxes of $10,500 for tax year 2010 Required a) b) Calculate Caribbean Holdings Ltd tax adjusted profit, after capital allowances, for the year ended 31 December 2010 (15 marks) (5 marks) Calculate the final tax liability SECTIONA QUESTION 1 (20 marks) Caribbean Holdings Ltd is a manufacturer of cricket balls, bats and all other cricket gear. The company's summarized profit and loss account for the year ended 31 December 2010 is as follows Gross profit 380,000 Operating expenses Depreciation Gifts and donations (note 1) Professional fees (note 2) Repairs and renewals (note 3) Other expenses (note 4) Loss on disposal of vehicle (note 5)8,000 Bad debt expense (note 6) Miscellaneous expenses (note 7) 53,800 8,000 9,000 35,000 45,000 16,000 46,000 Operating profit Interest payable (note 8) Profit before taxation 220,800 159,200 31,000 128,200 Notes to accounts Note 1- Gifts and donations Gifts to customers (pens costing $15 each displaying Caribbean Holdings name) Donation to a political party Donation to an anonymous person Donation to a local registered charity 3,000 2,500 1,500 1,000 8,000 Note 2 - Professional fees Accountancy and audit fee Legal fees in connection with the issue of share capital The cost of registering the company's trademark Debt collection Legal fees in connection with the defense of the company's 2,500 3,000 500 1,000 Human Resource Manager in a harassment law suit 2,000 9,000 Note 3- Repairs and renewals The figure of S35,000 for repairs and renewals includes $8,000 for replacing the floor of a warehouse,which was in a bad state of repair, $17,000 for initial repairs to an office building acquired on 24h March 2008. The office building was not habitable until the repairs were carried out, this fact was reflected in the purchase price. An extension to an existing warehouse was also included at a cost of $10,000 Note 4- Other expenses The figure of $45,000 for other expenses includes $6,000 for entertaining customers, $5,000 for entertaining employees. A fine of $9,000 for publishing a misleading advertisement and $8,000 for entertaining guests at birthday party for the Managing Director's daughter, the travel expenses of $5,000 for the managing director and his family going to Adventure Land for vacation. The remaining expenses are all fully allowable. Note 5-Disposal of vehicle The vehicle had a purchase price of $60,000; at the date of sale the capital allowances for the period were $48,000. The proceeds for the vehicle amounted to $25,000. The cost to deliver the vehicle to the place of sale was $1,000 Note 6- Bad debts Trade debts written off Increase in specific bad debt provision Increase in general provision for doubtful debts Reserve created for probable loss of fixed assets 3,500 5,200 4,800 2,500 16,000 Note 7- Miscellaneous expenses Fine for speeding incurred by the company's messenger during working hours Cost of a delivery truck Fine in respect of late filing of corporation tax Defalcation by managing director 3,000 35,000 5,000 3,000 46,000 Note 8 - Interest payable The interest payable figure includes $25,000 in respect of a 6% debenture loan used for trading purposes, the remaining amount relates to interest paid on behalf of a director on a loan for personal use $ 6,000 Note 9 - Capital Allowances On 1 January 2010, the written down values of fixed assets were as follows Isukzu truck (original cost - $48,500) Plant and Machinery (original cost - S16,500) Computer (original cost - $5,500) $25,000 S9,500 $3,500 During the year ended 31 December 2010, the following occurred. Purchased a Nissan Sentra for S30,500 Note 10- Other information Caribbean Holdings Ltd had unrelieved tax losses brought forward of $20,500 as at the previous financial year. The company had prepaid corporation taxes of $10,500 for tax year 2010 Required a) b) Calculate Caribbean Holdings Ltd tax adjusted profit, after capital allowances, for the year ended 31 December 2010 (15 marks) (5 marks) Calculate the final tax liability