Answered step by step

Verified Expert Solution

Question

1 Approved Answer

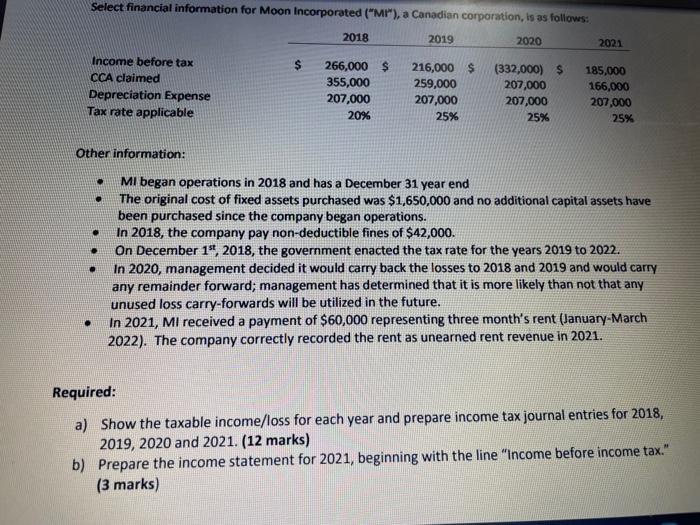

Select financial information for Moon Incorporated (MI), a Canadian corporation, is as follows: 2018 2019 2020 2021 Income before tax 266,000 $ 355,000 216,000

Select financial information for Moon Incorporated ("MI"), a Canadian corporation, is as follows: 2018 2019 2020 2021 Income before tax 266,000 $ 355,000 216,000 $ 259,000 207,000 (332,000) $ 207,000 207,000 185,000 CCA claimed 166,000 Depreciation Expense Tax rate applicable 207,000 207,000 20% 25% 25% 25% Other information: MI began operations in 2018 and has a December 31 year end The original cost of fixed assets purchased was $1,650,000 and no additional capital assets have been purchased since the company began operations. In 2018, the company pay non-deductible fines of $42,000. On December 14, 2018, the government enacted the tax rate for the years 2019 to 2022. In 2020, management decided it would carry back the losses to 2018 and 2019 and would carry any remainder forward; management has determined that it is more likely than not that any unused loss carry-forwards will be utilized in the future. In 2021, MI received a payment of $60,000 representing three month's rent (January-March 2022). The company correctly recorded the rent as unearned rent revenue in 2021. Required: a) Show the taxable income/loss for each year and prepare income tax journal entries for 2018, 2019, 2020 and 2021. (12 marks) b) Prepare the income statement for 2021, beginning with the line "Income before income tax." (3 marks)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

D Tax Payable Tax Table Glom 48150 Computation of Taxable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started