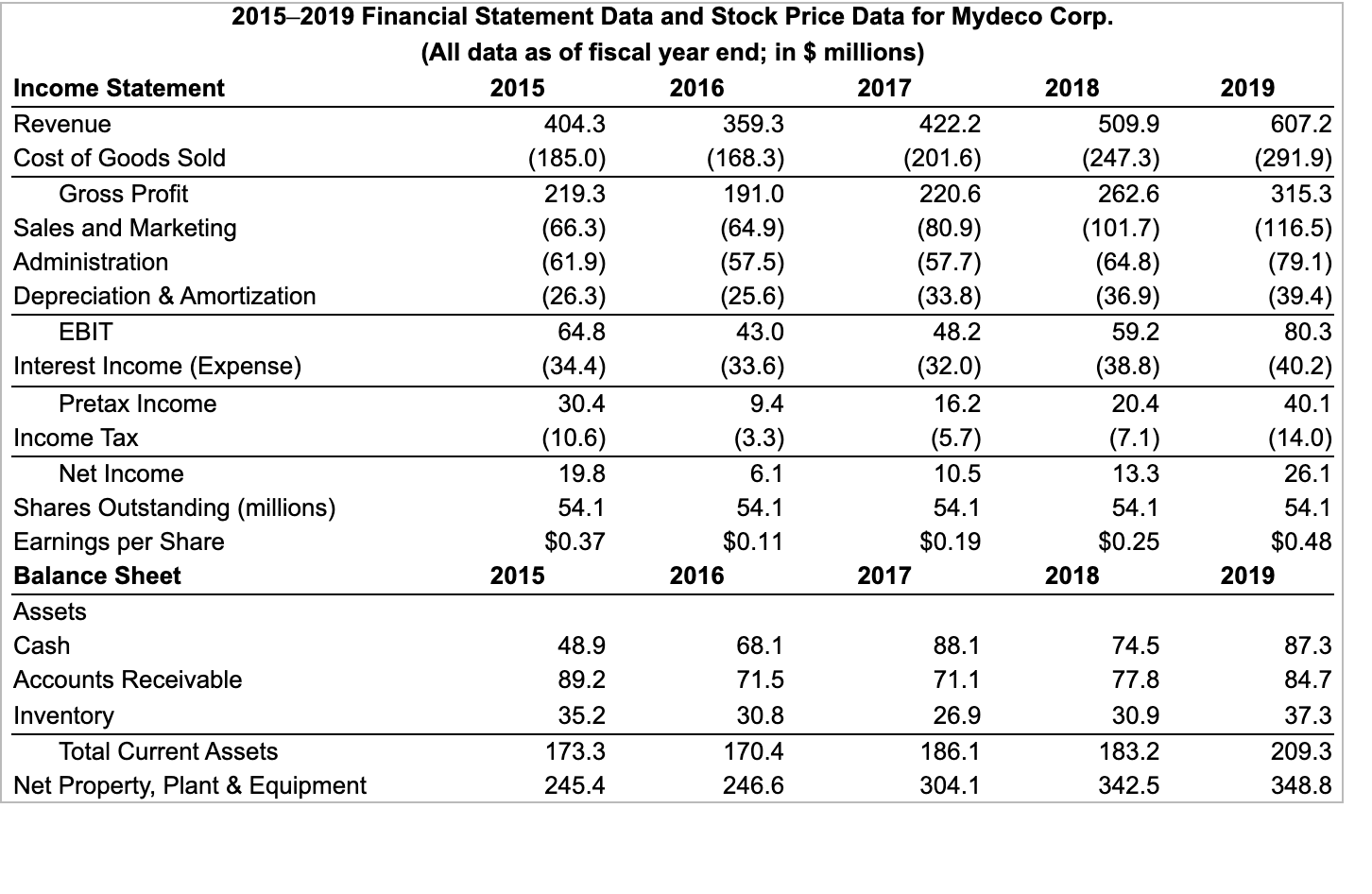

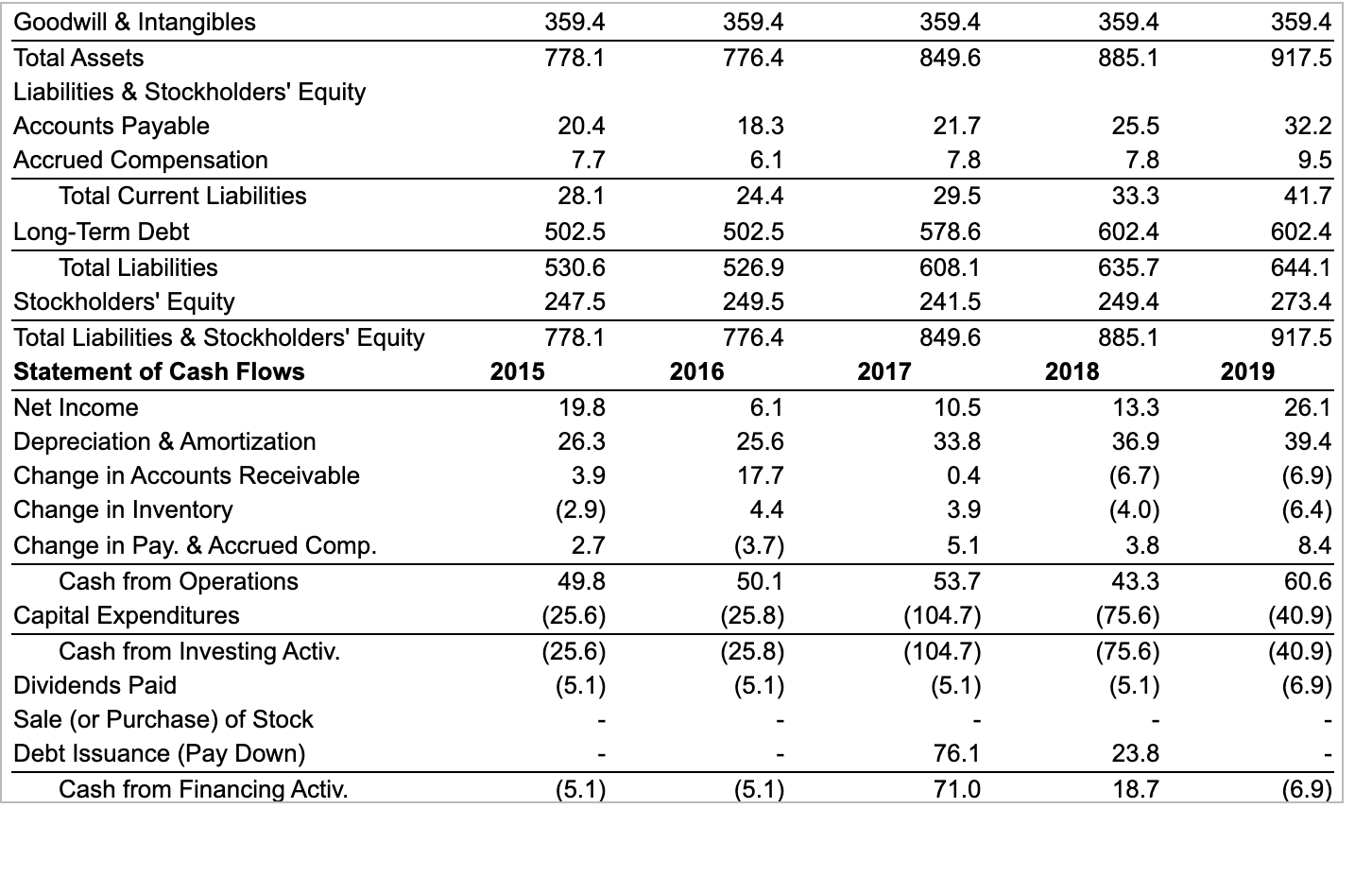

