Answered step by step

Verified Expert Solution

Question

1 Approved Answer

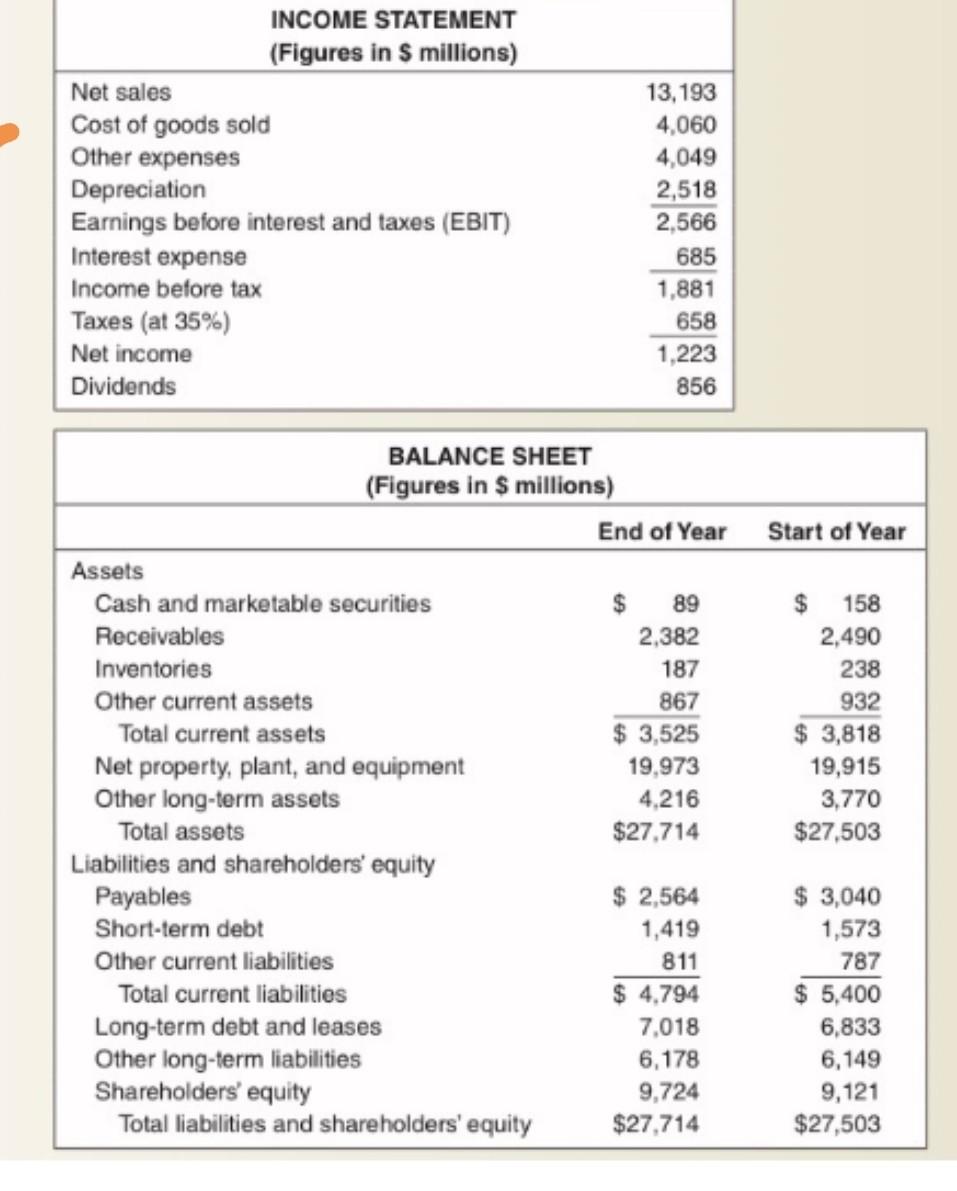

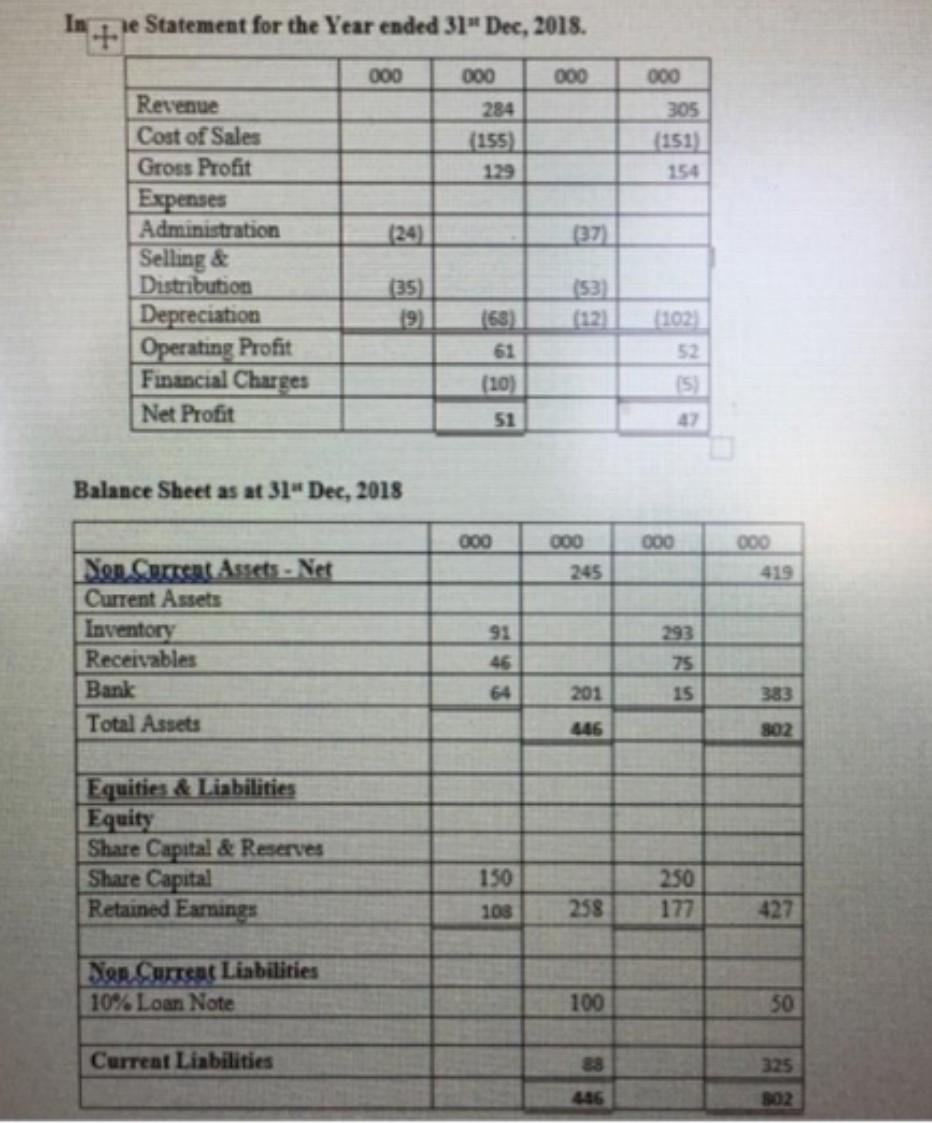

Select the Income Statements and Balance Sheets of Company A and Company B from the internet and calculate the following financial ratios: Long-term debt ratios

Select the Income Statements and Balance Sheets of Company A and Company B from the internet and calculate the following financial ratios:

Long-term debt ratios

Total debt ratio

Times interest earned

Cash coverage ration

current ratio

Quick ratio

Operating profit margin

Inventory Turnover

Days in inventory

Average collection period

Return on equity

Return on assets

Payout rations

Compare the financial ratios you have calculated above and write a report on the basis of that comparison.

Company A :

Company B:

INCOME STATEMENT (Figures in S millions) Net sales Cost of goods sold Other expenses Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes (at 35%) Net income Dividends 13,193 4,060 4,049 2,518 2,566 685 1,881 658 1,223 856 BALANCE SHEET (Figures in $ millions) End of Year Start of Year Assets Cash and marketable securities $ 89 $ 158 Receivables 2,382 2,490 