Answered step by step

Verified Expert Solution

Question

1 Approved Answer

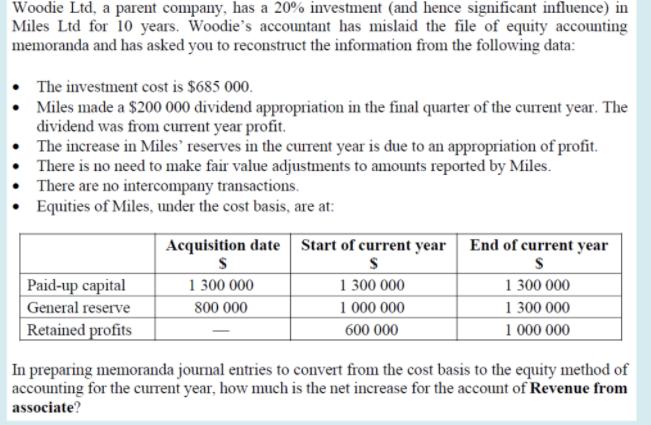

Select one: A. $200,000 B. $140,000 C. $80,000 D. $40,000 Woodie Ltd, a parent company, has a 20% investment (and hence significant influence) in Miles

Select one:

Select one:

A. $200,000

B. $140,000

C. $80,000

D. $40,000

Woodie Ltd, a parent company, has a 20% investment (and hence significant influence) in Miles Ltd for 10 years. Woodie s accountant has mislaid the file of equity accounting memoranda and has asked you to reconstruct the information from the following data: The investment cost is $685 000. Miles made a $200 000 dividend appropriation in the final quarter of the current year. The dividend was from current year profit. The increase in Miles reserves in the current year is due to an appropriation of profit. There is no need to make fair value adjustments to amounts reported by Miles. There are no intercompany transactions. Equities of Miles, under the cost basis, are at: Paid-up capital General reserve Retained profits Acquisition date S 1 300 000 800 000 Start of current year End of current year S S 1 300 000 1 000 000 600 000 1 300 000 1 300 000 1 000 000 In preparing memoranda journal entries to convert from the cost basis to the equity method of accounting for the current year, how much is the net increase for the account of Revenue from associate?

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

B 140000 Net Increase in Gene...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started