See question below

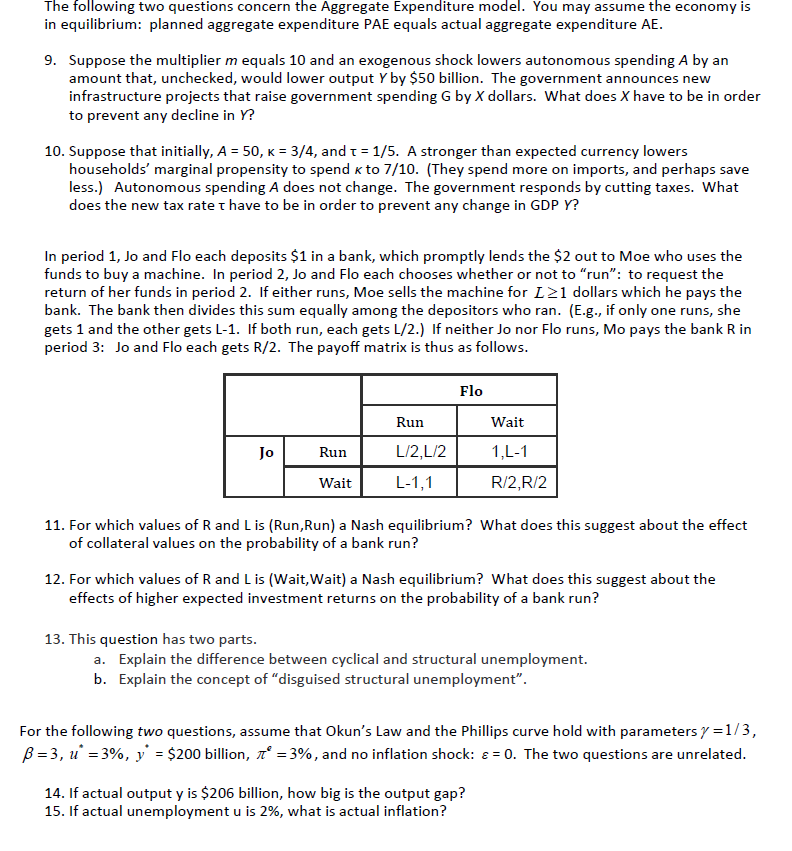

The following two questions concern the Aggregate Expenditure model. You may assume the economy is in equilibrium: planned aggregate expenditure PAE equals actual aggregate expenditure PE. 9. Suppose the muitiplier m equals 10 and an exogenous shock lowers autonomous spendingA by an amount that, unchecked, would lower output i" by $50 billion. The government announces new infrastructure projects that raise government spending G by Xdollars. What does X have to be in order to prevent any decline in '1"? 1t}. Suppose that in itially, A = 5D, x = 3151, and 1: = 1.5. A stronger than expected currency lowers households' marginal propensity to spend x to 'r'f}. {They spend more on imports, and perhaps save less.] Autonomous spending A does not change. The government responds by cutting taxes. What does the new tax rater have to be in order to prevent any change in GDP i\"? In period 1, Jo and Flo each deposits $1 in a bank, which promptly lends the 52 out to Moe who uses the funds to buy a machine. In period 2, Jo and Flo each chooses whether or not to I'run\": to request the return of her funds in period 2. If either runs, Moe sells the machine for L 21 dollars which he pays the bank. The bank then divides this sum equally among the depositors who ran. [E.g., if only one runs, she gets 1 and the other gets L1. If both run, each gets U2.) If neither Jo nor Flo runs, Mo pays the bank R in period 3: Jo and Flo each gets HIE. The payoff matrix is thus as follows. -m m 11. For which values of R and L is {Run,Run} a Nash equilibrium? What does this suggest about the effect of collateral values on the probability of a banl: run? 12. For which values of R and L is {Wait,Wait} a Nash equilibrium? What does this suggest about the effects of higher expected investment returns on the probability of a bank run? 13. This question has two parts. a. Explain the difference between cyclical and structural unemployment. b. Explain the concept of "disguised structural unemployment". For the following two questions, assume that Okun's Law and the Phillips curve hold with parameters j? =1!\" 3 , = 3, u' = 3%, y. = $200 billion, at" = 3%, and no inflation shock: a = D. The two questions are unrelated. 14. If actual output y is $206 billion.r how big is the output gap? 15. If actual unemployment u is 2%, what is actual inflation