Inventories 187 238 Other current assets 867 932 Total current assets $ 3,525 $ 3,818 Net property, plant, and equipment 19,973 19,915 Other long-term assets 4,216 3,770 Total assets $27.714 $27,503 Liabilities and shareholders' equity Payables $ 2,564 $ 3,040 Short-term debt 1,419 1,573 Other current liabilities 811 787 Total current liabilities $ 4,794 $ 5,400 Long-term debt and leases 7,018 6,833 Other long-term liabilities 6,178 6,149 Shareholders' equity 9.724 9,121 Total liabilities and shareholders' equity $27,714 $27,503 e Statement for the Year ended 31" Dec, 2018. 000 000 000 284 155) 129 000 305 (151) 154 (24 137) Revenue Cost of Sales Gross Profit Expenses Administration Selling & Distribution Depreciation Operating Profit Financial Charges Net Profit (35) (53) 19) 163) 61 (102 52 (10) 15 51 Balance Sheet as at 31 Dec, 2018 000 000 000 000 245 419 Sen Current Assets - Net Current Assets Inventory Receivables Bank Total Assets 293 46 75 15 201 383 446 802 Equities & Liabilities Equity Share Capital & Reserves Share Capital Retained Earnings 150 250 177 103 258 427 Ser Current Liabilities 10% Loan Note 100 50 Current Liabilities 325

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started