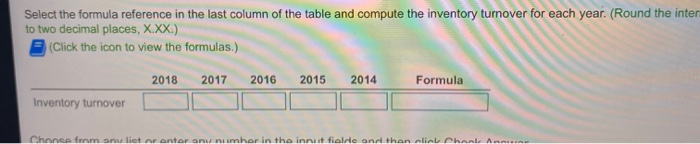

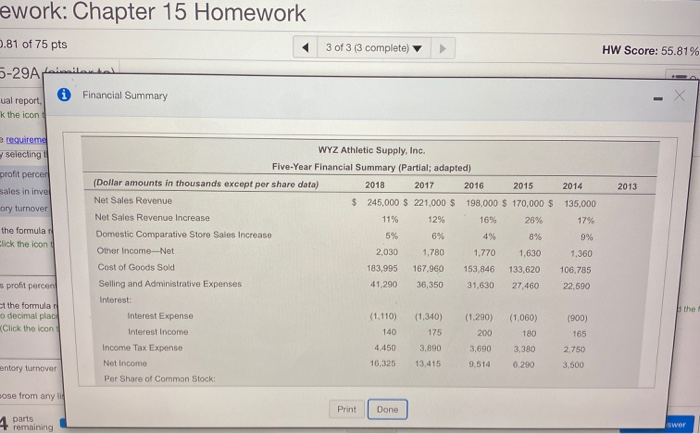

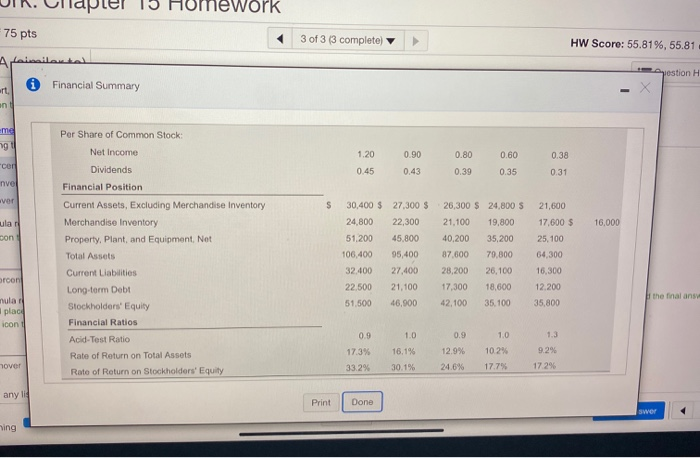

Select the formula reference in the last column of the table and compute the inventory turnover for each year. (Round the inter to two decimal places, X.XX.) (Click the icon to view the formulas.) 2018 2017 2016 2015 2014 Formula Inventory turnover Chance from anu liet ar antar anu number in the innuit field and then clin Chant An. ework: Chapter 15 Homework 1.81 of 75 pts 3 of 3 (3 complete) HW Score: 55.81% 5-29A Limia ual report, 0 Financial Summary k the icon requiremd selecting 2013 profit perce sales in invel ory turnover the formular lick the icon WYZ Athletic Supply, Inc. Five-Year Financial Summary (Partial; adapted) (Dollar amounts in thousands except per share data) 2018 2017 2016 2015 Net Sales Revenue $ 245,000 $ 221,000 $ 198.000 $ 170,000 $ Net Sales Revenue Increase 11% 12% 16% 26% Domestic Comparative Store Sales Increase 5% Other Income-Net 2,030 1,780 1,770 1,630 Cost of Goods Sold 183.995 167.960 153,846 133,620 Selling and Administrative Expenses 41,290 36,350 31,630 27.460 Interest: Interest Expense (1.110) (1,340) (1.290) (1.060) Interest Income 140 175 200 180 Income Tax Expense 4.450 3.890 3,690 3.380 Net Income 16,325 13.415 9.514 6.290 Per Share of Common Stock 2014 135,000 17% 9% 1,360 106.785 22,590 profit percent the formular decimal plac Click the icon (900) 165 2.750 3.500 Entory turnover ose from any Print Done 1 parts + remaining JIN, Ullapiei 19 nomework 75 pts 3 of 3 (3 complete) HW Score: 55.81%, 55.81 estion 0 Financial Summary ime 1.20 0.45 0.90 0.43 0.80 0.39 0.60 0.35 0.38 0.31 cer wer 16,000 son Per Share of Common Stock Net Income Dividends Financial Position Current Assets, Excluding Merchandise Inventory Merchandise Inventory Property, Plant, and Equipment. Not Total Assets Current Liabilities Long-term Debt Stockholders' Equity Financial Ratios Acid-Test Ratio Rate of Return on Total Assets Rate of Return on Stockholders' Equity 30,400 $ 24,800 51,200 106.400 32.400 22,500 51.500 27.300 $ 22,300 45,800 95.400 27.400 21,100 46,000 26,300 $ 21,100 40,200 87.600 28,200 17,300 42,100 24,800 $ 19,800 35.200 79.800 26,100 18,600 35.100 21,600 17,600 $ 25.100 64,300 16,300 12.200 35,800 troon the Malans nular place icon 09 17.3% 10 16,1% 30.1% 0.0 12,9% 24.0% 1.0 10,2% 17.7% 9.2% 17.296 sover 33.2% any Print Done ing