Question

Segmented Net Income. Valdez Company has two divisionsAppliances and Tools. The following segmented financial information is for the most recent fiscal year ended December 31.

Segmented Net Income. Valdez Company has two divisionsAppliances and Tools. The following segmented financial information is for the most recent fiscal year ended December 31.

| Appliances Division | Tools Division | |

| Sales | $3,000,000 | $1,000,000 |

| Cost of goods sold | 1,600,000 | 430,000 |

| Allocated overhead | 375,000 | 125,000 |

| Selling and administrative expenses | 250,000 | 200,000 |

Assume the tax rate is 30 percent.

Required:

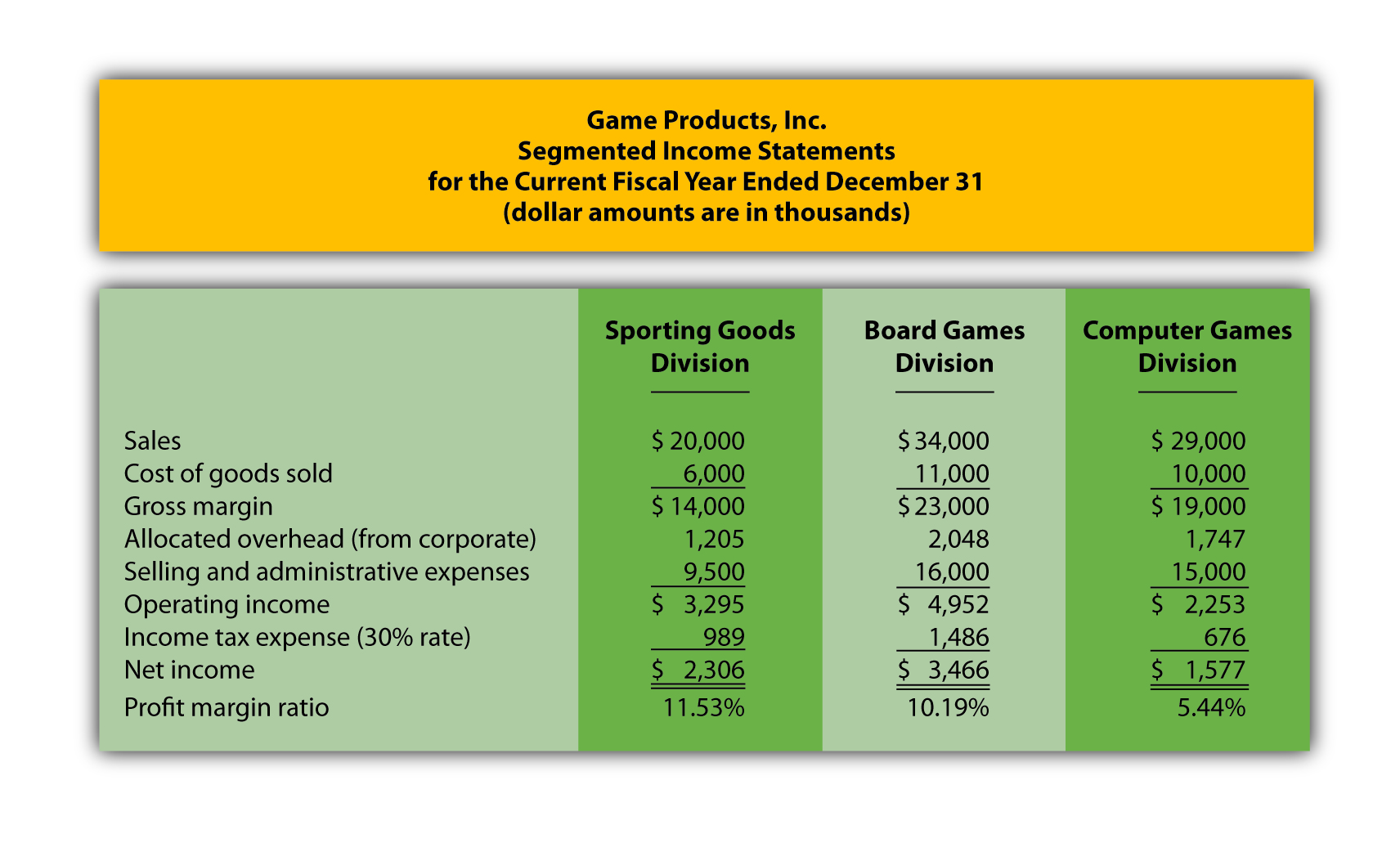

Prepare a segmented income statement using the format presented in Figure 11.3. Include the profit margin ratio for each division at the bottom of the segmented income statement.

Using net income as the measure, which division is most profitable? Explain why this conclusion might be misleading.

What does the profit margin ratio tell us about each division? Why do organizations often use profit margin ratio to evaluate division performance rather than simply using net income?

Figure 11.3 Segmented Income Statements (Game Products, Inc.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started