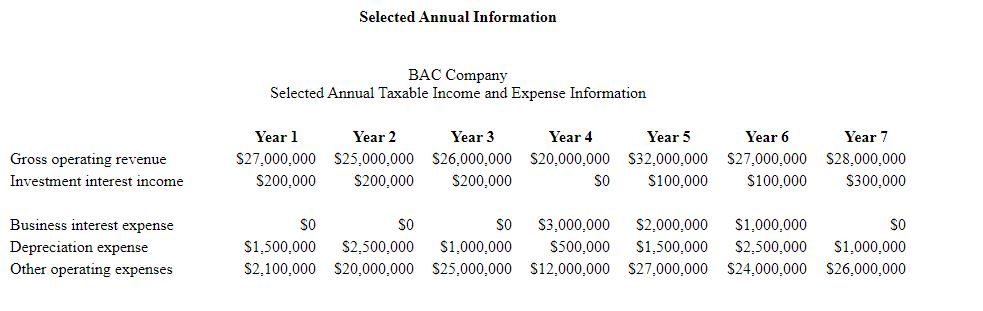

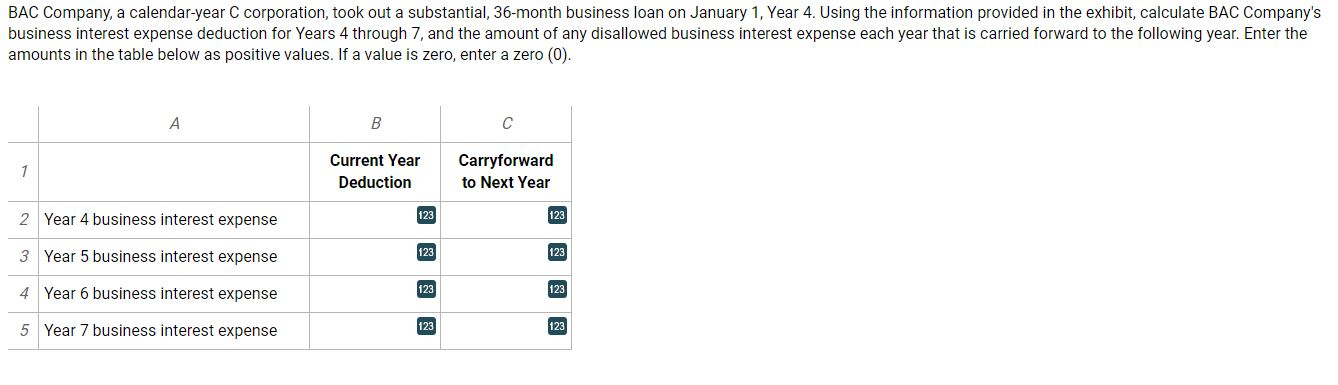

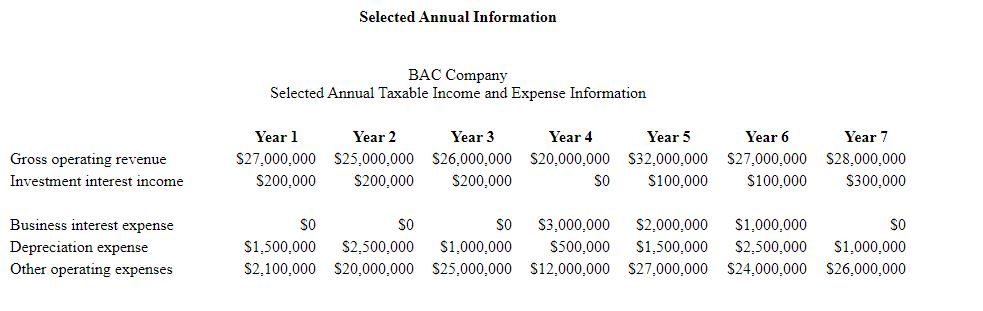

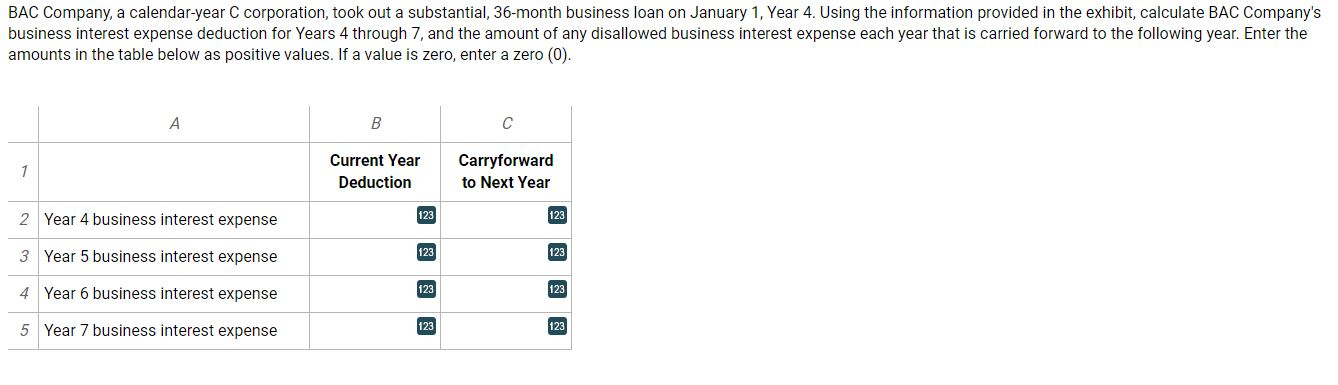

Selected Annual Information BAC Company Selected Annual Taxable Income and Expense Information Year 1 Year 4 Year 5 Year 2 Year 3 Year 6 Year 7 Gross operating revenue S27,000,000 $25,000,000 $26,000,000 $20,000,000 $32,000,000 $27,000,000 $28,000,000 Investment interest income $200,000 $300,000 $200,000 S200,000 SC S100,000 s100,000 Business interest expense S3,000,000 S0 S0 S0 S2,000,000 S1,000,000 $0 Depreciation expense Other operating expenses $2,500,000 $1,000,000 S1,000,000 S1,500,000 S500,000 $1,500,000 $2,500,000 S2,100,000 $20.000,000 S25,000,000 S12,000,000 S27,000,000 S24,000,000 S26,000,000 BAC Company, a calendar-year C corporation, took out a substantial, 36-month business loan on January 1, Year 4. Using the information provided in the exhibit, calculate BAC Company's business interest expense deduction for Years 4 through 7, and the amount of any disallowed business interest expense each year that is carried forward to the following year. Enter the amounts in the table below as positive values. If a value is zero, enter a zero (0) A B C Current Year Carryforward 7 Deduction to Next Year 123 Year 4 business interest expense 123 2 123 Year 5 business interest expense 3 