- Select 2 of these and point out one positive aspect of using that source that may not be available with the other sources. Then, select 2 others and point out one negative aspect of using that source that may not be available with the other sources.

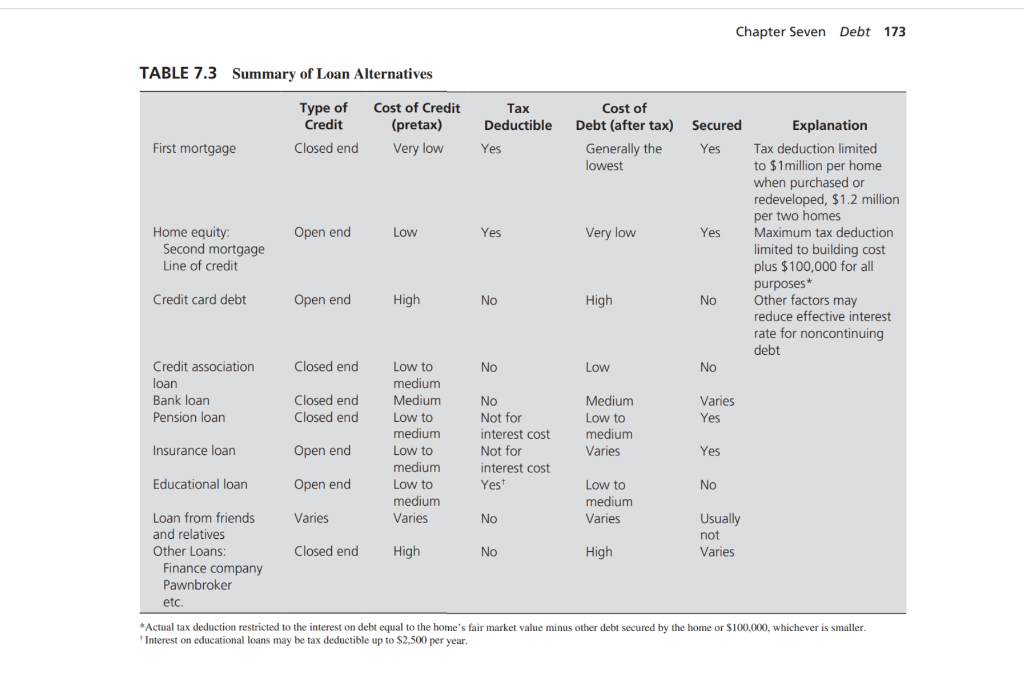

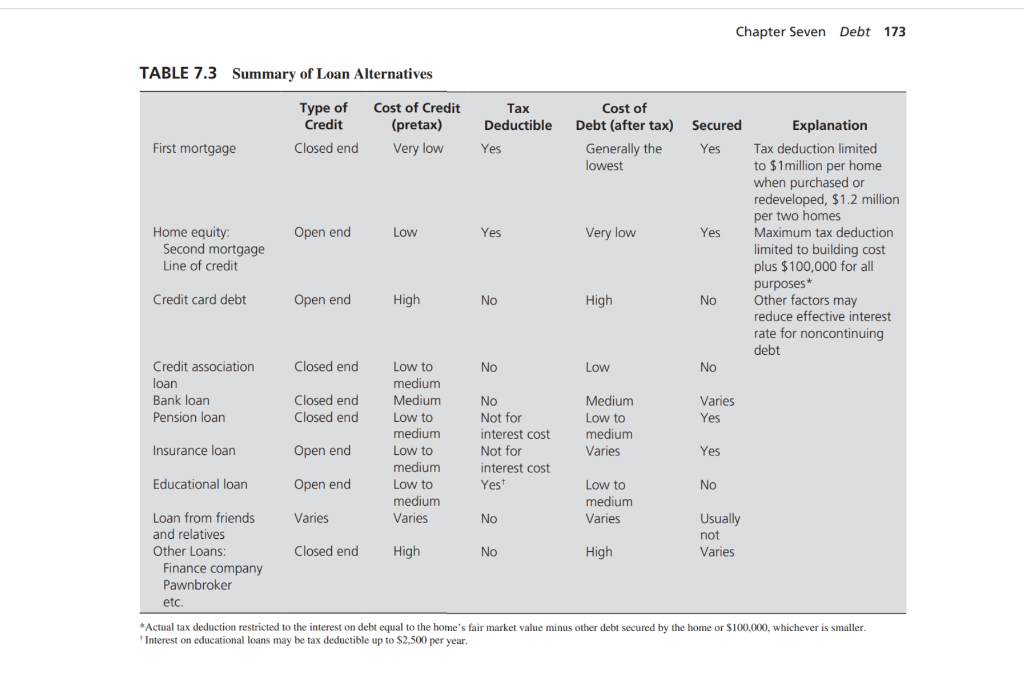

Chapter Seven Debt 173 TABLE 7.3 Summary of Loan Alternatives Type of Credit Cost of Credit (pretax) Very low Tax Deductible Secured Cost of Debt (after tax) Generally the lowest First mortgage Closed end Yes Yes Open end Low Yes Very low Yes Home equity: Second mortgage Line of credit Explanation Tax deduction limited to $1million per home when purchased or redeveloped, $1.2 million per two homes Maximum tax deduction limited to building cost plus $100,000 for all purposes* Other factors may reduce effective interest rate for noncontinuing debt Credit card debt Open end High No High No Closed end No Low No Credit association loan Bank loan Pension loan Varies Closed end Closed end Yes Low to medium Medium Low to medium Low to medium Low to medium Varies No Not for interest cost Not for interest cost Yest Medium Low to medium Varies Insurance loan Open end Yes Educational loan Open end No Low to medium Varies Varies No Usually not Varies Closed end Loan from friends and relatives Other Loans Finance company Pawnbroker etc. High No High *Actual tax deduction restricted to the interest on debt equal to the home's fair market value minus other debt secured by the home or $100,000, whichever is smaller. * Interest on educational loans may be tax deductible up to $2,500 per year. Chapter Seven Debt 173 TABLE 7.3 Summary of Loan Alternatives Type of Credit Cost of Credit (pretax) Very low Tax Deductible Secured Cost of Debt (after tax) Generally the lowest First mortgage Closed end Yes Yes Open end Low Yes Very low Yes Home equity: Second mortgage Line of credit Explanation Tax deduction limited to $1million per home when purchased or redeveloped, $1.2 million per two homes Maximum tax deduction limited to building cost plus $100,000 for all purposes* Other factors may reduce effective interest rate for noncontinuing debt Credit card debt Open end High No High No Closed end No Low No Credit association loan Bank loan Pension loan Varies Closed end Closed end Yes Low to medium Medium Low to medium Low to medium Low to medium Varies No Not for interest cost Not for interest cost Yest Medium Low to medium Varies Insurance loan Open end Yes Educational loan Open end No Low to medium Varies Varies No Usually not Varies Closed end Loan from friends and relatives Other Loans Finance company Pawnbroker etc. High No High *Actual tax deduction restricted to the interest on debt equal to the home's fair market value minus other debt secured by the home or $100,000, whichever is smaller. * Interest on educational loans may be tax deductible up to $2,500 per year