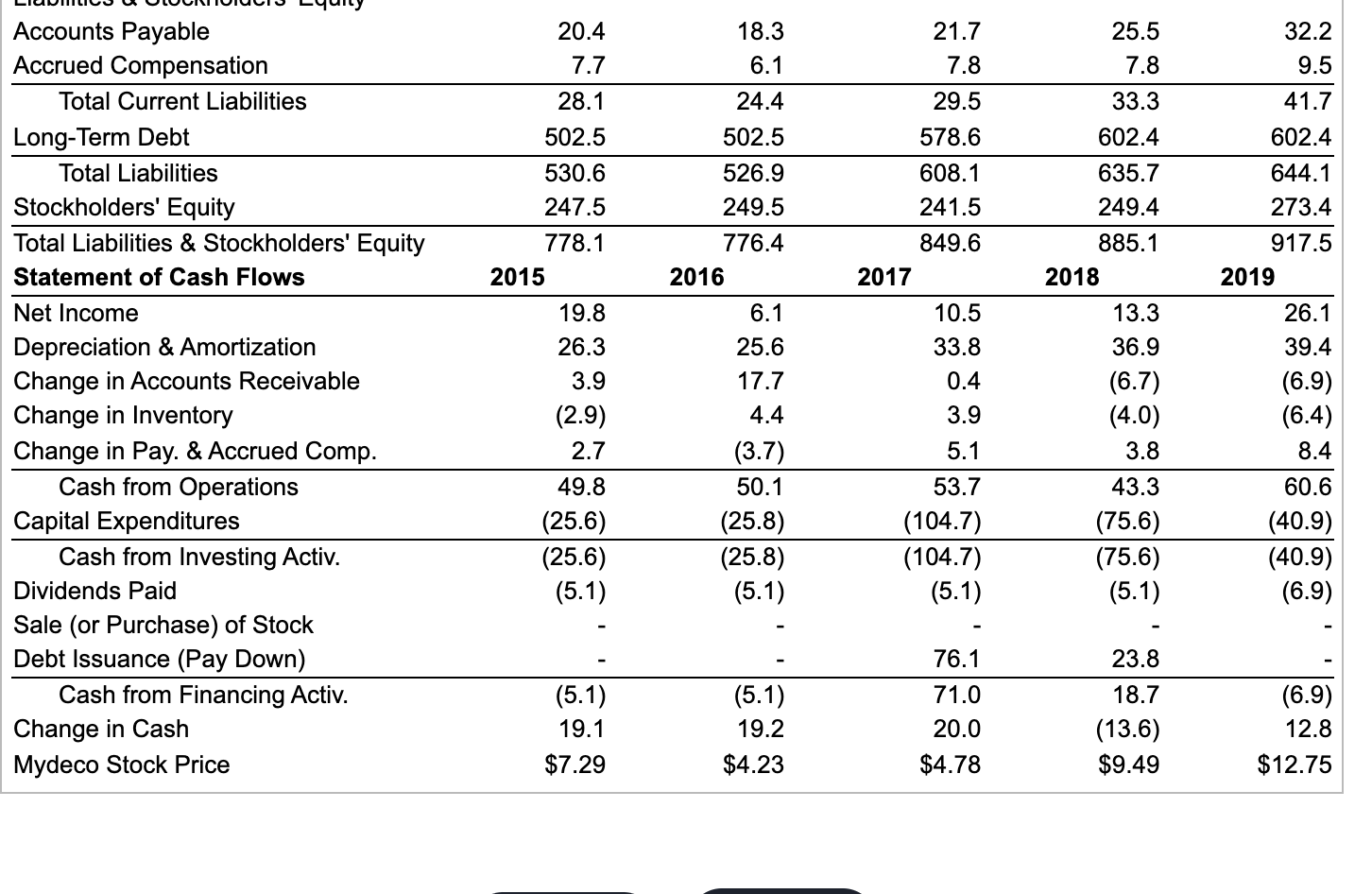

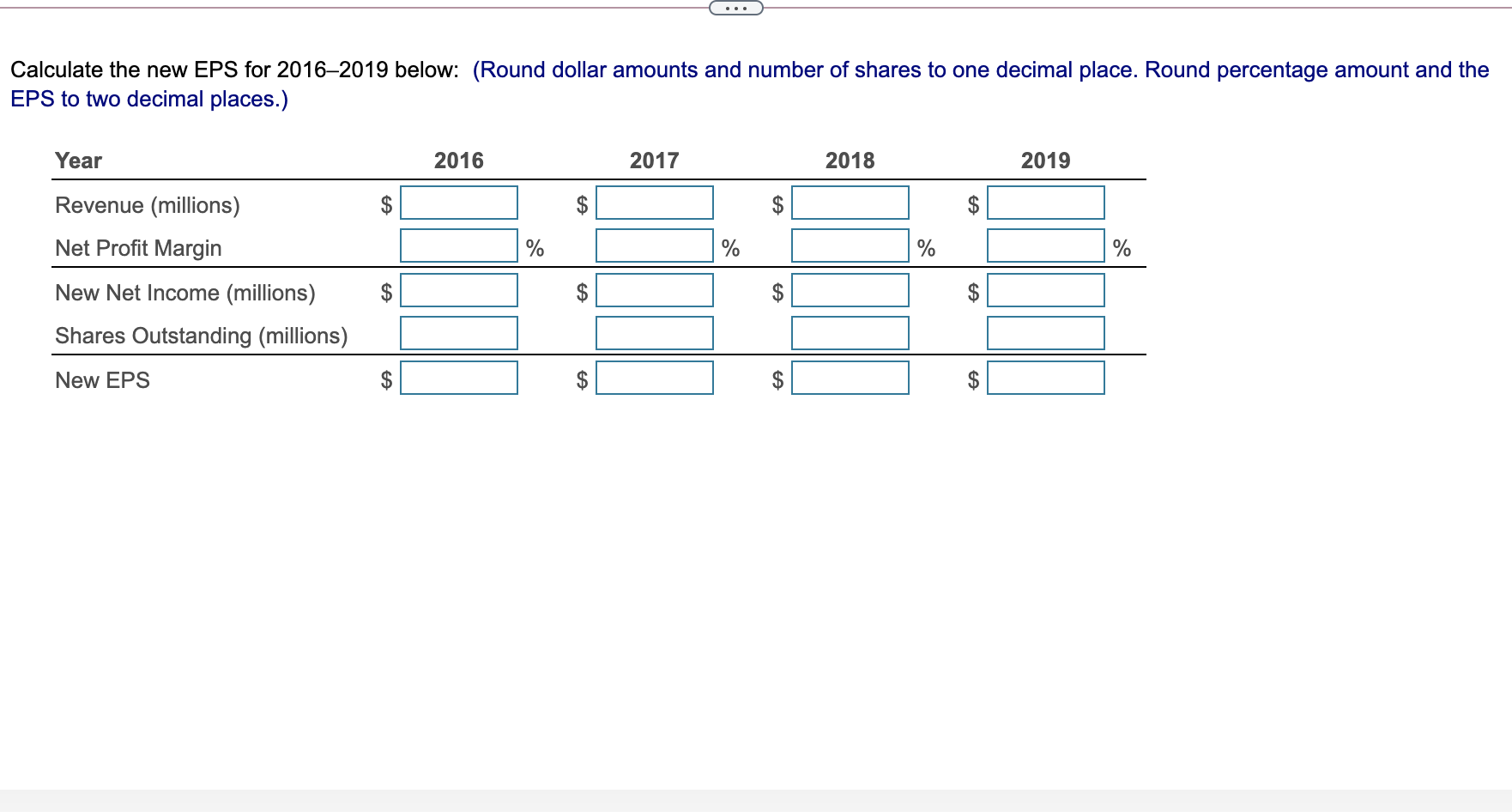

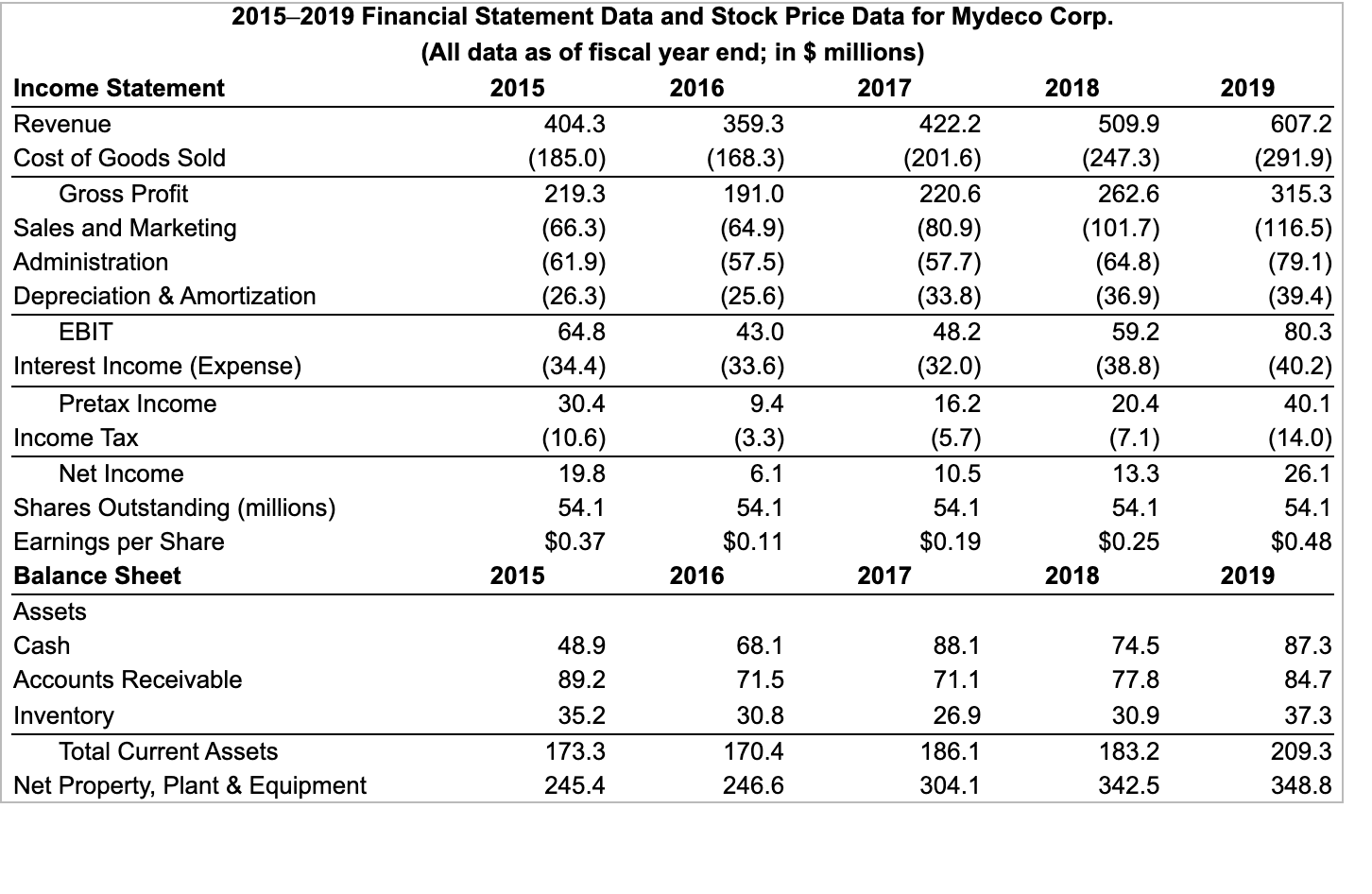

