Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Select the best answer. If an accountant performs accounting and bookkeeping services that conform with the independence rules of the AICPA Code of Professional Conduct

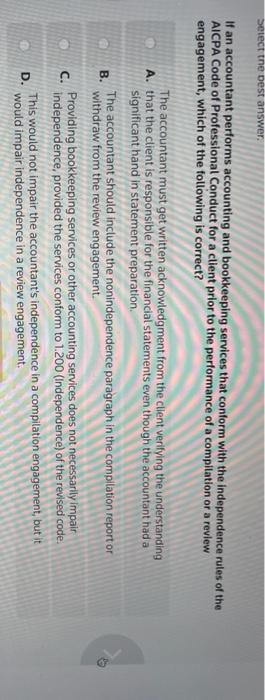

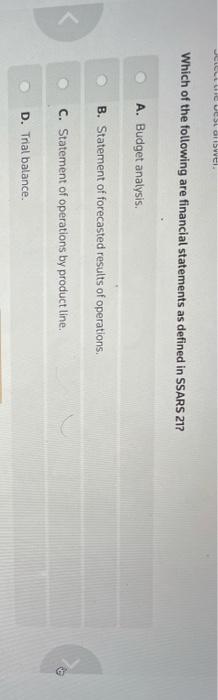

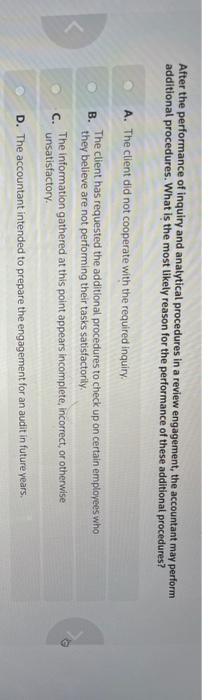

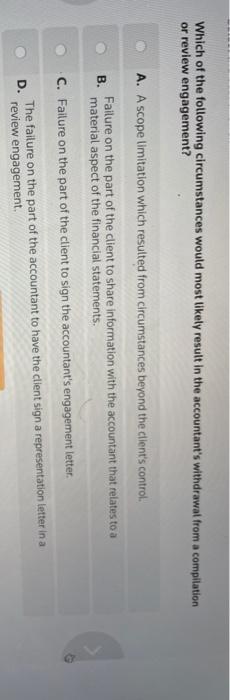

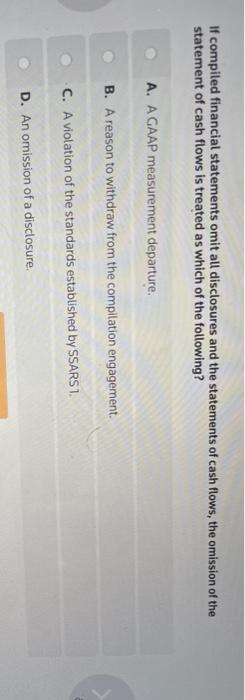

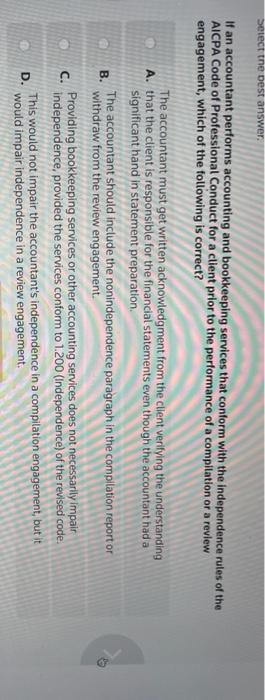

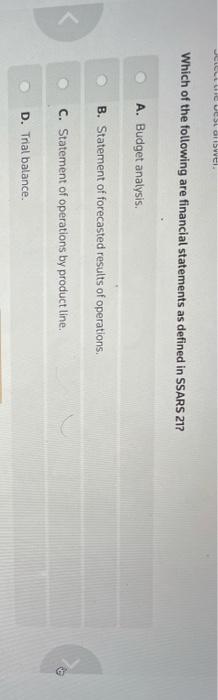

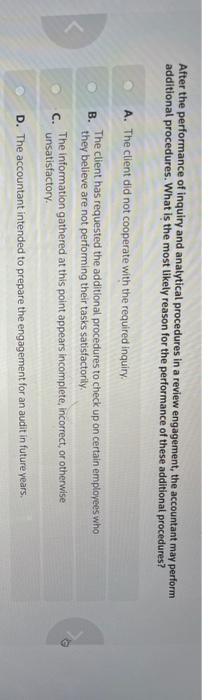

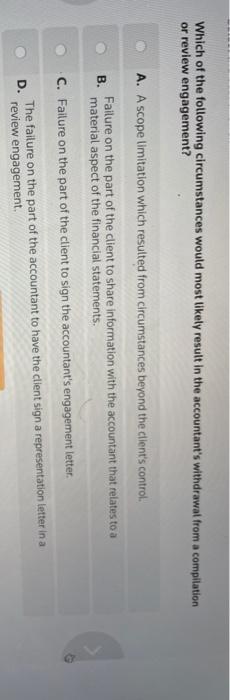

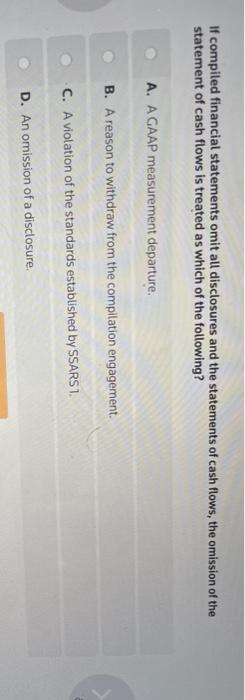

Select the best answer. If an accountant performs accounting and bookkeeping services that conform with the independence rules of the AICPA Code of Professional Conduct for a client prior to the performance of a compilation or a review engagement, which of the following is correct? The accountant must get written acknowledgment from the client verifying the understanding A. that the client is responsible for the financial statements even though the accountant had a significant hand in statement preparation The accountant should include the nonindependence paragraph in the compilation report or B. withdraw from the review engagement. C. Providing bookkeeping services or other accounting services does not necessarily impair independence, provided the services conform to 1.200 (Independence) of the revised code This would not impair the accountant's independence in a compilation engagement, but it D. would impair independence in a review engagement. LULU USL abwe Which of the following are financial statements as defined in SSARS 217 A. Budget analysis B. Statement of forecasted results of operations. C. Statement of operations by product line. D. Trial balance. After the performance of inquiry and analytical procedures in a review engagement, the accountant may perform additional procedures. What is the most likely reason for the performance of these additional procedures? B. A. The client did not cooperate with the required inquiry The client has requested the additional procedures to check up on certain employees who they believe are not performing their tasks satisfactorily, The information gathered at this point appears incomplete, incorrect, or otherwise c. unsatisfactory D. The accountant intended to prepare the engagement for an audit in future years, Which of the following circumstances would most likely result in the accountant's withdrawal from a compilation or review engagement? A. A scope limitation which resulted from circumstances beyond the client's control. B. Failure on the part of the client to share information with the accountant that relates to a material aspect of the financial statements. C. Failure on the part of the client to sign the accountant's engagement letter. The failure on the part of the accountant to have the client sign a representation letter in a D. review engagement If compiled financial statements omit all disclosures and the statements of cash flows, the omission of the statement of cash flows is treated as which of the following? A. A GAAP measurement departure. B. A reason to withdraw from the compilation engagement C. A violation of the standards established by SSARS 1. D. An omission of a disclosure

