Answered step by step

Verified Expert Solution

Question

1 Approved Answer

See Table showing financial statement data and stock price data for Mydeco Corp. a. How did Mydeco's accounts receivable days change over this period? b.

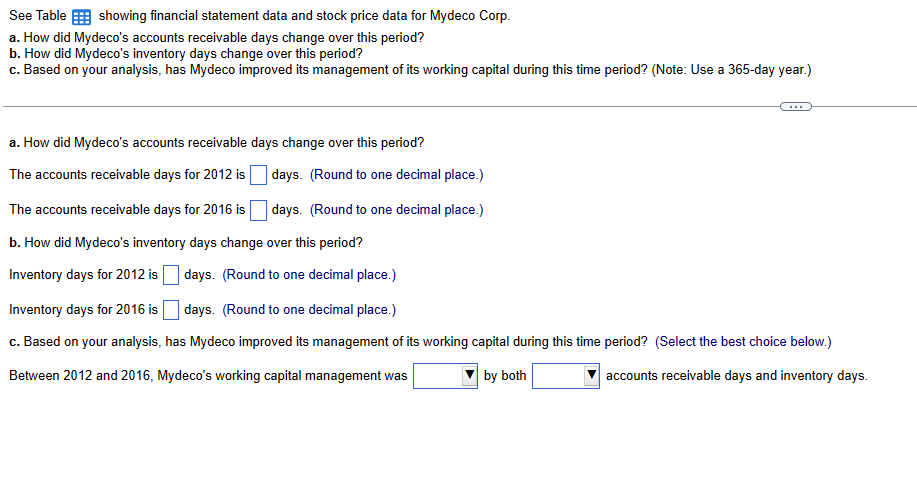

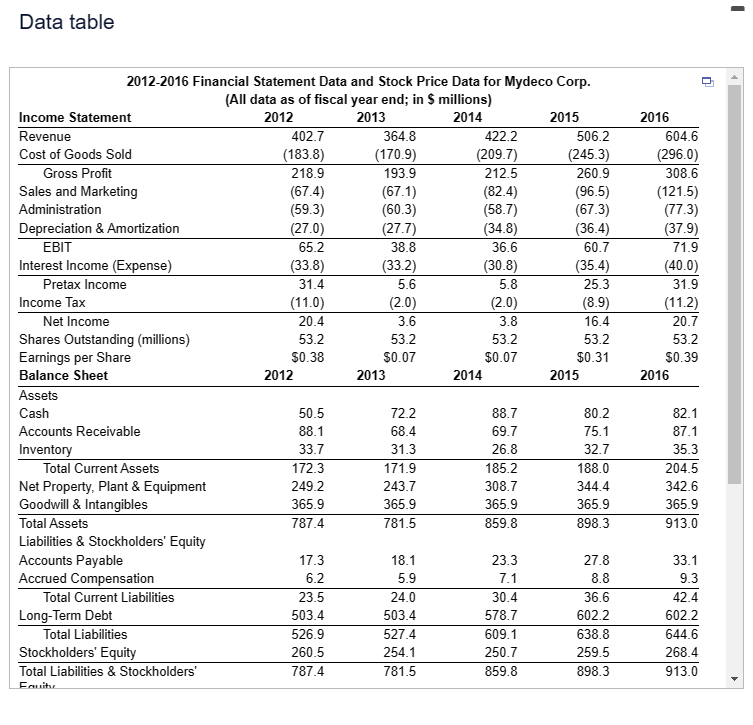

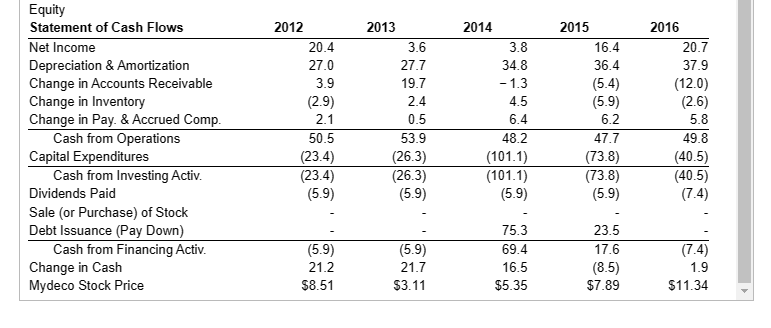

See Table showing financial statement data and stock price data for Mydeco Corp. a. How did Mydeco's accounts receivable days change over this period? b. How did Mydeco's inventory days change over this period? c. Based on your analysis, has Mydeco improved its management of its working capital during this time period? (Note: Use a 365-day year.) a. How did Mydeco's accounts receivable days change over this period? The accounts receivable days for 2012 is days. (Round to one decimal place.) The accounts receivable days for 2016 is days. (Round to one decimal place.) b. How did Mydeco's inventory days change over this period? Inventory days for 2012 is days. (Round to one decimal place.) Inventory days for 2016 is days. (Round to one decimal place.) c. Based on your analysis, has Mydeco improved its management of its working capital during this time period? (Select the best choice below.) Between 2012 and 2016, Mydeco's working capital management was by both accounts receivable days and inventory days. Data table Equity \begin{tabular}{lrrrrr} Statement of Cash Flows & 2012 & 2013 & 2014 & 2015 & 2016 \\ \hline Net Income & 20.4 & 3.6 & 3.8 & 16.4 & 20.7 \\ Depreciation \& Amortization & 27.0 & 27.7 & 34.8 & 36.4 & 37.9 \\ Change in Accounts Receivable & 3.9 & 19.7 & -1.3 & (5.4) & (12.0) \\ Change in Inventory & (2.9) & 2.4 & 4.5 & (5.9) & (2.6) \\ Change in Pay. \& Accrued Comp. & 2.1 & 0.5 & 6.4 & 6.2 & 5.8 \\ \hline Cash from Operations & 50.5 & 53.9 & 48.2 & 47.7 & 49.8 \\ Capital Expenditures & (23.4) & (26.3) & (101.1) & (73.8) & (40.5) \\ \hline \multicolumn{1}{c}{ Cash from Investing Activ. } & (23.4) & (26.3) & (101.1) & (73.8) & (40.5) \\ Dividends Paid & (5.9) & (5.9) & (5.9) & (5.9) & (7.4) \\ Sale (or Purchase) of Stock & - & - & - & - & - \\ Debt Issuance (Pay Down) & - & - & 75.3 & 23.5 & - \\ \hline Cash from Financing Activ. & (5.9) & (5.9) & 69.4 & 17.6 & (7.4) \\ Change in Cash & 21.2 & 21.7 & 16.5 & (8.5) & 1.9 \\ Mydeco Stock Price & $8.51 & $3.11 & $5.35 & $7.89 \end{tabular}