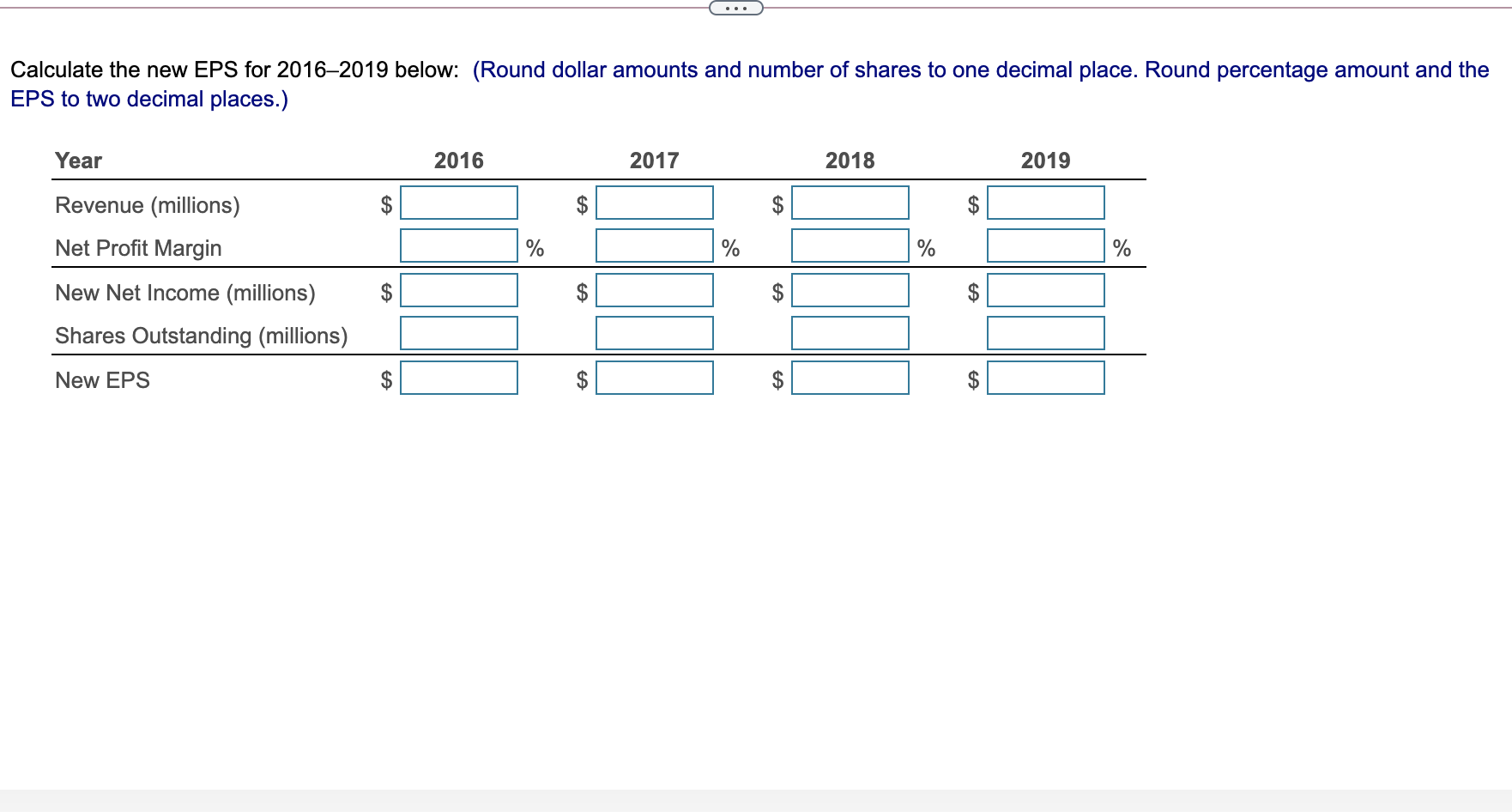

See Table 2.5 showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco's costs and expenses had been the same fraction of revenues in 20162019 as they were in 2015. What would Mydeco's EPS have been each year in this case?

