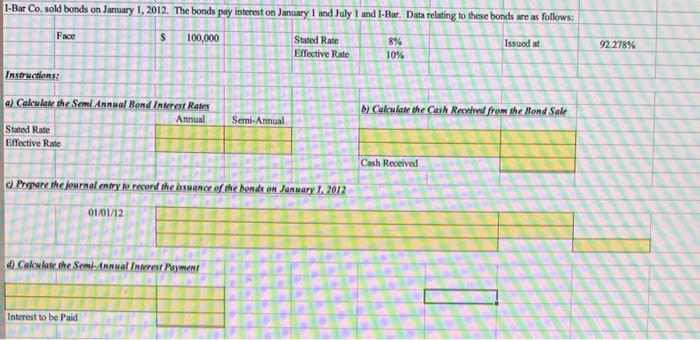

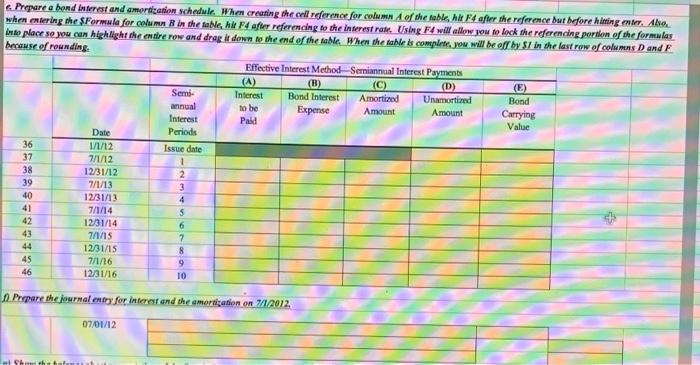

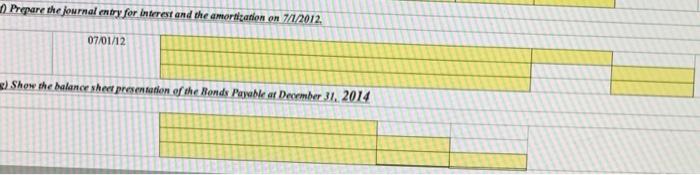

Select save and choose the save destination Open the file from where you saved it Use the information from the Data Section at the top of the page to complete the sections below using the effective interest rate method A grading sheet is posted in the administrative section of blackboard to help you understand how the problem will be graded All amount must be cell references or formulas. For columns A and B in the chart, use an absolute cell reference. See the excel instructions for guidance. T-Bar Co. sold bonds on January 1, 2012. The bonds pay interest on January 1 and July 1 and I-Bar. Data relating to these bonds are as follows: Face S 100,000 Stated Rate Effective Rate 8% 10% Issued at 92.278% Instructions: b) Calculate the Cash Rehvid from the Bond Sale a) Calculate the Semi Annual Bond Interest Rates Annual Stated Rate Effective Rate Semi-Annual Cash Received Prepare the journal entry to record the usuance of the bonds on January 1, 2012 01/01/12 d) Calculate the Semi-Annual interest Payment Interest to be paid Prepare a bond Interest and amortization schedule. When creating the cell reference for column of the table hit F4 after the reference but before hitting enter. Alle when entering the $Formula for column in the table, hie F4 after referencing to the interest rate. Using F4 will allow you to lock the referencing portion of the formulas Into place so you can highlight the entire row and drag it down to the end of the table. When the table is complete, you will be off by SI in the last row of columns D and F because of rounding Effective Interest Method Serniannual Interest Payments (A) (B) (C) (D) (E) Semi- Interest Bond Interest Amortized Unamortired Bond annual to be Expense Amount Amount Carrying Interest Paid Value Date Periods 36 1/1/12 Issue date 37 7/1/12 1 38 12/31/12 2 39 7/1/13 40 12/31/13 41 7/1/14 5 42 12/31/14 7/1/15 7 44 12/31/15 8 45 7/1/16 9 46 12/31/16 10 3 4 6 43 Prepare the journal entry for interest and the amortization on 71/2012, 07/01/12 Prepare the journal entry for interest and the amortization on 7/1/2012, 07/01/12