See Table showing financial statement data and stock price data for Mydeco Corp. a. How did Mydeco's accounts receivable days change over this period? b. How did Mydeco's inventory days change over this period? c. Based on your analysis, has Mydeco improved its management of its working capital during this time period? (Note: Use a 365-day year.) a. How did Mydeco's accounts receivable days change over this period? The accounts receivable days for 2012 is days. (Round to one decimal place.) The accounts receivable days for 2016 is days. (Round to one decimal place.) b. How did Mydeco's inventory days change over this period? Inventory days for 2012 is days. (Round to one decimal place.) Inventory days for 2016 is days. (Round to one decimal place.) c. Based on your analysis, has Mydeco improved its management of its working capital during this time period? (Select the best choice below.) Between 2012 and 2016, Mydeco's working capital management was by both accounts receivable days and inventory days. Data table Equity \begin{tabular}{lrrrrr} Statement of Cash Flows & 2012 & 2013 & 2014 & 2015 & 2016 \\ \hline Net Income & 20.4 & 3.6 & 3.8 & 16.4 & 20.7 \\ Depreciation \& Amortization & 27.0 & 27.7 & 34.8 & 36.4 & 37.9 \\ Change in Accounts Receivable & 3.9 & 19.7 & -1.3 & (5.4) & (12.0) \\ Change in Inventory & (2.9) & 2.4 & 4.5 & (5.9) & (2.6) \\ Change in Pay. \& Accrued Comp. & 2.1 & 0.5 & 6.4 & 6.2 & 5.8 \\ \hline Cash from Operations & 50.5 & 53.9 & 48.2 & 47.7 & 49.8 \\ Capital Expenditures & (23.4) & (26.3) & (101.1) & (73.8) & (40.5) \\ \hline \multicolumn{1}{c}{ Cash from Investing Activ. } & (23.4) & (26.3) & (101.1) & (73.8) & (40.5) \\ Dividends Paid & (5.9) & (5.9) & (5.9) & (5.9) & (7.4) \\ Sale (or Purchase) of Stock & - & - & - & - & - \\ Debt Issuance (Pay Down) & - & - & 75.3 & 23.5 & - \\ \hline Cash from Financing Activ. & (5.9) & (5.9) & 69.4 & 17.6 & (7.4) \\ Change in Cash & 21.2 & 21.7 & 16.5 & (8.5) & 1.9 \\ Mydeco Stock Price & $8.51 & $3.11 & $5.35 & $7.89 \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started