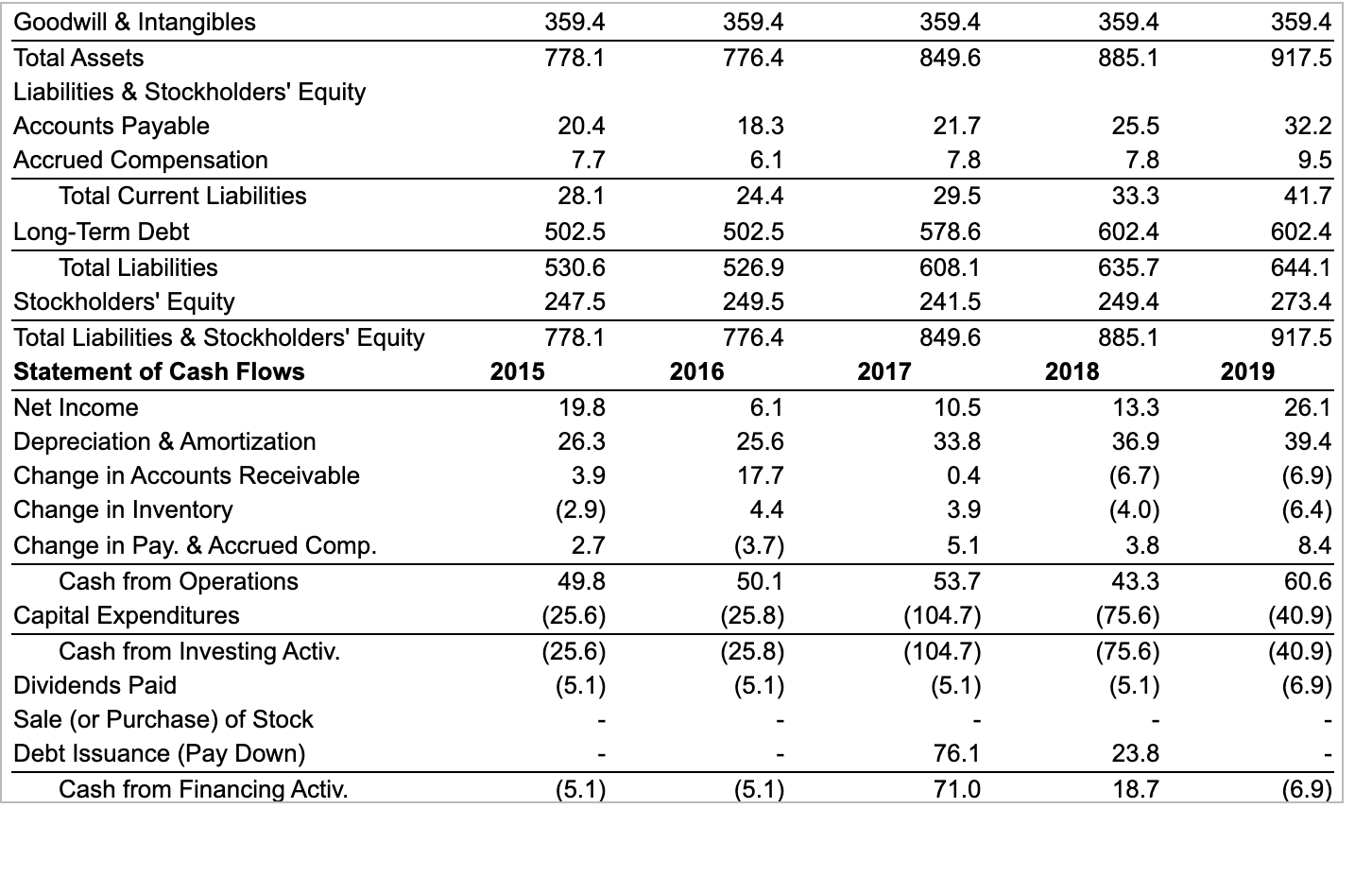

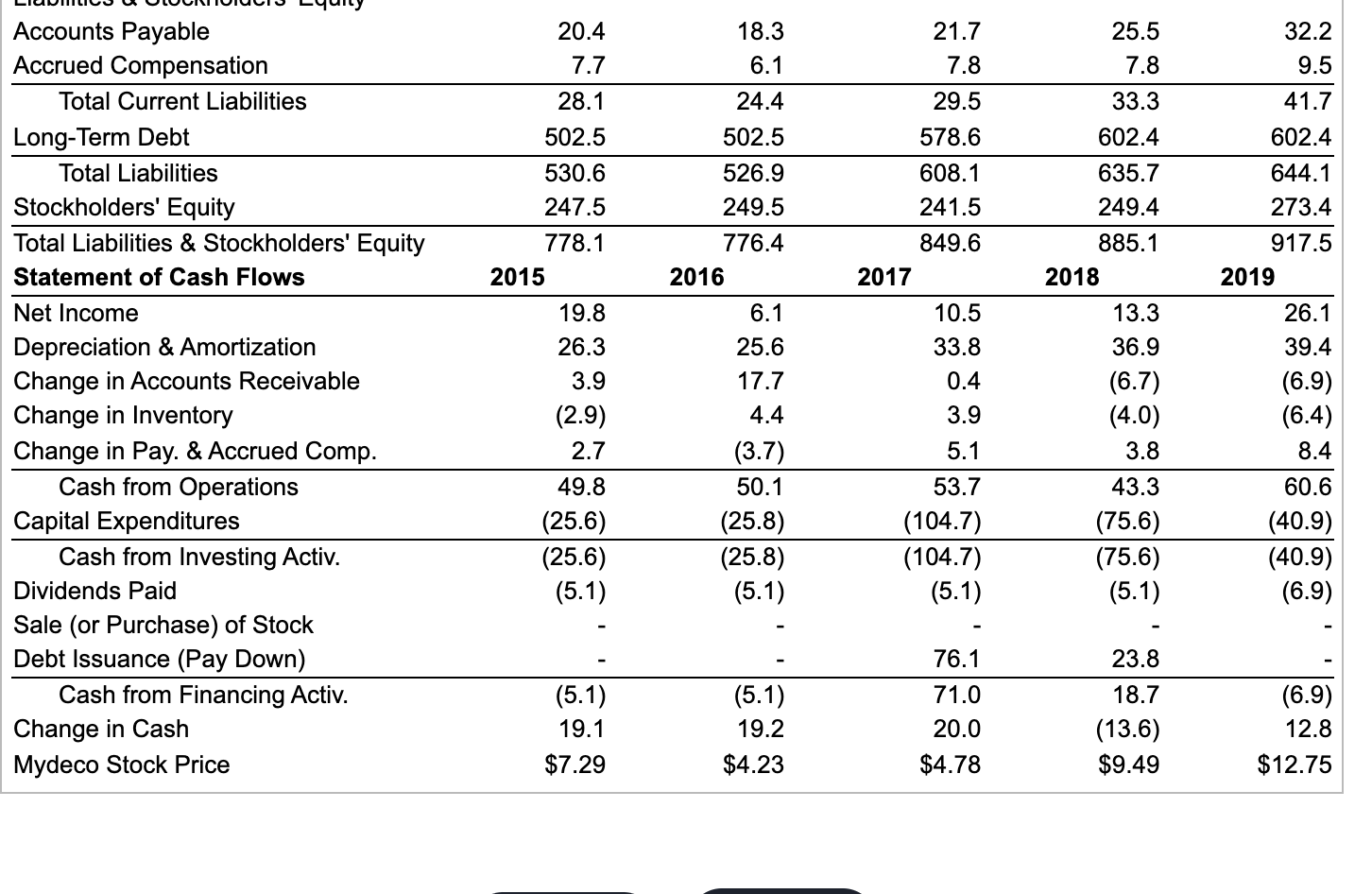

2019 20152019 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; in $ millions) Income Statement 2015 2016 2017 2018 Revenue 404.3 359.3 422.2 509.9 Cost of Goods Sold (185.0) (168.3) (201.6) (247.3) Gross Profit 219.3 191.0 220.6 262.6 Sales and Marketing (66.3) (64.9) (80.9) (101.7) Administration (61.9) (57.5) (57.7) (64.8) Depreciation & Amortization (26.3) (25.6) (33.8) (36.9) EBIT 64.8 43.0 48.2 59.2 Interest Income (Expense) (34.4) (33.6) (32.0) (38.8) Pretax Income 30.4 9.4 16.2 20.4 Income Tax (10.6) (3.3) (5.7) (7.1) Net Income 19.8 6.1 10.5 13.3 Shares Outstanding (millions) 54.1 54.1 54.1 54.1 Earnings per Share $0.37 $0.11 $0.19 $0.25 Balance Sheet 2015 2016 2017 2018 Assets Cash 48.9 68.1 88.1 74.5 Accounts Receivable 89.2 71.5 71.1 77.8 Inventory 35.2 30.8 26.9 30.9 Total Current Assets 173.3 170.4 186.1 183.2 Net Property, Plant & Equipment 245.4 246.6 304.1 342.5 607.2 (291.9) 315.3 (116.5) (79.1) (39.4) 80.3 (40.2) 40.1 (14.0) 26.1 54.1 $0.48 2019 87.3 84.7 37.3 209.3 348.8 359.4 359.4 359.4 359.4 778.1 359.4 917.5 776.4 849.6 885.1 32.2 9.5 20.4 7.7 28.1 502.5 18.3 6.1 