Answered step by step

Verified Expert Solution

Question

1 Approved Answer

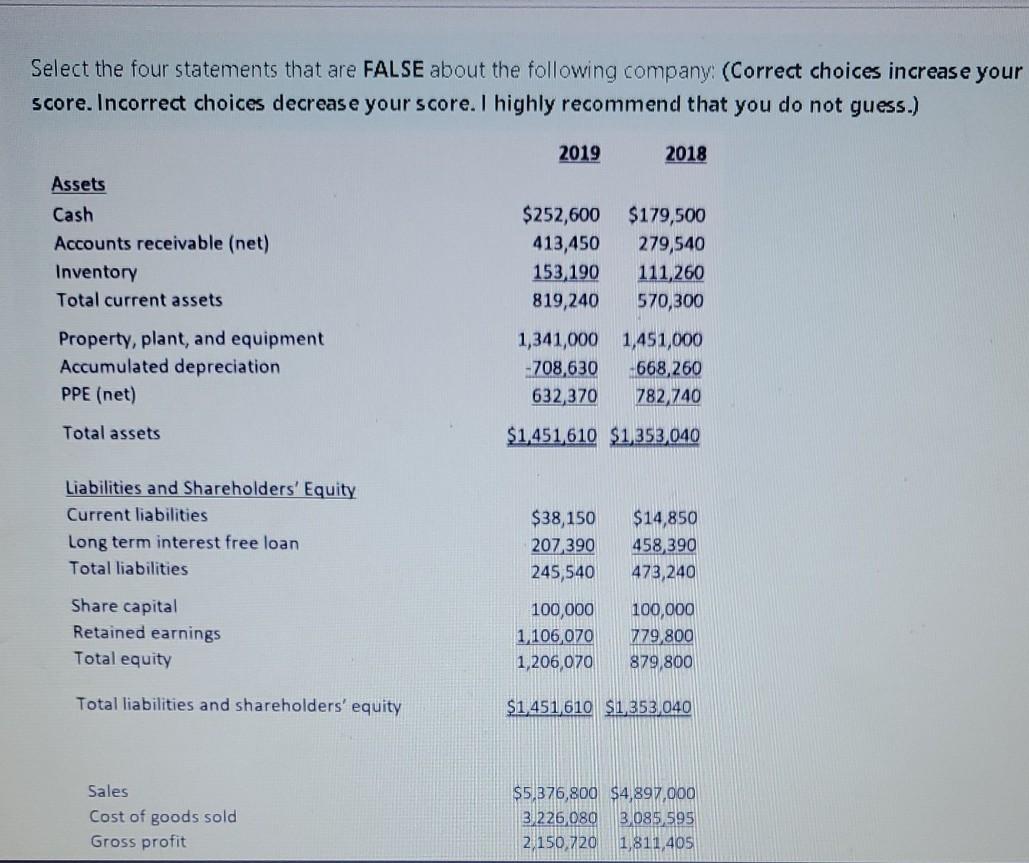

Select the four statements that are FALSE about the following company (Correct choices increase your score. Incorrect choices decrease your score. I highly recommend that

