Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Seinfeld Creative Productions is evaluating the construction of a studio complex. The planned site is currently valued at $400,000 but this parcel would not

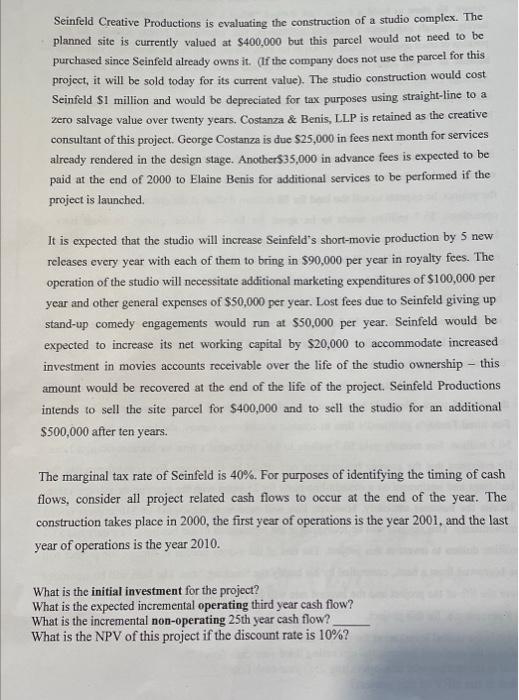

Seinfeld Creative Productions is evaluating the construction of a studio complex. The planned site is currently valued at $400,000 but this parcel would not need to be purchased since Seinfeld already owns it. (If the company does not use the parcel for this project, it will be sold today for its current value). The studio construction would cost Seinfeld $1 million and would be depreciated for tax purposes using straight-line to a zero salvage value over twenty years. Costanza & Benis, LLP is retained as the creative consultant of this project. George Costanza is due $25,000 in fees next month for services already rendered in the design stage. Another$35,000 in advance fees is expected to be paid at the end of 2000 to Elaine Benis for additional services to be performed if the project is launched. It is expected that the studio will increase Seinfeld's short-movie production by 5 new releases every year with each of them to bring in $90,000 per year in royalty fees. The operation of the studio will necessitate additional marketing expenditures of $100,000 per year and other general expenses of $50,000 per year. Lost fees due to Seinfeld giving up stand-up comedy engagements would run at $50,000 per year. Seinfeld would be expected to increase its net working capital by $20,000 to accommodate increased investment in movies accounts receivable over the life of the studio ownership - this amount would be recovered at the end of the life of the project. Seinfeld Productions intends to sell the site parcel for $400,000 and to sell the studio for an additional $500,000 after ten years. The marginal tax rate of Seinfeld is 40%. For purposes of identifying the timing of cash flows, consider all project related cash flows to occur at the end of the year. The construction takes place in 2000, the first year of operations is the year 2001, and the last year of operations is the year 2010. What is the initial investment for the project? What is the expected incremental operating third year cash flow? What is the incremental non-operating 25th year cash flow? What is the NPV of this project if the discount rate is 10%?

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the initial investment we need to add up all the costs associated with the project in year 0 These include the construction cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started