Answered step by step

Verified Expert Solution

Question

1 Approved Answer

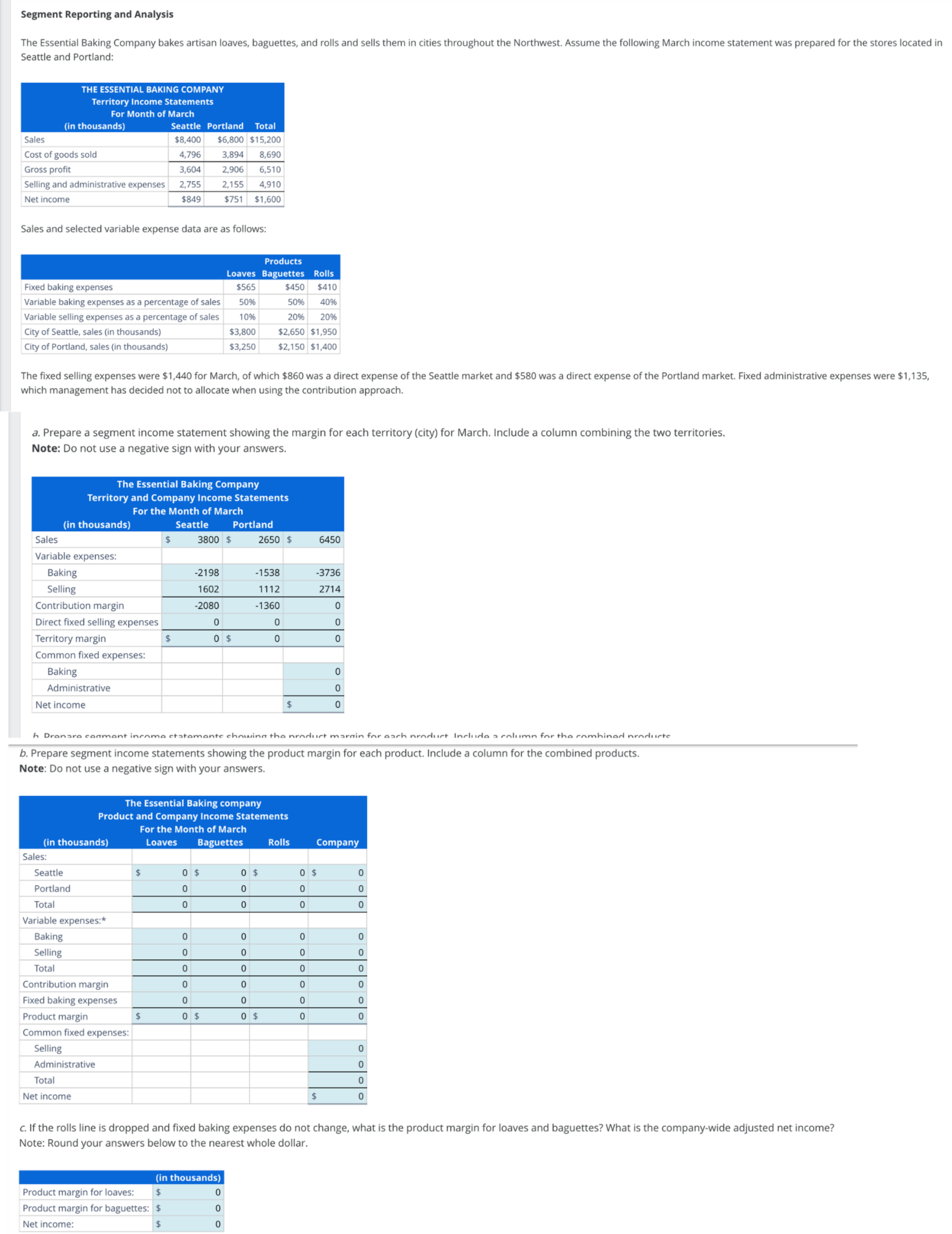

Segment Reporting and Analysis The Essential Baking Company bakes artisan loaves, baguettes, and rolls and sells them in cities throughout the Northwest. Assume the following

Segment Reporting and Analysis

The Essential Baking Company bakes artisan loaves, baguettes, and rolls and sells them in cities throughout the Northwest. Assume the following March income statement was prepared for the stores located in Seattle and Portland:

THE ESSENTIAL BAKING COMPANY

Territory Income Statements

For Month of March

in thousands Seattle Portland Total

Sales $ $ $

Cost of goods sold

Gross profit

Selling and administrative expenses

Net income $ $ $

Sales and selected variable expense data are as follows:

Products

Loaves Baguettes Rolls

Fixed baking expenses $ $ $

Variable baking expenses as a percentage of sales

Variable selling expenses as a percentage of sales

City of Seattle, sales in thousands $ $ $

City of Portland, sales in thousands $ $ $

The fixed selling expenses were $ for March, of which $ was a direct expense of the Seattle market and $ was a direct expense of the Portland market. Fixed administrative expenses were $ which management has decided not to allocate when using the contribution approach.

Required

a Prepare a segment income statement showing the margin for each territory city for March. Include a column combining the two territories.

Note: Do not use a negative sign with your answers.