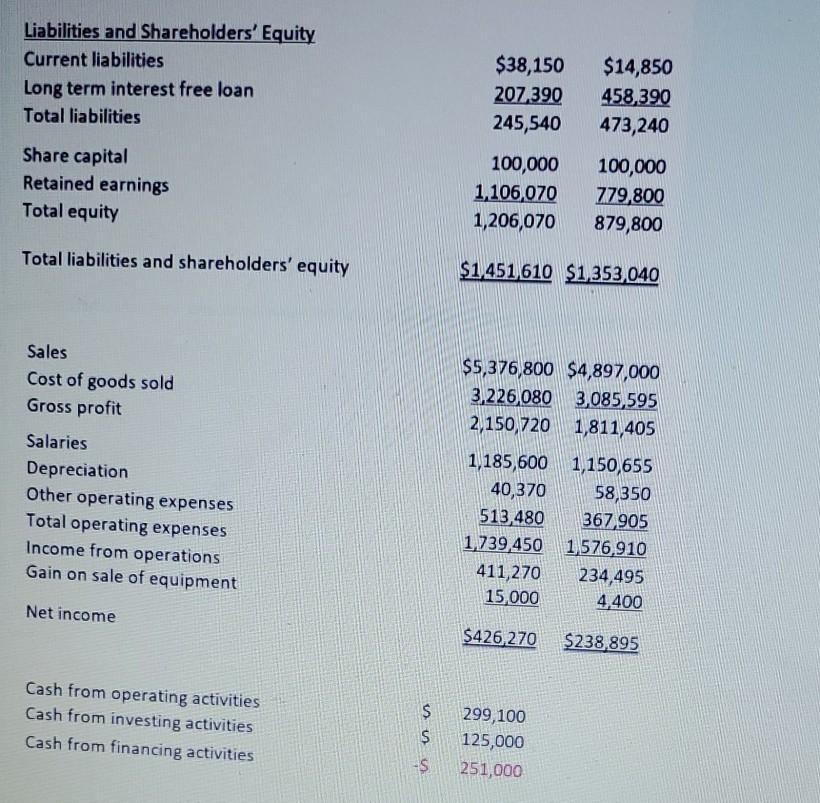

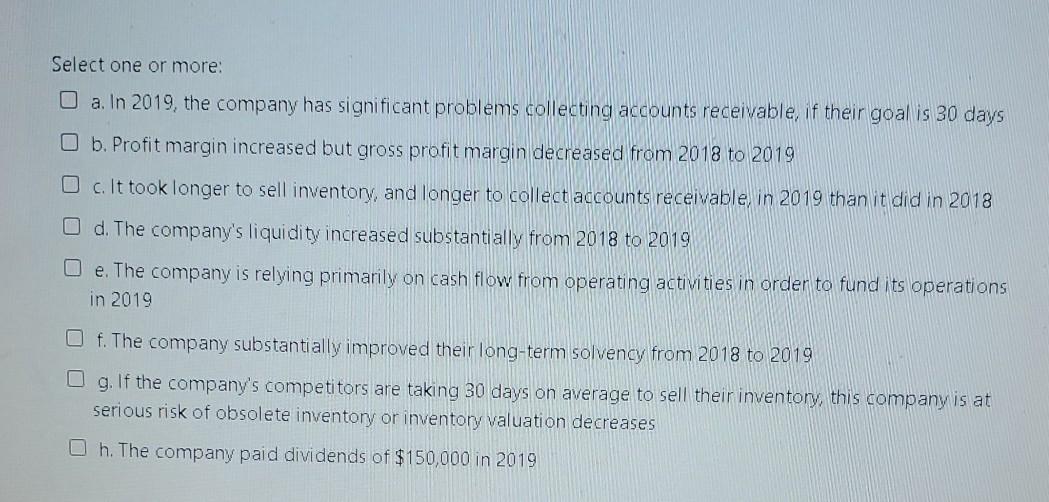

Select the four statements that are FALSE about the following company (Correct choices increase your score. Incorrect choices decrease your score. I highly recommend that you do not guess.) 2019 2018 Assets Cash Accounts receivable (net) Inventory Total current assets $252,600 $179,500 413,450 279,540 153, 190 111,260 819,240 570,300 1,341,000 1,451,000 -708,630 -668,260 632,370 782,740 Property, plant, and equipment Accumulated depreciation PPE (net) Total assets $1,451,610 $1,353,040 Liabilities and Shareholders' Equity Current liabilities Long term interest free loan Total liabilities $38,150 207,390 245,540 $14,850 458,390 473,240 Share capital Retained earnings Total equity 100,000 1,106,070 1,206,070 100,000 779,800 879,800 Total liabilities and shareholders' equity $1.451,610 $1,353,040 Sales Cost of goods sold Gross profit $5,376,800 $4,897,000 3226 080 3,085,595 2,150,720 1,811 405 Liabilities and Shareholders' Equity Current liabilities Long term interest free loan Total liabilities $38,150 207,390 245,540 $14,850 458,390 473,240 Share capital Retained earnings Total equity 100,000 1,106,070 1,206,070 100,000 779,800 879,800 Total liabilities and shareholders' equity $1.451,610 $1353,040 Sales Cost of goods sold Gross profit Salaries Depreciation Other operating expenses Total operating expenses Income from operations Gain on sale of equipment $5,376,800 $4,897,000 3,226,080 3,085,595 2,150, 720 1,811,405 1,185,600 1,150,655 40,370 58,350 513 480 367 905 1,739,450 1,576,910 411,270 234,495 15,000 4,400 Net income $426,270 $238.895 Cash from operating activities Cash from investing activities Cash from financing activities S $ 299, 100 125,000 251,000 -S Select one or more: O a. In 2019, the company has significant problems collecting accounts receivable, if their goal is 30 days b. Profit margin increased but gross profit margin decreased from 2018 to 2019 c. It took longer to sell inventory, and longer to collect accounts receivable, in 2019 than it did in 2018 d. The company's liquidity increased substantially from 2018 to 2019 e. The company is relying primarily on cash flow from operating activities in order to fund its operations in 2019 f. The company substantially improved their long-term solvency from 2018 to 2019 O g. If the company's competitors are taking 30 days on average to sell their inventory, this company is at serious risk of obsolete inventory or inventory valuation decreases h. The company paid dividends of $150,000 in 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started