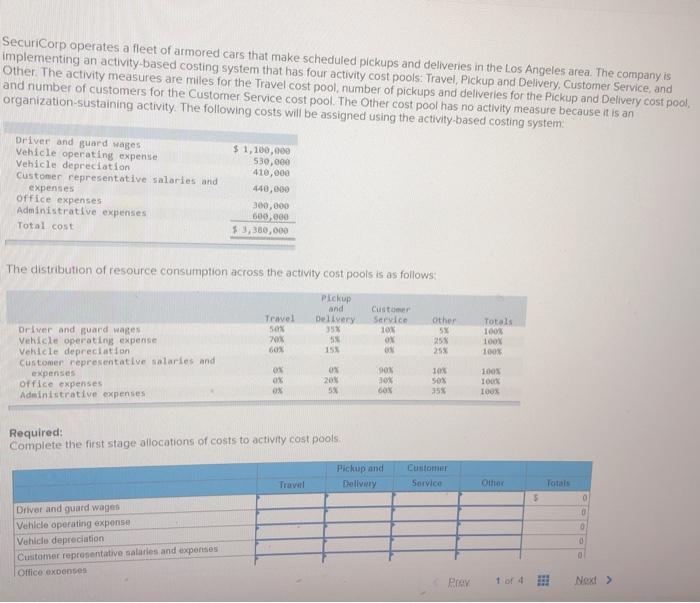

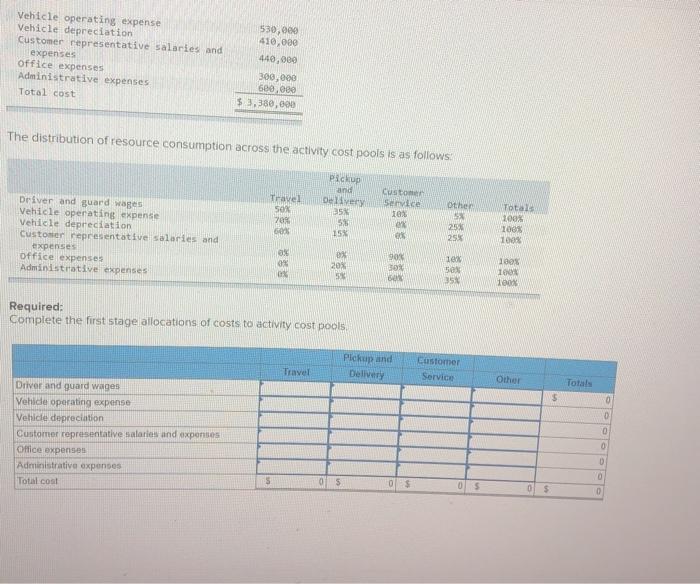

SecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveries in the Los Angeles area. The company is implementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity based costing system Driver and guard wages Vehicle operating expense Vehicle depreciation Customer representative salaries and expenses Office expenses Administrative expenses Total cost $1,100,000 530,000 410,000 440,000 300,000 600,000 $3,300,000 The distribution of resource consumption across the activity cost pools is as follows: Pickup and Customer Travel Delivery Service other Driver and guard wages 50% 10 5x Vehicle operating expense 70% 5 Ox 25% Vehicle depreciation 60 155 25 Customer representative salaries and expenses ox 90 10% Office expenses Ox 2013 30% 50% Administrative expenses OX GON 35% Totals 100% 100% 100% 100% TOK 100% Required: Complete the first stage allocations of costs to activity cost pools Pickup and Delivery Customer Service Travel Othe Totals 5 0 0 Driver and guard wagen Vehicle operating expense Vehicle depreciation Customer representative salaries and expenses Office expenses Prav Next > Vehicle operating expense Vehicle depreciation Customer representative salaries and expenses Office expenses Administrative expenses Total cost 530,00 410,000 440,000 300,000 600.000 $ 3,380,000 The distribution of resource consumption across the activity cost pools is as follows: Pickup and Delivery 358 56 15% Customer Service 10 Driver and guard wages Vehicle operating expense Vehicle depreciation Customer representative salaries and expenses office expenses Administrative expenses Travel SOK 70% 60 Othe 25 25% Total 2003 IO 100% es 03 90% 20% 5 1e 50x 35 100% 1 100% GM Required: Complete the first stage allocations of costs to activity cost pools pickup and Delivery Travel Customer Service Other Totals $ 0 0 Driver and guard Wages Vehide operating expense Vehicle depreciation Customer representative salaries and expenses Office expenses Administrative expenses Total cost 0 0 0 S OS 05 05 0 0 $