See photo attached. Please show your calculations. Thank you.

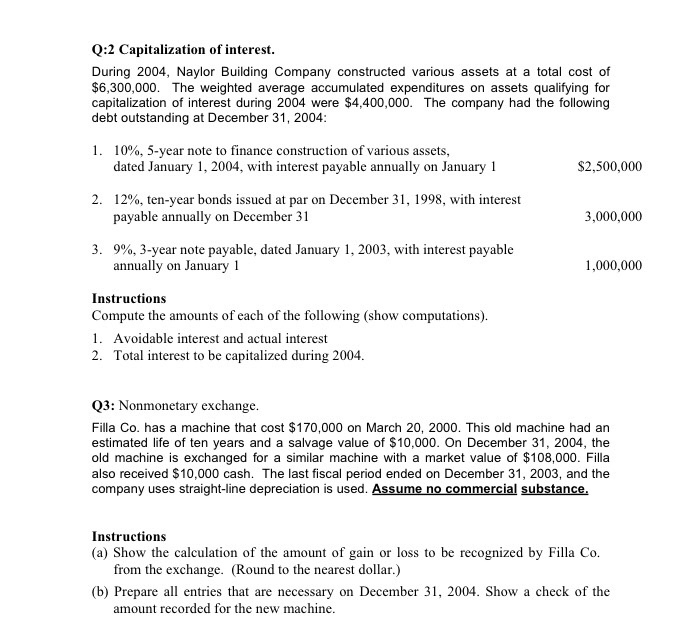

During 2004, Naylor Building Company constructed various assets at a total cost of $6,300,000. The weighted average accumulated expenditures on assets qualifying for capitalization of interest during 2004 were $4,400,000. The company had the following debt outstanding at December 31, 2004: 10%, 5-year note to finance construction of various assets, dated January 1, 2004, with interest payable annually on January 1 12%, ten-year bonds issued at par on December 31, 1998, with interest payable annually on December 31 9%, 3-year note payable, dated January 1, 2003, with interest payable annually on January 1 Compute the amounts of each of the following (show computations). Avoidable interest and actual interest Total interest to be capitalized during 2004. Filla Co. has a machine that cost $170,000 on March 20, 2000. This old machine had an estimated life of ten years and a salvage value of $10,000. On December 31, 2004, the old machine is exchanged for a similar machine with a market value of $108,000. Filla also received $10,000 cash. The last fiscal period ended on December 31, 2003, and the company uses straight-line depreciation is used. Assume no commercial substance. Show' the calculation of the amount of gain or loss to be recognized by Filla Co. from the exchange. (Round to the nearest dollar.) Prepare all entries that are necessary on December 31, 2004. Show a check of the amount recorded for the new machine. During 2004, Naylor Building Company constructed various assets at a total cost of $6,300,000. The weighted average accumulated expenditures on assets qualifying for capitalization of interest during 2004 were $4,400,000. The company had the following debt outstanding at December 31, 2004: 10%, 5-year note to finance construction of various assets, dated January 1, 2004, with interest payable annually on January 1 12%, ten-year bonds issued at par on December 31, 1998, with interest payable annually on December 31 9%, 3-year note payable, dated January 1, 2003, with interest payable annually on January 1 Compute the amounts of each of the following (show computations). Avoidable interest and actual interest Total interest to be capitalized during 2004. Filla Co. has a machine that cost $170,000 on March 20, 2000. This old machine had an estimated life of ten years and a salvage value of $10,000. On December 31, 2004, the old machine is exchanged for a similar machine with a market value of $108,000. Filla also received $10,000 cash. The last fiscal period ended on December 31, 2003, and the company uses straight-line depreciation is used. Assume no commercial substance. Show' the calculation of the amount of gain or loss to be recognized by Filla Co. from the exchange. (Round to the nearest dollar.) Prepare all entries that are necessary on December 31, 2004. Show a check of the amount recorded for the new machine