24.4 502.5 21.7 7.8 29.5 578.6 608.1 241.5 25.5 7.8 33.3 602.4 41.7 602.4 526.9 249.5 635.7 249.4 885.1 2018 Goodwill & Intangibles Total Assets Liabilities & Stockholders' Equity Accounts Payable Accrued Compensation Total Current Liabilities Long-Term Debt Total Liabilities Stockholders' Equity Total Liabilities & Stockholders' Equity Statement of Cash Flows Net Income Depreciation & Amortization Change in Accounts Receivable Change in Inventory Change in Pay. & Accrued Comp. Cash from Operations Capital Expenditures Cash from Investing Activ. Dividends Paid Sale (or Purchase) of Stock Debt Issuance (Pay Down) Cash from Financing Activ. 530.6 247.5 778.1 2015 19.8 26.3 3.9 (2.9) 2.7 49.8 (25.6) (25.6) (5.1) 776.4 2016 6.1 25.6 17.7 4.4 849.6 2017 10.5 33.8 0.4 3.9 644.1 273.4 917.5 2019 26.1 39.4 (6.9) (6.4) 8.4 60.6 (40.9) (40.9) (6.9) 5.1 13.3 36.9 (6.7) (4.0) 3.8 43.3 (75.6) (75.6) (5.1) (3.7) 50.1 (25.8) (25.8) (5.1) 53.7 (104.7) (104.7) (5.1) 76.1 23.8 18.7 (5.1) (5.1) 71.0 (6.9) 18.3 6.1 21.7 7.8 32.2 9.5 24.4 Accounts Payable Accrued Compensation Total Current Liabilities Long-Term Debt Total Liabilities Stockholders' Equity Total Liabilities & Stockholders' Equity