Answered step by step

Verified Expert Solution

Question

1 Approved Answer

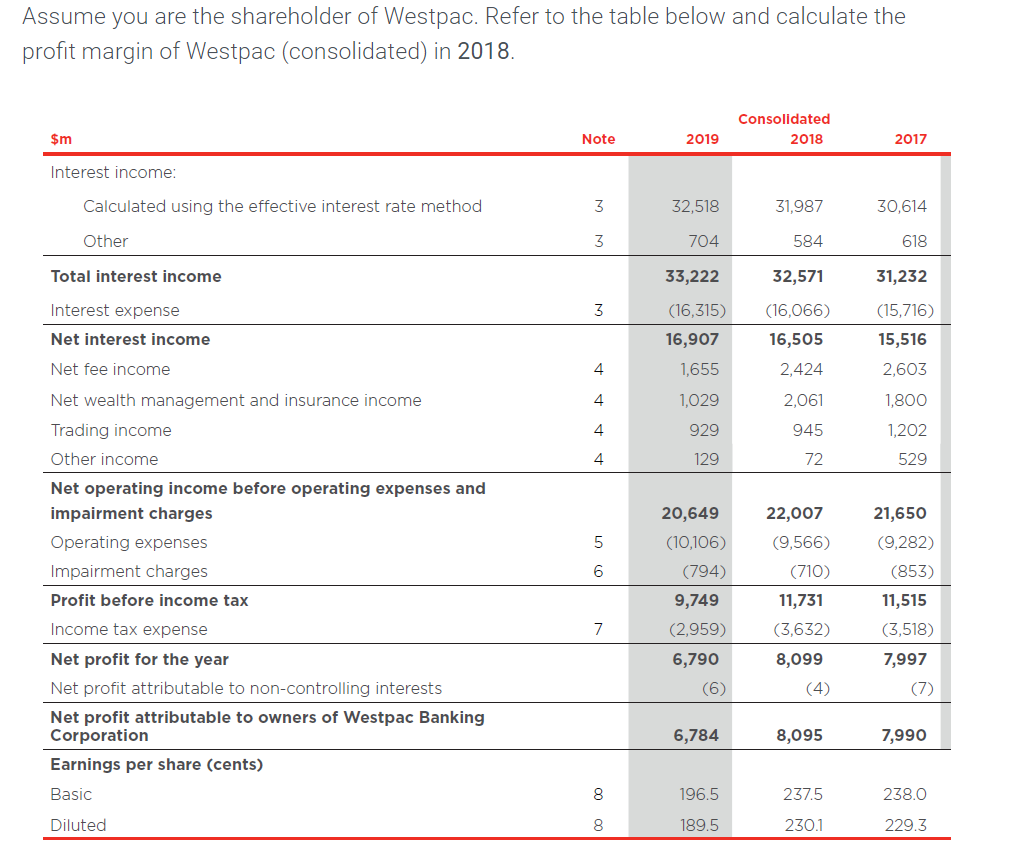

Select one: a. 16.50% b. 21.26% c. 36.78% d. 24.85% Assume you are the shareholder of Westpac. Refer to the table below and calculate the

Select one:

a. 16.50%

b. 21.26%

c. 36.78%

d. 24.85%

Assume you are the shareholder of Westpac. Refer to the table below and calculate the profit margin of Westpac (consolidated) in 2018. Consolidated 2018 $m Note 2019 2017 Interest income: Calculated using the effective interest rate method 3 32,518 31,987 30.614 Other 3 704 584 618 Total interest income 33,222 32,571 31,232 Interest expense 3 (16,315) (16,066) Net interest income 16,907 1,655 16,505 2,424 (15,716) 15,516 2,603 Net fee income 4 4 2,061 1,029 929 1,800 1,202 4 945 4 129 72 529 5 22,007 (9,566) (710) 6 Net wealth management and insurance income Trading income Other income Net operating income before operating expenses and impairment charges Operating expenses Impairment charges Profit before income tax Income tax expense Net profit for the year Net profit attributable to non-controlling interests Net profit attributable to owners of Westpac Banking Corporation Earnings per share (cents) Basic 20,649 (10,106) (794) 9,749 (2,959) 6,790 (6) 21,650 (9,282) (853) 11,515 (3,518) 7,997 (7) 11,731 (3,632) 8,099 (4) 7 6,784 8,095 7,990 8 196.5 237.5 238.0 Diluted 8 189.5 230.1 229.3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started