Answered step by step

Verified Expert Solution

Question

1 Approved Answer

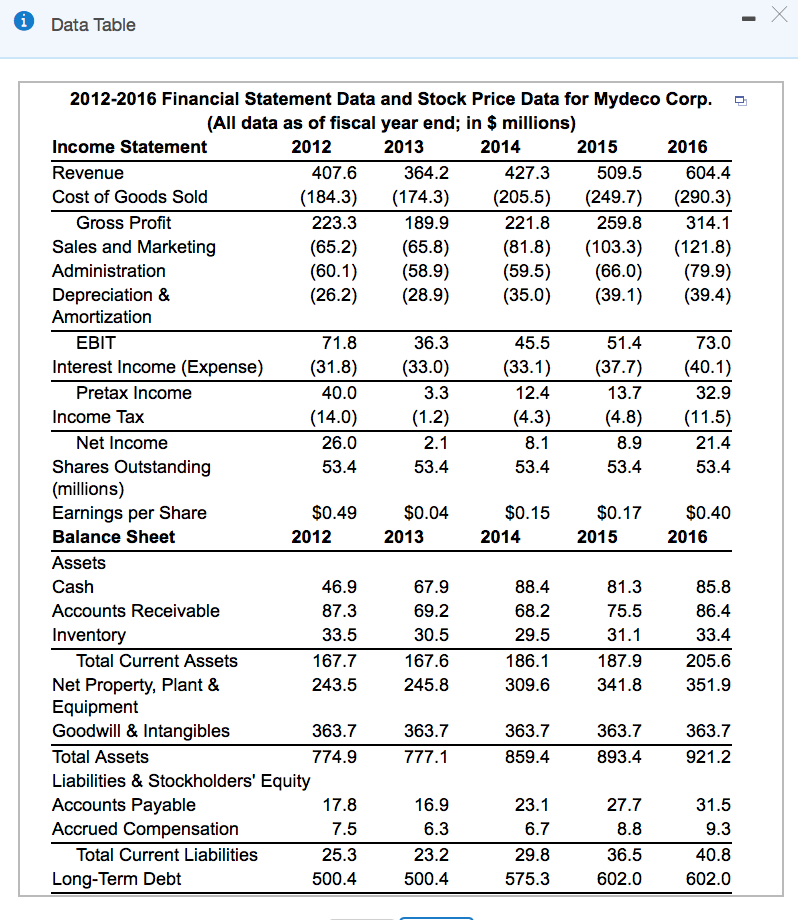

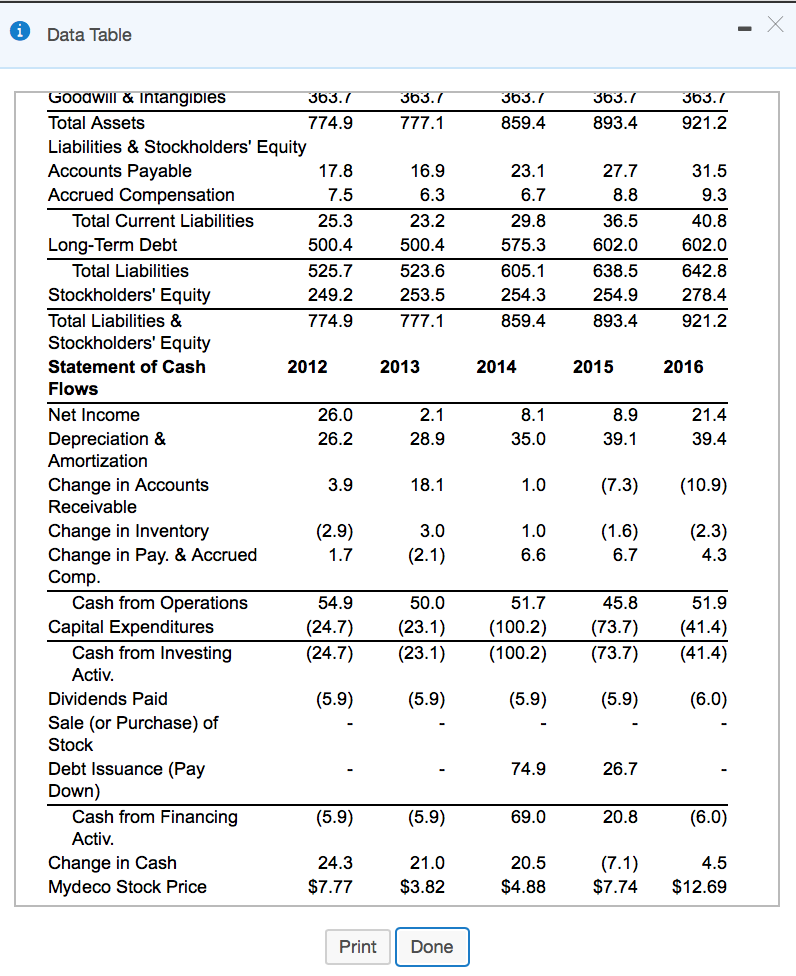

See Table (I will be sure to include the table Included in several photos) showing financial statement data and stock price data for Mydeco Corp.

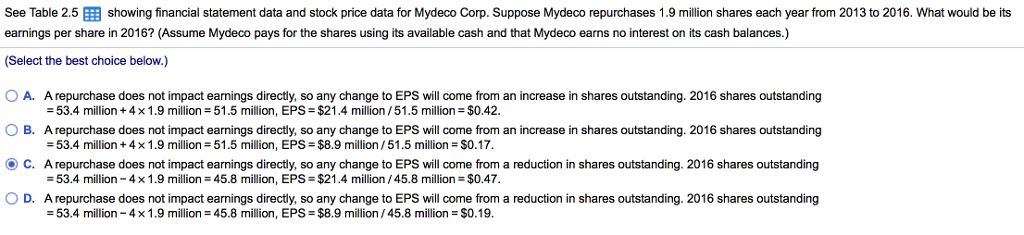

See Table (I will be sure to include the table Included in several photos) showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco repurchases 1.9 million shares each year from 2013 to 2016. What would be its earnings per share in 2016? (Assume Mydeco pays for the shares using its available cash and that Mydeco earns no interest on its cash balances.) I really appreicate any help in advance as i have been having some difficulty with this question. Thank you for your help!

