Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Segura Corporation began a very lucrative consulting operation on December 1, 2014. They are authorized to issue 400,000 shares of $2.00 cumulative preferred shares. They

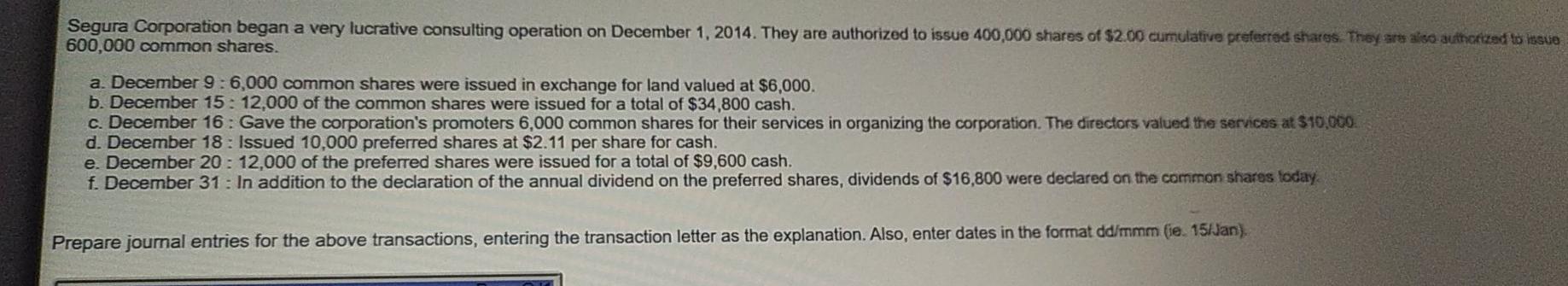

Segura Corporation began a very lucrative consulting operation on December 1, 2014. They are authorized to issue 400,000 shares of $2.00 cumulative preferred shares. They are also authorized to issue 600,000 common shares. a. December 9:6,000 common shares were issued in exchange for land valued at $6,000. b. December 15: 12,000 of the common shares were issued for a total of $34,800 cash. c. December 16: Gave the corporation's promoters 6,000 common shares for their services in organizing the corporation. The directors valued the services at $10,000 d. December 18: Issued 10,000 preferred shares at $2.11 per share for cash. e. December 20: 12,000 of the preferred shares were issued for a total of $9,600 cash. f. December 31: In addition to the declaration of the annual dividend on the preferred shares, dividends of $16,800 were declared on the common shares today Prepare journal entries for the above transactions, entering the transaction letter as the explanation. Also, enter dates in the format dd/mmm (ie. 15/Jan)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started