The Essential Baking Company

Territory and Company Income Statements

For the Month of March

in thousands Seattle Portland

Sales Answer

Answer

Answer

Variable expenses:

Baking Answer

Answer

Answer

Selling Answer

Answer

Answer

Contribution margin Answer

Answer

Answer

Direct fixed selling expenses Answer

Answer

Answer

Territory margin Answer

Answer

Answer

Common fixed expenses:

Baking Answer

Administrative Answer

Net income Answer

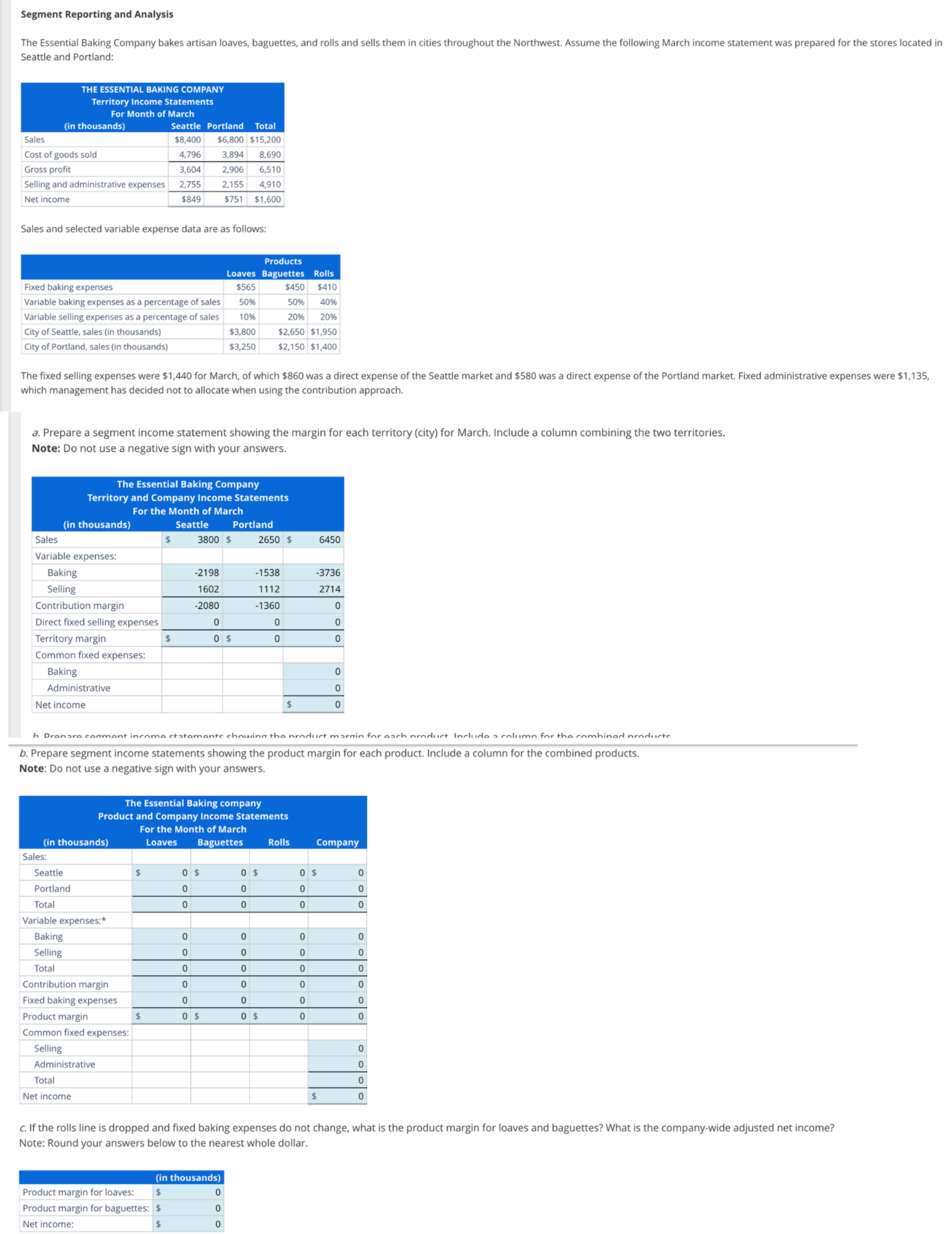

b Prepare segment income statements showing the product margin for each product. Include a column for the combined products.

Note: Do not use a negative sign with your answers.

The Essential Baking company

Product and Company Income Statements

For the Month of March

in thousands Loaves Baguettes Rolls Company

Sales:

Seattle Answer

Answer

Answer

Answer

Portland Answer

Answer

Answer

Answer

Total Answer

Answer

Answer

Answer

Variable expenses:

Baking Answer

Answer

Answer

Answer

Selling Answer

Answer

Answer

Answer

Total Answer

Answer

Answer

Answer

Contribution margin Answer

Answer

Answer

Answer

Fixed baking expenses Answer

Answer

Answer

Answer

Product margin Answer

Answer

Answer

Answer

Common fixed expenses:

Selling Answer

Administrative Answer

Total Answer

Net income Answer

c If the rolls line is dropped and fixed baking expenses do not change, what is the product margin for loaves and baguettes? What is the companywide adjusted net income?

Note: Round your answers below to the nearest whole dollar.

in thousands

Product margin for loaves: Answer

Product margin for baguettes: Answer

Net income: Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started