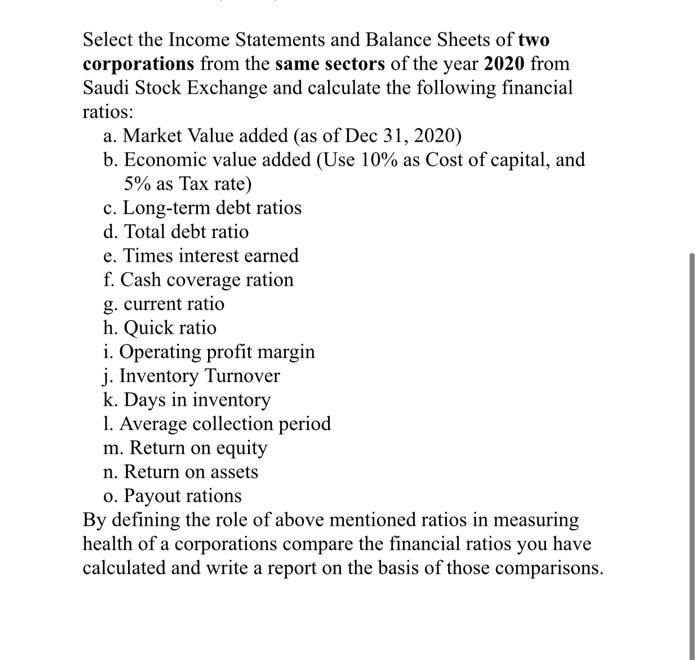

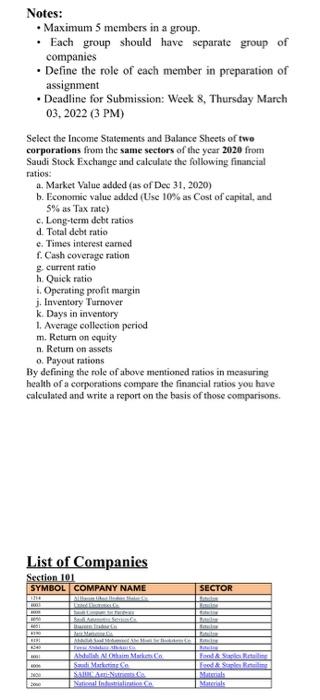

Select the Income Statements and Balance Sheets of two corporations from the same sectors of the year 2020 from Saudi Stock Exchange and calculate the following financial ratios: a. Market Value added (as of Dec 31, 2020) b. Economic value added (Use 10% as Cost of capital, and 5% as Tax rate) c. Long-term debt ratios d. Total debt ratio e. Times interest earned f. Cash coverage ration g. current ratio h. Quick ratio i. Operating profit margin j. Inventory Turnover k. Days in inventory 1. Average collection period m. Return on equity n. Return on assets o. Payout rations By defining the role of above mentioned ratios in measuring health of a corporations compare the financial ratios you have calculated and write a report on the basis of those comparisons. List of Companies Section 101 SYMBOL COMPANY NAME 1214 Al Hassan Ghazi Ibrahim Shaker Co. 4003 United Electronics Co. 4008 Saudi Company for Hardware 4050 Saudi Automotive Services Co. 4051 Baazeem Trading Co. 4190 Jarir Marketing Co. 4191 Abdullah Saad Mohammed Abo Moati for Bookstores Co. 4240 Fawaz Abdulaziz Alhokair Co. 4001 Abdullah Al Othaim Markets Co. 4006 Saudi Marketing Co. 2020 SABIC Agri-Nutrients Co. 2060 National Industrialization Co. SECTOR Retailing Retailing Retailing Retailing Retailing Retailing Retailing Retailing Food & Staples Retailing Food & Staples Retailing Materials Materials Notes: Maximum 5 members in a group, . Each group should have separate group of companies Define the role of each member in preparation of assignment Deadline for Submission: Week 8, Thursday March 03.2022 (3 PM) Select the Income Statements and Balance Sheets of two corporations from the same sectors of the year 2020 from Saudi Stock Exchange and calculate the following financial ratios: a. Market Value aduled (as of Dec 31, 2020) b. Economic value added (Usc 10% as Cost of capital, and 5% as Tax rate) c. Long-term debt ratios d. Total debt ratio e. Times interest eamed f. Cash coverage ration current ratio h. Quick ratio 1. Operating profit margin j. Inventory Turnover k Days in inventory 1. Average collection period m. Return on equity n. Retum on assets o. Payout rations By defining the role of above mentioned ratios in measuring health of a corporations compare the financial ratios you have calculated and write a report on the basis of those comparisons List of Companies Section 101 SYMBOL COMPANY NAME BAL mm BS SECTOR w BON 001 HE LOGAS TERENGGA Ali H Tim Min Market BEHAENAI Nadines Food Sales Retail Finder M Mas Select the Income Statements and Balance Sheets of two corporations from the same sectors of the year 2020 from Saudi Stock Exchange and calculate the following financial ratios: a. Market Value added (as of Dec 31, 2020) b. Economic value added (Use 10% as Cost of capital, and 5% as Tax rate) c. Long-term debt ratios d. Total debt ratio e. Times interest earned f. Cash coverage ration g. current ratio h. Quick ratio i. Operating profit margin j. Inventory Turnover k. Days in inventory 1. Average collection period m. Return on equity n. Return on assets o. Payout rations By defining the role of above mentioned ratios in measuring health of a corporations compare the financial ratios you have calculated and write a report on the basis of those comparisons. List of Companies Section 101 SYMBOL COMPANY NAME 1214 Al Hassan Ghazi Ibrahim Shaker Co. 4003 United Electronics Co. 4008 Saudi Company for Hardware 4050 Saudi Automotive Services Co. 4051 Baazeem Trading Co. 4190 Jarir Marketing Co. 4191 Abdullah Saad Mohammed Abo Moati for Bookstores Co. 4240 Fawaz Abdulaziz Alhokair Co. 4001 Abdullah Al Othaim Markets Co. 4006 Saudi Marketing Co. 2020 SABIC Agri-Nutrients Co. 2060 National Industrialization Co. SECTOR Retailing Retailing Retailing Retailing Retailing Retailing Retailing Retailing Food & Staples Retailing Food & Staples Retailing Materials Materials Notes: Maximum 5 members in a group, . Each group should have separate group of companies Define the role of each member in preparation of assignment Deadline for Submission: Week 8, Thursday March 03.2022 (3 PM) Select the Income Statements and Balance Sheets of two corporations from the same sectors of the year 2020 from Saudi Stock Exchange and calculate the following financial ratios: a. Market Value aduled (as of Dec 31, 2020) b. Economic value added (Usc 10% as Cost of capital, and 5% as Tax rate) c. Long-term debt ratios d. Total debt ratio e. Times interest eamed f. Cash coverage ration current ratio h. Quick ratio 1. Operating profit margin j. Inventory Turnover k Days in inventory 1. Average collection period m. Return on equity n. Retum on assets o. Payout rations By defining the role of above mentioned ratios in measuring health of a corporations compare the financial ratios you have calculated and write a report on the basis of those comparisons List of Companies Section 101 SYMBOL COMPANY NAME BAL mm BS SECTOR w BON 001 HE LOGAS TERENGGA Ali H Tim Min Market BEHAENAI Nadines Food Sales Retail Finder M Mas