Answered step by step

Verified Expert Solution

Question

1 Approved Answer

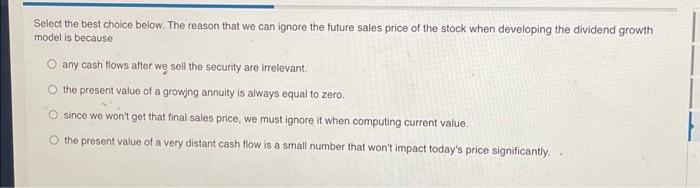

Select the best choice below. The reason that we can ignore the future sales price of the stock when developing the dividend growth model is

Select the best choice below. The reason that we can ignore the future sales price of the stock when developing the dividend growth model is because any cash flows after we sell the security are irrelevant. the present value of a growing annuity is always equal to zero. since we won't get that final sales price, we must ignore it when computing current value. the present value of a very distant cash flow is a small number that won't impact today's price significantly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started