Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sedona Company is internally reviewing their financial statements in preparation for their fiscal year end 2019. During the review, Sedona Company discovered the following errors

Sedona Company is internally reviewing their financial statements in preparation for their fiscal year end 2019. During the review, Sedona Company discovered the following errors in the financial information:

(a) Sedona failed to accrue sales commissions at the end of 2017 and 2018. During 2017 $22,000 and during 2018 $14,250 of sales commissions were not accrued. In both years, the commissions were paid in January of the following year.

(b) Sedona discovered that inventory for the past three years was reported incorrectly. The errors were as follows:

2017 $41,300 understated

2018 $54,200 overstated

2019 $15,000 understated - this incorrect amount has already been recorded in the 2019 financial statements.

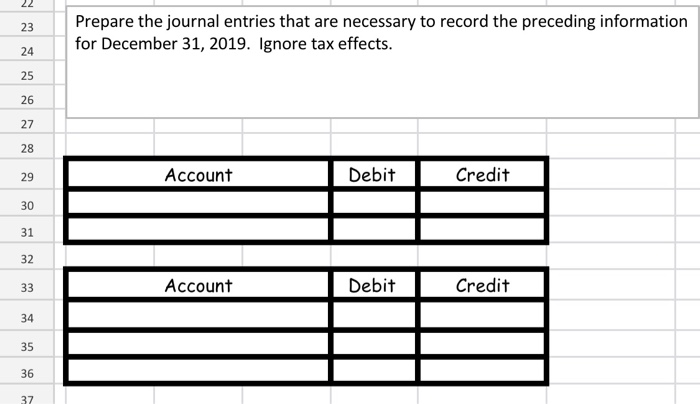

Prepare the journal entries that are necessary to record the preceding information for December 31, 2019. Ignore tax effects.

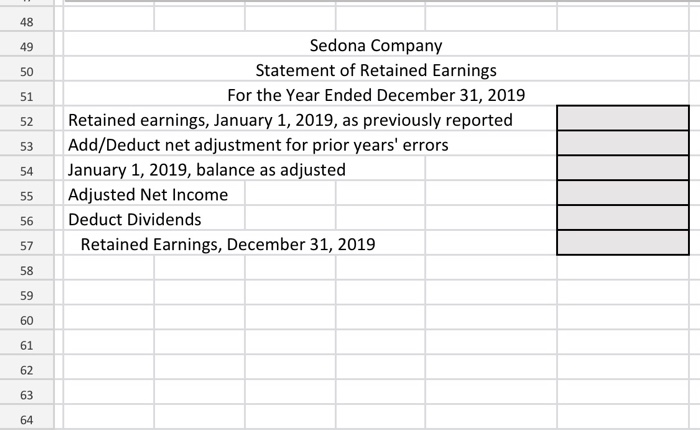

Assume Sedona Company had unadjusted retained earnings balance at the beginning of 2019 was $1,265,000. The unadjusted net income for 2019 was $300,000. Additionally, $175,000 of dividends were declared during 2019.

Prepare a statement of retained earnings for Sedona Company for 2019, considering the adjustments made above. Assume no tax implications.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started