123 123 Year 6 business interest expense 4 123 5 Year 7 business interest expense 123 Selected Annual Information BAC Company Selected Annual Taxable Income and Expense Information Year 1 Year 4 Year 5 Year 2 Year 3 Year 6 Year 7 Gross operating revenue S27,000,000 $25,000,000 $26,000,000 $20,000,000 $32,000,000 $27,000,000 $28,000,000 Investment interest income $200,000 $300,000 $200,000 S200,000 SC S100,000 s100,000 Business interest expense S3,000,000 S0 S0 S0 S2,000,000 S1,000,000 $0 Depreciation expense Other operating expenses $2,500,000 $1,000,000 S1,000,000 S1,500,000 S500,000 $1,500,000 $2,500,000 S2,100,000 $20.000,000 S25,000,000 S12,000,000 S27,000,000 S24,000,000 S26,000,000 BAC Company, a calendar-year C corporation, took out a substantial, 36-month business loan on January 1, Year 4. Using the information provided in the exhibit, calculate BAC Company's business interest expense deduction for Years 4 through 7, and the amount of any disallowed business interest expense each year that is carried forward to the following year. Enter the amounts in the table below as positive values. If a value is zero, enter a zero (0) A B C Current Year Carryforward 7 Deduction to Next Year 123 Year 4 business interest expense 123 2 123 Year 5 business interest expense 3 123 123 Year 6 business interest expense 4 123 5 Year 7 business interest expense 123