Question

Select two companies in the same industry that are publicly traded in a US stock market (ex: NYSE). It must be companies that sell inventory.

Select two companies in the same industry that are publicly traded in a US stock market (ex: NYSE). It must be companies that sell inventory. You will need to use their financial statements for the two most recent fiscal years. They must be obtained from their 10-K filing with the SEC (sec.gov).

Requirements:

1. Using Excel, prepare common size financial statements for both years for each company.

2. Compute the following ratios using Excel for the past two years for each company (you must show all calculations):

Liquidity:

a. Current ratio b. Acid-Test ratio c. Collection period d. Days to sell inventory

Capital Structure and Solvency:

a. Total debt to equity b. Long-term debt to equity c. Times interest earned

Return on Investment: a. Return on assets b. Return on common equity

Operating Performance: a. Gross profit margin b. Operating profit margin (pre-tax) c. Net profit margin

Asset Utilization: a. Cash turnover b. Accounts receivable turnover c. Inventory turnover d. Working capital turnover e. PPE turnover f. Total asset turnover

Market Measures: a. Price-to-earnings b. Earnings yield c. Dividend yield d. Dividend yield payout rate e. Price-to-book

3. Obtain copies of the most recently filed quarterly financial statements (10-Q) from the SEC website.

4. Read all of the notes to the financial statements.

5. Listen to the most recent analyst conference call. There should be a link on the company’s website in the “investor relations” section where you can listen to the recording.

6. Using the information from 1 – 5 above, prepare a 5-6 page pager discussing these various items:

a. Description of the business and main product(s) sold? Who are their major competitors? What countries do they mainly operate in?

b. Liquidity.

c. Capital Structure.

d. Return on Investment, Operating Performance and Asset Utilization.

e. Market Measures.

f. From the Notes, what method of accounting do they use for the following items (if applicable):

• Leases • Inventory • Capitalization of Long Term Assets • Depreciation • Intangibles • Investments

g. What disclosure (if any) do they have about: • Contingencies • Accounting changes • Financial Instruments and Derivatives • Long-Term Debt • Incentive Programs (Stock Options, Stock Appreciation Rights, Etc…) • Pension/Retirement Benefits • Income Taxes (and Deferred Taxes)

h. Are there any additional disclosures that would be material to analyzing the company?

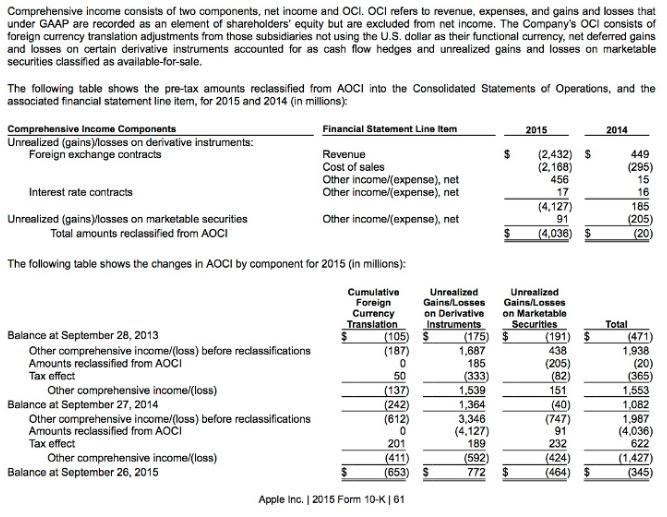

i. Do your companies have Other Comprehensive Income? If so, what items are they reporting as part of Other Comprehensive Income and how do they impact the ratios?

j. Do they use the equity method for any of their investments? Are there any investments where they have a controlling interest and there is a non-controlling interest?

k. Are they reporting any special items (unusual or infrequent) or any discontinued operations?

l. During the conference call, did management mention any events that impacted the financial statements? If so, how? Did they discuss any forecast and projections? If so, how will they impact any of the ratios?

m. Is management using any accounting policies to improve any of the ratios? For example, do they have operating leases versus capital leases that impact many of the ratios?

n. What is the company’s credit rating?

o. Which company would you invest in? Why?

Comprehensive income consists of two components, net income and OCI. OCI refers to revenue, expenses, and gains and losses that under GAAP are recorded as an element of shareholders' equity but are excluded from net income. The Company's OCI consists of foreign currency translation adjustments from those subsidiaries not using the U.S. dollar as their functional currency, net deferred gains and losses on certain derivative instruments accounted for as cash flow hedges and unrealized gains and losses on marketable securities classified as available-for-sale. The following table shows the pre-tax amounts reclassified from AOCI into the Consolidated Statements of Operations, and the associated financial statement line item, for 2015 and 2014 (in millions): Comprehensive Income Components Financial Statement Line Item 2015 2014 Unrealized (gainsMosses on derivative instruments: Foreign exchange contracts (2,432) $ (2,168) 456 17 Revenue Cost of sales 2$ 449 (295) 15 16 Other income/(expense), net Interest rate contracts (4,127) 91 185 Unrealized (gains)Mosses on marketable securities Total amounts reclassified from AOCI Other income/(expense), net (205) (20 (4,036) $ The following table shows the changes in AOCI by component for 2015 (in millions): Cumulative Foreign Currency Translation (105) S (187) Unrealized Gains/Losses on Derivative Instruments (175) $ 1,687 185 Unrealized Gains/Losses on Marketable Securities (191 438 Total (471 1,938 (20) (365 1,553 1,082 Balance at September 28, 2013 Other comprehensive income/(loss) before reclassifications Amounts reclassified from AOI (205) (82) 151 effect 50 (333) 1,539 1,364 3,346 (4,127) 189 Other comprehensive income/(loss) Balance at September 27, 2014 Other comprehensive income/(loss) before reclassifications Amounts reclassified from AOI (137) (242) (612) (40) (747) 91 1,987 (4,036) 622 Tax effect 201 232 Other comprehensive income/(loss) (411) (653) (592) (424) (464) (1,427) (345) Balance at September 26, 2015 772 2$ Apple Inc. | 2015 Form 10-K|61

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Using Excel prepare common size financial statements for both years for each company To prepare common size financial statements for both years for each company the first step is to open a new Excel ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started