Data Table 2012-2016 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; in $ millions) 2012 2014 2016 Income Statement Revenue Cost of Goods Sold 2013 2015 407.6 364.2 427.3 509.5 604.4 (184.3) (174.3) (205.5) (249.7) (290.3) 223.3 221.8 (81.8) (103.3) (121.8) (59.5)66.0 (79.9) 259.8 Gross Profit Sales and Marketing Administration Depreciation & Amortization 189.9 EBIT 36.3 (31.8)(33.0) 45.5 73.0 Interest Income (Expense) Pretax Income 40.0 32.9 Income Tax Net Income Shares Outstanding (millions) Earnings per Share Balance Sheet Assets 26.0 53.4 $0.49$0.04 2012 $0.15$0.17$0.40 2014 2013 2015 2016 67.9 69.2 30.5 167.6 245.8 85.8 Accounts Receivable 87.3 68.2 29.5 186.1 309.6 75.5 Inventory 187.9 Total Current Assets Net Property, Plant & Equipment Goodwill & Intangibles Total Assets Liabilities & Stockholders' Equity Accounts Payable Accrued Compensation 167.7 243.5 205.6 351.9 363.7 774.9 363.7 363.7 363.7 363.7 921.2 859.4 893.4 27.7 Total Current Liabilities 25.3 500.4 23.2 500.4 36.5 602.0 Long-Term Debt 575.3 602.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started