Answered step by step

Verified Expert Solution

Question

1 Approved Answer

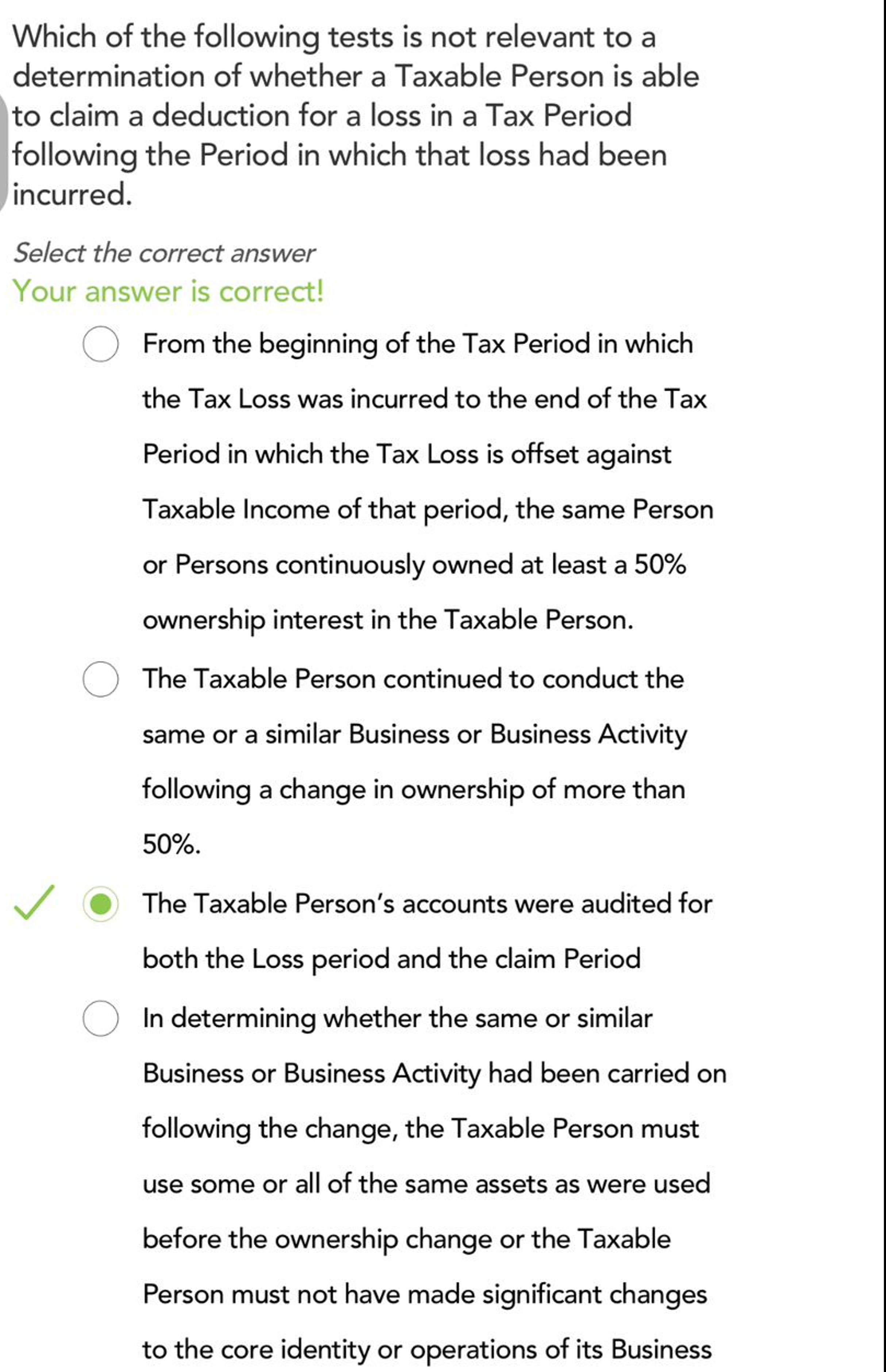

Select the correct answer Your answer is correct! From the beginning of the Tax Period in which the Tax Loss was incurred to the end

Select the correct answer

Your answer is correct!

From the beginning of the Tax Period in which

the Tax Loss was incurred to the end of the Tax

Period in which the Tax Loss is offset against

Taxable Income of that period, the same Person

or Persons continuously owned at least a

ownership interest in the Taxable Person.

The Taxable Person continued to conduct the

same or a similar Business or Business Activity

following a change in ownership of more than

The Taxable Person's accounts were audited for

both the Loss period and the claim Period

In determining whether the same or similar

Business or Business Activity had been carried on

following the change, the Taxable Person must

use some or all of the same assets as were used

before the ownership change or the Taxable

Person must not have made significant changes

to the core identity or operations of its Business

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started