Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Select box options: Would, Would not Higher, Lower I, II, or III Assume that the one-year U.S. interest rate is 8 percent, while the one-year

Select box options:

Select box options:

Would, Would not

Higher, Lower

I, II, or III

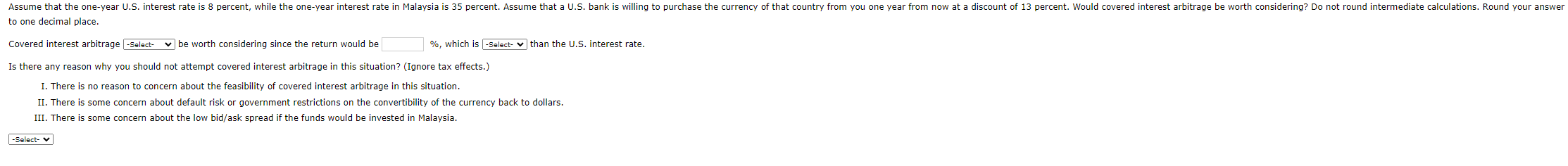

Assume that the one-year U.S. interest rate is 8 percent, while the one-year interest rate in Malaysia is 35 percent. Assume that a U.S. bank is willing to purchase the currency of that country from you one year from now at a discount of 13 percent. Would covered interest arbitrage be worth considering? Do not round intermediate calculations. Round your answer to one decimal place. Covered interest arbitrage -Select- be worth considering since the return would be %, which is -Select-than the U.S. interest rate. Is there any reason why you should not attempt covered interest arbitrage in this situation? (Ignore tax effects.) I. There is no reason to concern about the feasibility of covered interest arbitrage in this situation. II. There is some concern about default risk or government restrictions on the convertibility of the currency back to dollars. III. There is some concern about the low bid/ask spread if the funds would be invested in Malaysia. -SelectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started