Answered step by step

Verified Expert Solution

Question

1 Approved Answer

See Climeworks, the company information in the Pitchbook Note: You should have the idealized IRR plot handy1 Take the pre- and post money valuations, share

See Climeworks, the company information in the Pitchbook

Note: You should have the idealized IRR plot handy1

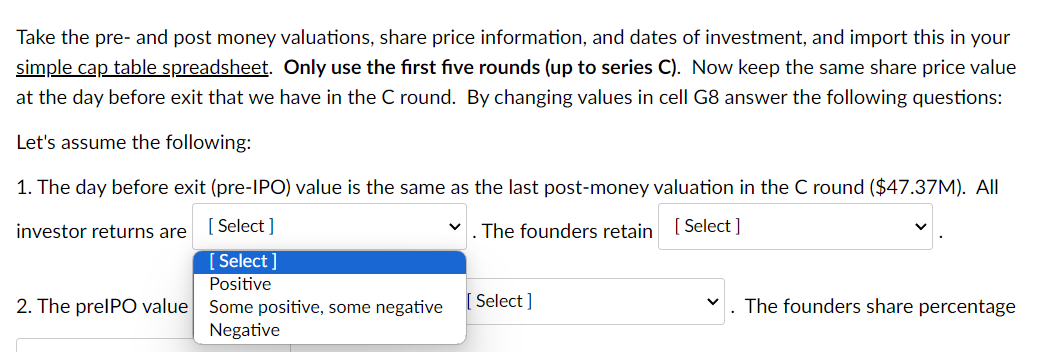

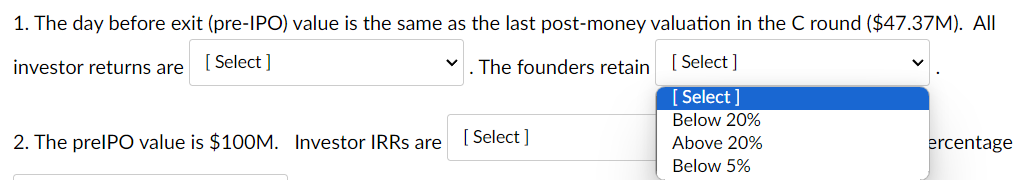

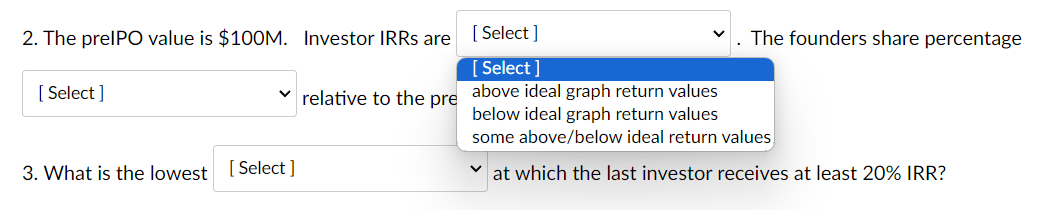

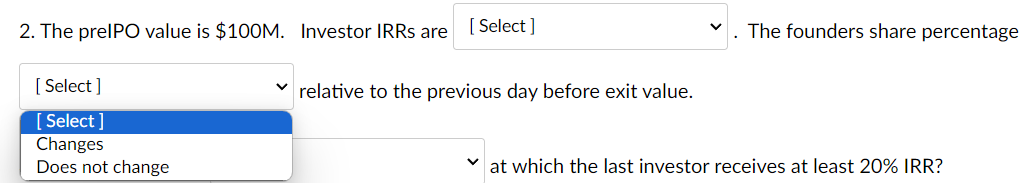

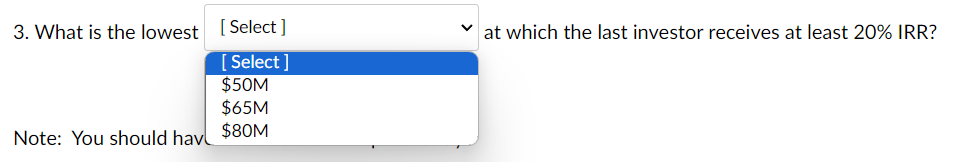

Take the pre- and post money valuations, share price information, and dates of investment, and import this in your simple cap table spreadsheet. Only use the first five rounds (up to series C). Now keep the same share price value at the day before exit that we have in the C round. By changing values in cell G8 answer the following questions: Let's assume the following: 1. The day before exit (pre-IPO) value is the same as the last post-money valuation in the C round ($47.37M). All investor returns are The founders retain 2. The prelPO value The founders share percentage 1. The day before exit (pre-IPO) value is the same as the last post-money valuation in the Cround ($47.37M). All investor returns are . The founders retain 2. The prelPO value is $100M. Investor IRRs are 2. The preIPO value is $100M. Investor IRRs are The founders share percentage relative to the pre 3. What is the lowest at which the last investor receives at least 20% IRR? 2. The preIPO value is $100M. Investor IRRs are The founders share percentage relative to the previous day before exit value. at which the last investor receives at least 20% IRR? 3. What is the lowest at which the last investor receives at least 20% IRR? Note: You should hav Take the pre- and post money valuations, share price information, and dates of investment, and import this in your simple cap table spreadsheet. Only use the first five rounds (up to series C). Now keep the same share price value at the day before exit that we have in the C round. By changing values in cell G8 answer the following questions: Let's assume the following: 1. The day before exit (pre-IPO) value is the same as the last post-money valuation in the C round ($47.37M). All investor returns are The founders retain 2. The prelPO value The founders share percentage 1. The day before exit (pre-IPO) value is the same as the last post-money valuation in the Cround ($47.37M). All investor returns are . The founders retain 2. The prelPO value is $100M. Investor IRRs are 2. The preIPO value is $100M. Investor IRRs are The founders share percentage relative to the pre 3. What is the lowest at which the last investor receives at least 20% IRR? 2. The preIPO value is $100M. Investor IRRs are The founders share percentage relative to the previous day before exit value. at which the last investor receives at least 20% IRR? 3. What is the lowest at which the last investor receives at least 20% IRR? Note: You should hav

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started