Select the best answer. If an accountant performs accounting and bookkeeping services that conform with the independence rules of the AICPA Code of Professional Conduct for a client prior to the performance of a compilation or a review engagement, which of the following is correct? The accountant must get written acknowledgment from the client verifying the understanding A. that the client is responsible for the financial statements even though the accountant had a significant hand in statement preparation The accountant should include the nonindependence paragraph in the compilation report or B. withdraw from the review engagement. C. Providing bookkeeping services or other accounting services does not necessarily impair independence, provided the services conform to 1.200 (Independence) of the revised code This would not impair the accountant's independence in a compilation engagement, but it D. would impair independence in a review engagement. LULU USL abwe Which of the following are financial statements as defined in SSARS 217 A. Budget analysis B. Statement of forecasted results of operations. C. Statement of operations by product line. D. Trial balance. After the performance of inquiry and analytical procedures in a review engagement, the accountant may perform additional procedures. What is the most likely reason for the performance of these additional procedures? B. A. The client did not cooperate with the required inquiry The client has requested the additional procedures to check up on certain employees who they believe are not performing their tasks satisfactorily, The information gathered at this point appears incomplete, incorrect, or otherwise c. unsatisfactory D. The accountant intended to prepare the engagement for an audit in future years, Which of the following circumstances would most likely result in the accountant's withdrawal from a compilation or review engagement? A. A scope limitation which resulted from circumstances beyond the client's control. B. Failure on the part of the client to share information with the accountant that relates to a material aspect of the financial statements. C. Failure on the part of the client to sign the accountant's engagement letter. The failure on the part of the accountant to have the client sign a representation letter in a D. review engagement If compiled financial statements omit all disclosures and the statements of cash flows, the omission of the statement of cash flows is treated as which of the following? A. A GAAP measurement departure. B. A reason to withdraw from the compilation engagement C. A violation of the standards established by SSARS 1. D. An omission of a disclosure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started