Investor A holds 3,000 common shares of BHP. He purchased the shares several years ago at $7, and the shares are now trading at

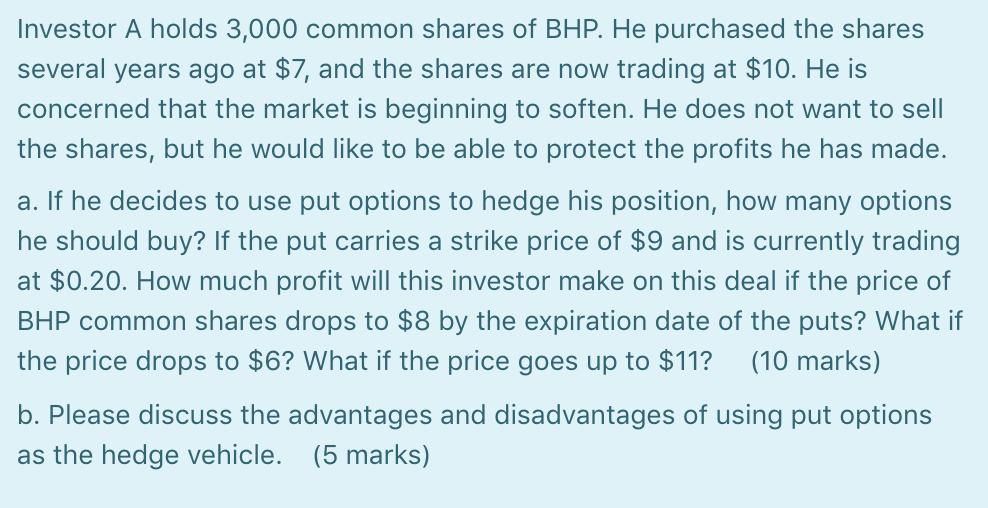

Investor A holds 3,000 common shares of BHP. He purchased the shares several years ago at $7, and the shares are now trading at $10. He is concerned that the market is beginning to soften. He does not want to sell the shares, but he would like to be able to protect the profits he has made. a. If he decides to use put options to hedge his position, how many options he should buy? If the put carries a strike price of $9 and is currently trading at $0.20. How much profit will this investor make on this deal if the price of BHP common shares drops to $8 by the expiration date of the puts? What if the price drops to $6? What if the price goes up to $11? (10 marks) b. Please discuss the advantages and disadvantages of using put options as the hedge vehicle. (5 marks)

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To hedge his position Investor A can purchase put options on BHP Each put option gives the holder the right but not the obligation to sell 100 shares of BHP at the strike price of 9 To determine how ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started