Statement of Cash Flows Net Income Depreciation & Amortization Change in Accounts Receivable Change in Inventory Change in Pay. & Accrued Comp. Cash from Operations Capital Expenditures Cash from Investing Activ. Dividends Paid Sale (or Purchase) of Stock Debt Issuance (Pay Down) Cash from Financing Activ. Change in Cash Mydeco Stock Price 41.7 602.4 644.1 273.4 917.5 2019 20.4 7.7 28.1 502.5 530.6 247.5 778.1 2015 19.8 26.3 3.9 (2.9) 2.7 49.8 (25.6) (25.6) (5.1) 29.5 578.6 608.1 241.5 849.6 2017 10.5 33.8 0.4 3.9 502.5 526.9 249.5 776.4 2016 6.1 25.6 17.7 4.4 (3.7) 50.1 (25.8) (25.8) 25.5 7.8 33.3 602.4 635.7 249.4 885.1 2018 13.3 36.9 (6.7) (4.0) 3.8 43.3 (75.6) (75.6) (5.1) 5.1 26.1 39.4 (6.9) (6.4) 8.4 60.6 (40.9) (40.9) (6.9) 53.7 (104.7) (104.7) (5.1) (5.1) (5.1) 19.1 $7.29 (5.1) 19.2 $4.23 76.1 71.0 20.0 $4.78 23.8 18.7 (13.6) $9.49 (6.9) 12.8 $12.75 Calculate the new EPS for 2016-2019 below: (Round dollar amounts and number of shares to one decimal place. Round percentage amount and the EPS to two decimal places.) Year 2016 2017 2018 2019 $ $ $ $ % % % Revenue (millions) Net Profit Margin New Net Income (millions) Shares Outstanding (millions) $ TA $ $ $ New EPS $ TA $ $ $