Answered step by step

Verified Expert Solution

Question

1 Approved Answer

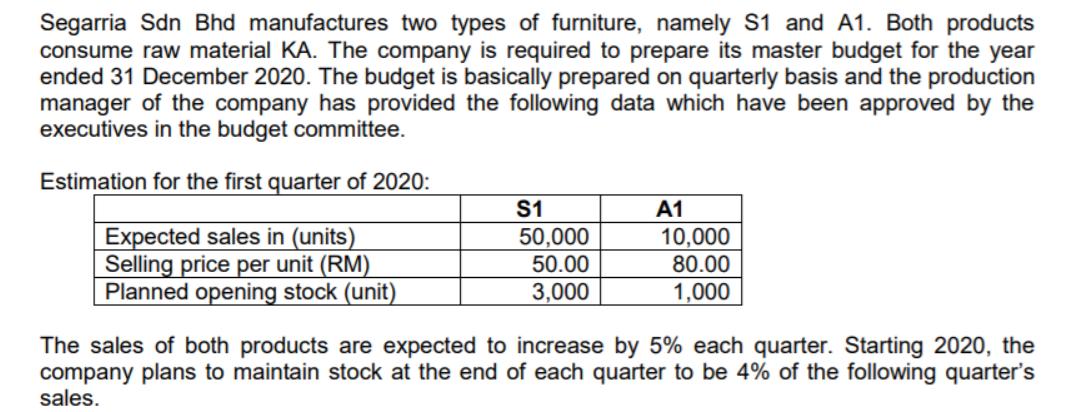

Segarria Sdn Bhd manufactures two types of furniture, namely S1 and A1. Both products consume raw material KA. The company is required to prepare

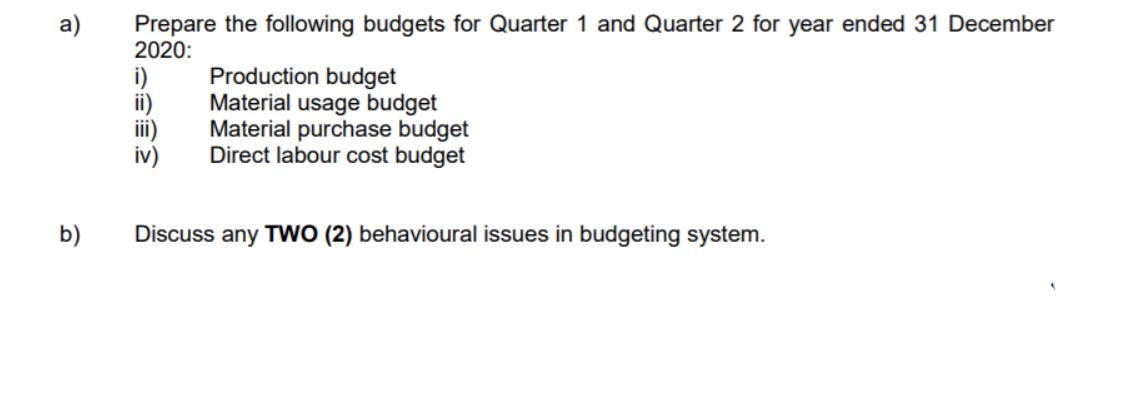

Segarria Sdn Bhd manufactures two types of furniture, namely S1 and A1. Both products consume raw material KA. The company is required to prepare its master budget for the year ended 31 December 2020. The budget is basically prepared on quarterly basis and the production manager of the company has provided the following data which have been approved by the executives in the budget committee. Estimation for the first quarter of 2020: Expected sales in (units) Selling price per unit (RM) Planned opening stock (unit) S1 50,000 50.00 3,000 A1 10,000 80.00 1,000 The sales of both products are expected to increase by 5% each quarter. Starting 2020, the company plans to maintain stock at the end of each quarter to be 4% of the following quarter's sales. a) b) Prepare the following budgets for Quarter 1 and Quarter 2 for year ended 31 December 2020: i) Production budget Material usage budget Material purchase budget Direct labour cost budget Discuss any TWO (2) behavioural issues in budgeting system.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Lets start with the budgets for Quarter 1 and Quarter 2 i Production Budget for Quarter 1 S1 Expected Sales 50000 units Planned Opening Stock 3000 u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started