Answered step by step

Verified Expert Solution

Question

1 Approved Answer

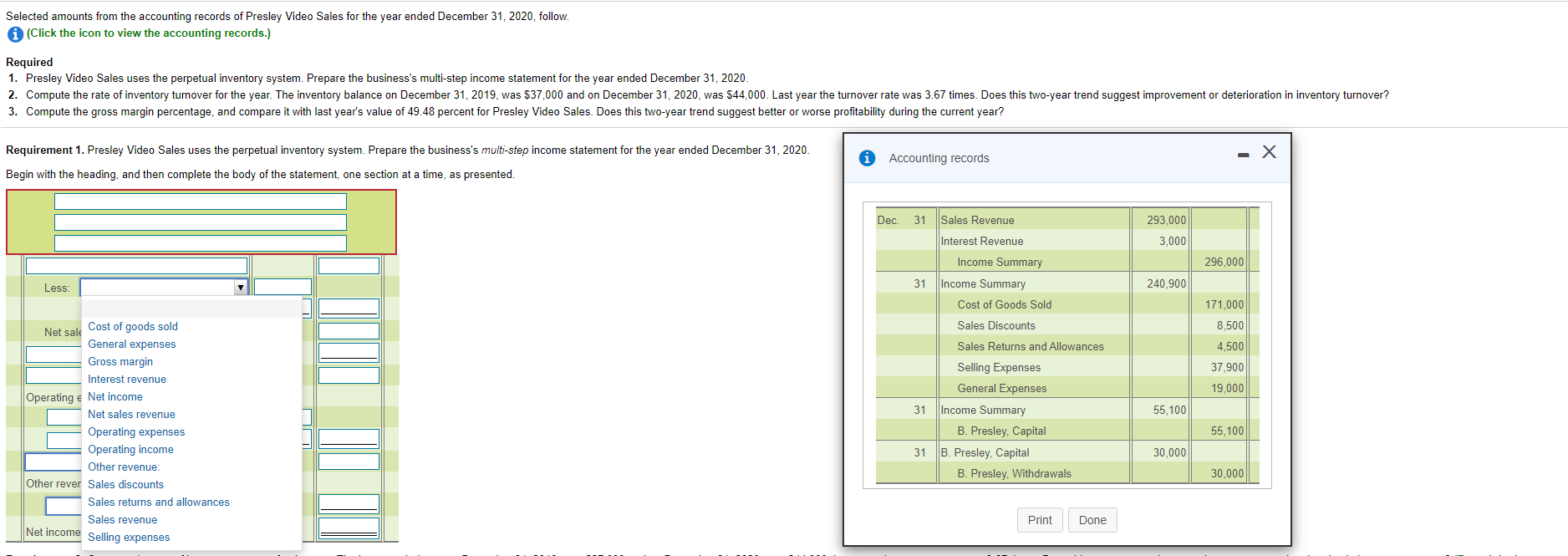

Selected amounts from the accounting records of Presley Video Sales for the year ended December 31, 2020, follow. LOADING... (Click the icon to view the

Selected amounts from the accounting records of

Presley Video Sales

for the year ended December 31,

2020,

follow.

LOADING...

(Click the icon to view the accounting records.)

Required

| 1. | Presley Video Sales uses the perpetual inventory system. Prepare the business's multi-step income statement for the year ended December 31,2020. |

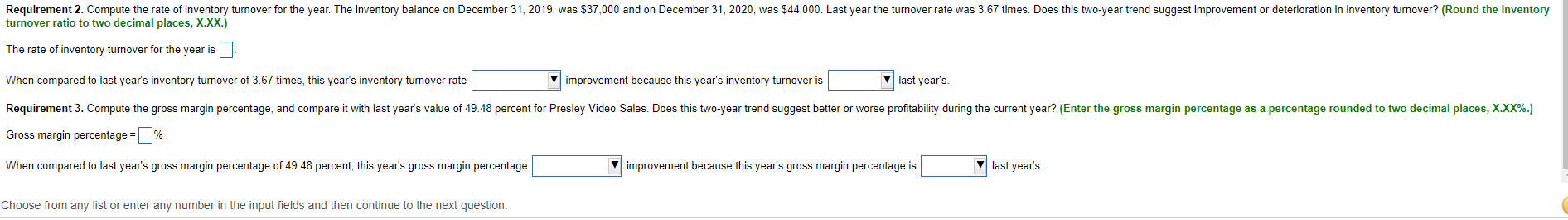

| 2. | Compute the rate of inventory turnover for the year. The inventory balance on December 31, 2019, was$37,000 and on December 31,2020, was$44,000. Last year the turnover rate was3.67 times. Does this two-year trend suggest improvement or deterioration in inventory turnover? |

| 3. | Compute the gross margin percentage, and compare it with last year's value of 49.48 percent forPresley Video Sales. Does this two-year trend suggest better or worse profitability during the current year?

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started